Highlights

- FY20 Q3 revenues up 4 percent YoY

- Electrical consumer durables drove up top line and margins

- Lighting and fixtures volumes increased, but revenues fell

- Focus on cost control initiatives pays off - Valuations reasonable from a long-term perspective

-------------------------------------------------

Consumer durable company Crompton Greaves Consumer Electricals (CGCE) (CMP: Rs 283, Market cap: Rs 17,785 crore) delivered a show full of sparks for the December quarter of 2019-20. Electrical consumer durables continued to be on a roll, but the lighting segment was a drag, which cast a shadow. The outlook remains stable and the business is on track to deliver yet another powerful year despite moderation in economic activity.

Key result highlights

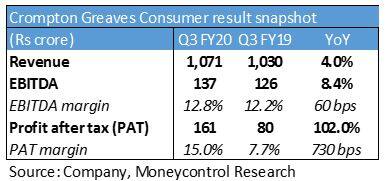

Revenues for the quarter rose 4 percent year-on-year (YoY) to Rs 1,071 crores as sales were impacted by the credit stress in trade channels and downbeat retail sales. Gross margins improved 30 bps YoY on the back of a richer product mix and easing commodity prices.

Cost control measures rubbed off on the operating margin. Earnings before interest, tax, depreciation and amortization (EBITDA) was up 8 percent YoY to Rs 131 crore. PAT (profit after tax) came in much higher because of income tax reversals and lower interest expenses.

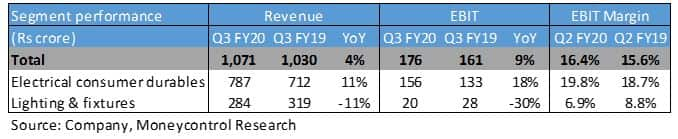

Electrical consumer durables picked up steam, whose revenues increased 11 percent YoY to Rs 787 crore. Market share gains across fans, geysers and mixer grinders kept the top line in good shape. Domestic pumps grew 8 percent in volume terms, but agriculture pumps took a hit from subdued rural demand and adverse weather conditions.

EBIT margins looked up owing to higher share of premium products and economies of scale. Crompton’s market share in the fans category has improved to 27 percent. Going forward, the management looks to scale up the vertical by ramping up its market share in geysers, air cooler and mixer grinders.

What flickered was lighting and fixtures, which disappointed. Sales contracted 11 percent from a year ago and EBIT margins came down by 170 bps (basis points). Within the lighting business, volume growth in LED and battens was strong at 15 percent. However, price erosion (~8-10 percent YoY) in the segment had an adverse impact on top line and margins.

Its EESL (Energy Efficiency Services Limited) revenues declined steeply by 38 percent as the business felt the heat due to slowdown in government spending and delay in project execution. Post correction in July-August 2019, the prices in lighting segment appear to have stabilised and further erosion is unlikely in coming months. Volume growth remains strong and the management is working on cost control initiatives to drive the margins higher from the current levels.

The China factor

The Indian consumer durables sector has a high dependency on China for key components such as motors, compressors and printed circuit boards. Crompton’s Q1 of 2020-21 is likely to be impacted by the current shutdown in China as a majority of the component manufacturers are yet to resume production due to the coronavirus outbreak in the country. While the production is anticipated to resume by February-end, subsequent delays could disrupt the entire sector and have a material impact on top line and margins of Crompton Greaves beyond Q1.

Outlook and Recommendation

India has been one of the largest growing electronics markets in the world in recent years. Rise in working age population, rural electrification and availability of credit financing have been stimulating demand for consumer durables in the country. The near-term growth would be challenging due to supply chain disruptions, aggressive competition and lacklustre consumer spending, but the government investment in infrastructure and schemes such as Housing for All will continue to propel the development of the sector in the long run.

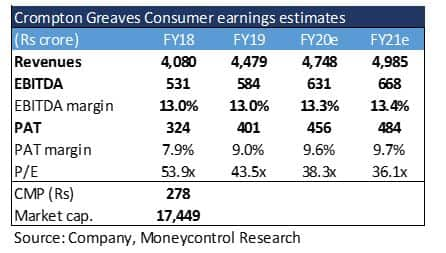

Despite the soft consumption trends, the long-term growth story of Crompton Consumer (36.1 times FY21 estimated price earnings) remains intact. Crompton’s fundamentals seem healthy owing to its pan-India presence, strong market positioning, superior return ratios and stable cash flows. Long-term investors should make use of any dips in the stock price to gradually build positions in the stock.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!