Highlights:- Realisations drove the quarterly earnings - Volumes contracted in April-June - Inaugurated its first distribution logistics centre in March - Growth prospects linked to macro environment

--------------------------------------------------

Concor, the leading rail freight transporter, reported a sturdy set of earnings for the first quarter of this fiscal year. The company reported a marginal growth in terms of revenue as well as operating profit.

Quarterly result highlightsFor the quarter ended June 2019, Concor’s standalone revenue increased by 5 percent on year-on-year (YoY) to Rs 1,639 crore. Revenue growth stood at 9 percent on a like-for-like basis as the base quarter includes SEIS (Service Exports from India Scheme) incentives related income of 71 crores.

The company reported an adjusted EBITDA (Earnings before interest, tax, depreciation and amortization) of Rs 403 crore in Q1 FY20 compared to Rs 319 crore in Q1 FY19. Adjusted operating margin for the quarter improved to 24.6 percent owing to price hikes and change in business mix. However, profit after tax was 10 percent lower due to increase in finance costs and depreciation charges.

Interest expenses were higher during the quarter as Concor undertook a working capital loan to meet its operational expenditures. However, the loan has been repaid at the end of May and cash position at the end of June is in excess of 1,000 crores.

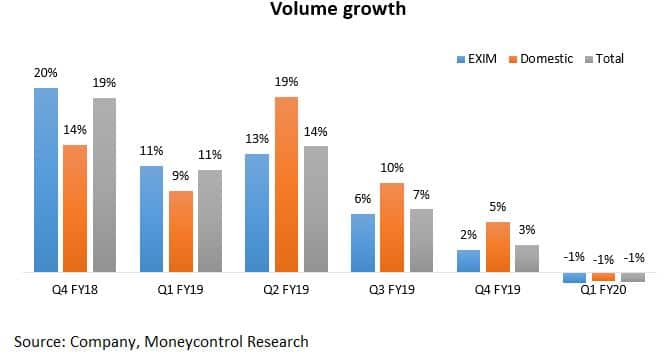

Revenue growth was driven entirely by higher realisations. Given the sluggishness in domestic and international markets, volumes were weaker across both its business segments- Export Import and Domestic. Handling volumes were down 1 percent year-on-year (YoY) and originating volumes declined nearly 6 percent YoY. The number of double stack trains also declined from 829 in Q1 FY19 to 728 in Q1 FY20. Overall market share in Apr-Jun period was lower in comparison to previous quarters due to limited participation in the low-margin volume business.

While the volumes contracted, operating margins expanded due to higher realisations, operational efficiencies and decline in empty running charges, which reduced to Rs 48 crore in Q1 FY20, from Rs 58 crore in Q1 FY19.

Concor’s foray into coastal shipping is progressing well. In Q1, the segment garnered revenues of 34 crores through multiple cargo ship voyages along the west coast. Further, the company plans to expand operations to the east coast and anticipates an annual revenue contribution of Rs 150-160 crore in the current fiscal year.

In March 2019, Concor inaugurated its first distribution logistics centre at Ennore (Chennai, Tamil Nadu). The facility has been set up in partnership with NOR Infrastructure and will act as fulfillment center for the customers of different manufacturers and importers. To further expand this business, Concor’s aims to add 4 more distribution logistic centres by the end of FY20. The company is also planning to enter the inland waterways business in coming quarters.

Outlook and RecommendationConcor’s volumes growth has been moderating for the past 4 quarters and the near term demand environment appears challenging but the long term outlook for the company is positive as company is taking several initiatives to aid future growth.

The management guidance of 10-12 percent volume and revenue growth for FY20 hinges on the sustenance of domestic GDP growth. There exists significant risks to the downside as the high frequency data indicators are signalling a further slowdown in the economy due to a combination of macro and micro factors. In our view, this fiscal year should turn out to be an year on consolidation in terms of both top line and bottom line.

Concor’s business has a direct correlation with the domestic and international trade environment and its expensive valuation (nearly 26 times FY20 estimated earnings) could witness some de-rating given the lack of earnings growth and sluggish volume trajectory. Despite near-term challenges, we expect Concor to be a steady performer over the next few years and investors should look to buy the stock during a weak phase as the company enjoys a market leadership position along with a steady earnings profile and cash rich-balance sheet.

Follow @Sach_Pal

For more research articles, visit our Moneycontrol Research pageDisclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed hereDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.