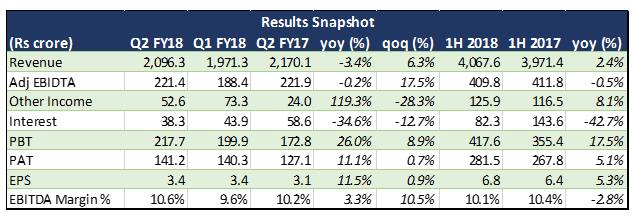

Chambal Fertilizers reported a decent Q2 performance with profits rising 11.1 percent owing majorly to strong performance of the marketed products even as revenues declined 3.4 percent year-on-year. Revenue for the quarter stood at Rs 2096 crore as against Rs 2170 crore in the year-ago quarter. Adjusted EBITDA came in at Rs 221.4 crore as against Rs 221.9 crore in the corresponding quarter of the previous year. EBITDA margins were steady at 10.6 percent.

The growth in the profits could also be attributed to changes on account of inventories and a reduction in finance costs, which the company expects to continue in the coming quarters. Other expenses saw an uptick of Rs 45 crore which was due to adverse foreign exchange variation, higher freight and forwarding expenses as well as loss on derivatives.

The company's marketed products namely Di-ammonium Phosphate (DAP) and Muriate of Potash (MOP) saw strong volumes which enhanced profitability. DAP and MOP volumes stood at 5.36 lakh tonnes and 1.54 lakh tonnes, respectively.

Gadepan-3 execution on trackThe execution of the latest project Gadepan 3, in Kota, is on track and is progressing as per schedule. The plant is expected to stabilise and begin commercial production with 85-90 percent capacity utilisation by January 2019.

The company expects to incur another Rs 1000 crore capex in the remaining half of the fiscal. Chambal has incurred Rs 2751 crore on the new plant till date and expects to run up a capex of Rs 4600 crore after the full completion of the project.

DBT (Direct Benefit Tax) implementationDBT implementation in 16 pilot districts, although successful, has seen a significant roadblock on account of the mismatch in reconciling opening stocks. Given the upcoming implementation of DBT in Rajasthan and Maharashtra (Chambal’s exposure is limited to Rajasthan) there is growing skepticism about the extent of benefits which would be transferred to manufacturers.

Impact of sulphur pricesOver the past months sulphur prices have seen a sharp upswing and have gone from around USD 100/ tonne to USD 150/tonne. Sulphur being a major component for manufacturing phosphoric acid, the price of phosphoric acid contracts are expected to be revised post the current contract period ending in December 2017.

Chambal is looking to increase urea production which would replace the existing urea imports. Domestic urea is considered to be of higher quality than imported urea owing to the soft nature of the material and disintegration due to multiple handling. This provides an edge to Chambal in urea sales in the coming quarters.

Follow @RuchiagrawalFor more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.