Neha Dave

Moneycontrol Research

Highlights

-Bandhan Bank to acquire Gruh Finance in a share swap deal

-This will help reduce promoter stake in Bandhan from 82 percent to 61 percent

-HDFC will end up getting 15 percent in merged entity

-Complimentary business makes Gruh a good fit for Bandhan-Though expensive, acquisition justified by Gruh’s impeccable track record

------------------------------------------------------

Bandhan Bank, the youngest bank in India, is set to acquire Gruh Finance, a housing finance subsidiary of HDFC. It will be an all share-swap merger with shareholders of Gruh Finance getting 568 shares of Bandhan Bank for every 1,000 shares held.

The merger would result in a reduction in promoter’s stake in Bandhan Bank from 82.2 percent to 61 percent. HDFC, which owns 57.86 percent in Gruh Finance as on September 30, 2018, will end up having around 14.96 percent in Bandhan Bank. Since the bank ownership norms stipulated by RBI caps single entity holding at 10 percent, HDFC will have to offload the additional stake in Bandhan.

At the stated swap ratio, the deal seems to be fairly valued and will be a win-win situation for the shareholders of Bandhan Bank as well as Gruh Finance. The swap ratio values Gruh Finance more or less in lines with its current market capitalization of Rs 22,000 crore. The swap ratio doesn’t imply any premium as Gruh is already trading at very rich valuations. The move will help Bandhan in getting closer to regulatory compliance while acquiring a top quality housing finance company.

Reduction in promoter holding – a key motive behind Bandhan’s move

The licensing norms of the Reserve bank require a newly licensed bank to bring down promoter holding to 40 percent within three years of starting operations. Thereafter, banks are required to reduce their shareholding to 20 and 15 percent within 10 years and 12 years, respectively.

For Bandhan Bank, the deadline of three years ended on August 23, 2018. Since the bank was not able to bring down the promoter’s holding to 40 percent, it attracted the regulator’s irk for non-compliance. As a penalty, RBI withdrew its general permission to open new branches and also ordered freezing of the remuneration of the MD & CEO of the bank at existing level till further notice in Aug. Read: RBI’s Bandhan Bank diktat: Here’s what investors need to know

The acquisition of Gruh Finance is intended to bring down the promoter’s holding in Bandhan Bank as required under the licensing conditions of the RBI. Though it would not result in full compliance with RBI’s norm, merger with Gruh is a good progress and will be viewed favourably by both regulators as well as the shareholders.

Gruh will help reduce Bandhan’s portfolio concentration

Though RBI’s licensing norms seems to be the primary motive behind Bandhan’s move, Gruh Finance would be a good strategic fit for the bank.

Gruh extends housing loans to individuals in the low-income group and economically weaker section popularly known as affordable housing segment. It operates primarily in the rural and semi-urban areas of Gujarat and Maharashtra (together comprising around 63 percent of the outstanding portfolio as on June 30, 2018).

On the other hand, Bandhan’s key strength is microlending which constitutes 86 percent of its total assets. Bandhan’s stronghold is eastern and northeastern regions of India which accounted for more than 80 percent of its total portfolio and around 65 percent of its distribution network as on September 30, 2018.

Merger with Gruh will help Bandhan reduce geographical concentration, diversify the product portfolio while maintaining its core target segment - underbanked and underpenetrated markets intact.

Why HDFC is trading off Gruh with Bandhan?

Gruh finance enjoys strong and consistent profitability backed by steady loan growth, stable margins and impeccable asset quality. Since it comes from the house of HDFC, the performance doesn’t surprise us. So what could have prompted HDFC to exit Gruh especially when the fortune of affordable housing space is on an upturn?

Through this deal, HDFC seems to have bartered affordable housing segment with micro lending. This makes a lot of sense as HDFC itself is increasingly targeting the economically weaker section (EWS) and lower income group (LIG) segments in affordable housing. These segments constituted 37 percent of HDFC’s approvals (incremental sanctions) in volume terms and 18 percent in value terms during the first half of FY19. Bandhan has a distinct portfolio (microlending), which complements that of HDFC's (housing finance).

Merger of equals

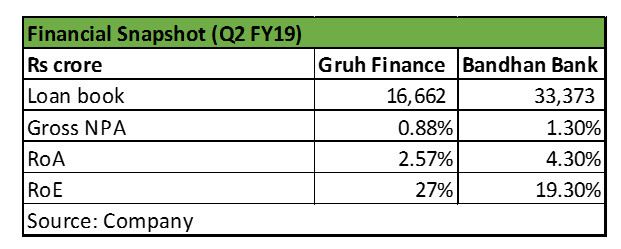

Gruh trades at very rich valuations of 14 times trailing book. As a result, the acquisition would be book value dilutive to Bandhan. However, Gruh will only add to Bandhan’s high RoE (return on equity). While Gruh may be an expensive addition, it will strengthen Bandhan’s presence at the bottom of the pyramid.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!