Sachin Pal

Moneycontrol Research

Highlights:

- Quarterly volumes came in 4 percent higher

- Margins declined to 14.1 percent in Q4

- Decline in input costs should ease cost pressures- Valuations reasonable at 8 times trailing EV/EBITDA

-------------------------------------------------

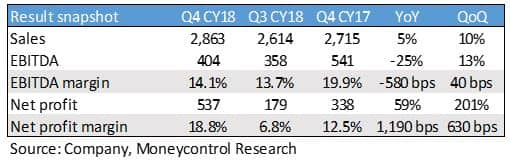

Ambuja Cements, the third largest cement manufacturer in India, had a disappointing fourth quarter. The volume growth was muted and the margins also remained under pressure. The bottom line, however, jumped on account of reversal of tax provisions.

Key Q4 positives

- The capacity utilisation moved higher to 83 percent in Q4CY18 from 79 percent in Q4CY17. For CY18, it stood at 82 percent (vs 78 percent in CY17).

- The company continues to focus on improving realisations through higher sales of the premium segment which includes Roof Special, Compocem and Cool Walls. The premiumisation strategy has aided the financial performance as the segment has reported a 38 percent year-on-year topline growth.

- Easing of cost pressures (decline in crude, petcoke, diesel prices) along with cost savings initiatives aided Ambuja’s operating margins on a sequential basis. The margin for Q4CY18 expanded to 14.1 percent from 13.7 percent in the previous quarter. On a per tonne basis, the cost pressures declined 3 percent sequentially which led to an improvement in Earnings before interest, tax, depreciation and amortization (EBITDA) per tonne.

- Despite a weaker operational performance, the bottomline surged more than 50 percent YoY to Rs 537 crores in Q4CY18, due to a reversal of tax provisions of Rs 333 crores. This was offset by an exceptional expense of Rs 130 crore relating to one-time employee separation costs and provisions on loans extended to its raw material supplier DIPL.

Key Q4 negatives

- Ambuja Cements reported revenues of Rs 2,813 crores in Q4CY18. Revenue growth of 5 percent year-on-year (YoY) was driven by a 4 percent YoY increase in volumes to 6.1 million tonnes. The volume growth was, however, lower than its similar-sized peers as well as industry standards.

- EBITDA for the quarter was Rs 404 crore compared to Rs 541 crore in the same period last year. EBITDA margin contracted ~580 bps on a yearly basis. Increase in costs (power and fuel expenses up 10 percent YoY and freight costs per tonne up 7 percent YoY) weighed on Q4 margins.

- Realisations remained muted across Ambuja’s key operating markets (North and West). On a pan-India basis, cement prices declined marginally in October, November and December impacting realisations in Q4.

Outlook and recommendation

- Strong demand from infrastructure and housing segments augurs well for the company. While the volumes are strong, cement prices remain muted amid increased competition. While Ambuja has enough spare capacity to capture the increasing market demand, the anticipated upcycle in cement prices appears some time away given the overhang of elections on the corporate capex cycle.

- Ambuja Cements (CMP: 197; Market Cap: 39,286) currently trades at a trailing EV/EBITDA multiple of 8.2x, which is at a significant discount to similar-sized peers as well as its own five-year average historic multiple. The cost pressures have started to ease as crude oil prices, as well as petcoke and coal prices, have softened in recent months. The decline in input costs should aid future margin improvement. Besides, the synergies from Master Supply Agreement with its subsidiary ACC for procurement clinker, cement, and other raw materials, would start kicking in over the next 6-12 months. We, therefore, recommend a gradual accumulation of the stock with a long-term view.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!