The extended last week remained highly volatile amid F&O expiry, coronavirus fears and a big event — Budget 2020, which disappointed the market as Sensex and Nifty posted the biggest single-day fall in nearly five years.

Nifty Bank posted the second biggest one-day fall ever.

Benchmark indices lost 2.5 percent on Budget day, making it the worst fall in last 10 Budget sessions.

"The markets will absorb the Budget effects in the next few days and in case the virus situation stabilizes, we may even see a bounce in the markets in the near term," Dhiraj Relli, MD & CEO, HDFC Securities said.

Finance Minister Nirmala Sitharaman presented Union Budget 2020-21 on February 1. It will not bring major reforms as LTCG and STT were not touched by the finance minister.

Also, the Budget fell short of expectations of giving the intended stimulus which could put the economy back on the high growth path.

FM Sitharaman introduced new slabs and reduced the tax rate for different slabs for an individual income of up to Rs 15 lakh per annum, if a taxpayer opts for foregoing exemptions and deductions.

Global markets also remained under pressure during the week on the back of extended fears of the novel coronavirus, which has killed over 300 people in China.

"Technically, the short-term trend is weak and is likely to continue for the next few trading sessions. The 11,875 level should be the immediate hurdle for the market and below the same, we could see extended correction wave up to 11,500- 11,350 levels," Shrikant Chouhan, Senior Vice-President, Equity Technical Research, Kotak Securities said.

While the Sensex shed 1,877.66 points (-4.5 percent) to end at 39,735.53 in the past week, the Nifty lost 586.4 points (-4.78 percent) to end at 11,661.85.

Foreign institutional investors (FIIs) sold equities worth Rs 9,151.61 crore, while Domestic Institutional Investors (DIIs) bought equities worth of Rs 6,388.54 crore.

The Indian rupee ended flat at 71.35 on January 31 against its January 24 closing of 71.33.

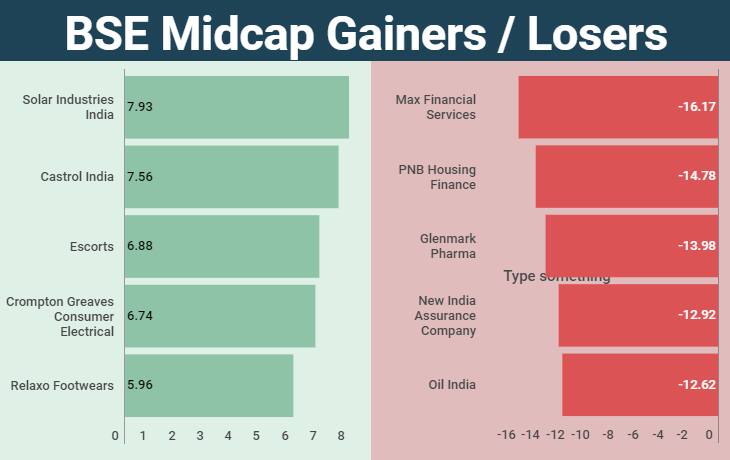

The BSE large-cap index plunged 5 percent, BSE small-cap index shed 3.3 percent and the BSE mid-cap index fell 4.4 percent in the past week.

On the BSE, Reliance Industries (RIL) lost the most in terms of market value. On the other hand, Bajaj Finance added the most in terms of market value, followed by Tech Mahindra and Bajaj Auto.

The Nifty Metal index underperformed the sectoral indices with a loss of over 11 percent during the week.

Disclaimer: Reliance Industries is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!