Equity benchmark indices continued their upward journey for the second straight session, with the Nifty 50 reporting a gain of 148 points on May 26. The market breadth remained positive, with 1,604 shares advancing compared to 1,000 declining shares on the NSE. The market is expected to consolidate after the two-day rally and may attempt another session of upward movement. Below are some short-term trading ideas to consider:

Jigar S Patel, Senior Manager - Equity Research at Anand Rathi

Great Eastern Shipping | CMP: Rs 931.8

While the shipping sector has already seen strong traction, Great Eastern Shipping has relatively underperformed — until now. Recently, the stock confirmed a breakout on the daily chart, emerging from a well-defined base formation. The downside appears limited as strong support has developed near Rs 825. Given this breakout and sectoral momentum, a fresh buying opportunity emerges. Investors may consider long positions in the Rs 920–925 range with a target of Rs 1,125.

Strategy: Buy

Target: Rs 1,125

Stop-Loss: Rs 825

Godrej Properties | CMP: Rs 2,246.9

Godrej Properties is poised for a breakout above its previous swing high of Rs 2,270. The price structure indicates a triangular consolidation, which typically precedes strong directional moves. In tandem, the daily RSI is on the verge of breaking past the 60 mark — a level that could spark renewed bullish momentum. A breakout above Rs 2,270 could open the path toward Rs 2,470. Buy only above the trigger level.

Strategy: Buy

Target: Rs 2,470

Stop-Loss: Rs 2,170

Rail Vikas Nigam | CMP: Rs 412.05

After a brief consolidation phase, railway stocks are regaining strength, and Rail Vikas Nigam is showing signs of trend resumption. The stock recently witnessed a healthy retracement from its prior move (Rs 317 to Rs 447) and is now forming a bullish engulfing candle on the daily chart, indicating renewed buying interest and trend continuation. Traders may consider buying near Rs 410 with a target of Rs 440.

Strategy: Buy

Target: Rs 440

Stop-Loss: Rs 395

Jay Thakkar, Vice President & Head of Derivatives and Quant Research at ICICI Securities

HDFC Bank June Futures | CMP: Rs 1,944.7

HDFC Bank has been consolidating within a range of Rs 1,900 to Rs 2,000. The range has been narrowing, and it is likely to break out from this level, helping the stock inch towards Rs 2,060. There has been significant short covering, which has pushed the stock from Rs 1,600 to Rs 1,950+. However, open interest (OI) has started to rise, and it is unclear whether it is due to short buildup or long buildup. Theoretically, it appears to be long buildup, hence pre-emptively recommending a long position. The price action will become clearer above Rs 1,980, so in anticipation of a breakout, one can go long on HDFC Bank Futures in the range of Rs 1,960 to Rs 1,950.

Strategy: Buy

Target: Rs 2,020, Rs 2,060

Stop-Loss: Rs 1,890

ITC June Futures | CMP: Rs 435.6

ITC has been consolidating within a range of Rs 420 and Rs 440, and a breakout from this range is likely on the way up. The stock has witnessed short covering post its quarterly results, and the price action is indicating an upward breakout. Although the stock has a large Call base at higher levels, there has been unwinding of Calls and some additions in Puts. If a breakout occurs, further confirmation may lead to massive short covering by the Call writers, potentially resulting in a Call writer trap.

Strategy: Buy

Target: Rs 460, Rs 475

Stop-Loss: Rs 426

SBI Cards and Payment Services | CMP: Rs 906.6

SBI Card has been consolidating within a range of Rs 930 to Rs 860 for the past few weeks. The stock has seen a significant rally from Rs 650 to Rs 930, mainly due to short covering. Now, the stock has seen an uptick in OI, though it is still unclear whether it's due to long or short buildup. Given the previous uptrend, the consolidation is likely to result in a breakout on the upside. In anticipation of an upside breakout, one can go long on SBI Card June Futures at Rs 912–906.

Strategy: Buy

Target: Rs 940, Rs 960

Stop-Loss: Rs 890

Vidnyan S Sawant, Head of Research at GEPL Capital

Dalmia Bharat | CMP: Rs 2,056.1

Dalmia Bharat has broken out of a 15-month consolidation phase near its 50-month EMA on the monthly chart, signaling a potential shift towards a sustained uptrend. On the weekly chart, the stock is holding firmly above its 12, 26, and 50-week EMAs, indicating a strong trend structure. The daily chart shows consistent higher highs and higher lows, supported by buying interest. Additionally, the RSI is above 60 across timeframes, confirming bullish momentum.

Strategy: Buy

Target: Rs 2,303

Stop-Loss: Rs 1,950

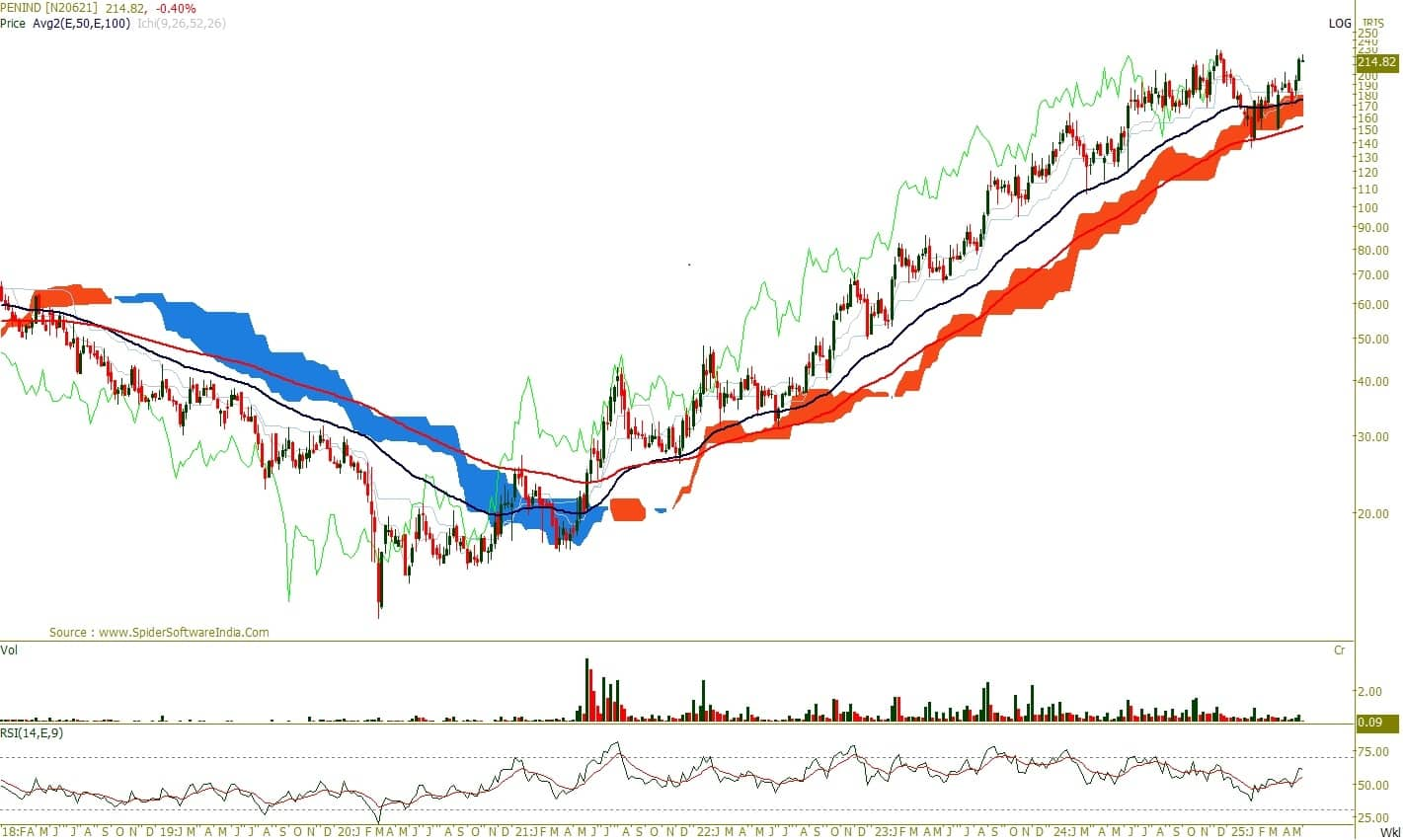

Pennar Industries | CMP: Rs 214.68

Pennar Industries has maintained a strong uptrend since 2021, forming higher bottoms on the monthly chart. Recently, the stock rebounded from the weekly Ichimoku cloud and the 100-week EMA after a 40 percent retracement, signaling a bullish mean reversion. This week, the stock broke out of a 22-week range with a strong bullish candle and volume surge, indicating renewed strength. The RSI above 60 further confirms sustained momentum across timeframes.

Strategy: Buy

Target: Rs 247

Stop-Loss: Rs 200

Bharat Heavy Electricals | CMP: Rs 261.85

BHEL, on the weekly chart, is forming a higher top and higher bottom structure after a bullish polarity shift observed in March 2025 from the 2012 and 2015 swing highs. On the daily timeframe, the stock has broken above its December 2024 swing top, reinforcing bullish sentiment. Additionally, the RSI stands at 62, supporting positive price action with strengthening momentum.

Strategy: Buy

Target: Rs 307

Stop-Loss: Rs 246

Inox Wind | CMP: Rs 190.63

Inox Wind has broken out of a 16-week consolidation phase near the key support zone, aligning with the 50 percent Fibonacci retracement level and the 100-week EMA. Sustaining above this breakout zone indicates the potential for the stock to resume its upward trajectory. On the daily chart, the stock continues to form higher tops and higher bottoms, reflecting a strong price structure. Additionally, the MACD on the weekly scale has shown a bullish crossover, reinforcing that the positive trend is supported by strong underlying momentum.

Strategy: Buy

Target: Rs 224

Stop-Loss: Rs 179

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!