The market extended an uptrend for the second consecutive session with the Nifty50 climbing above the 17,200 mark on December 28, as all sectors contributed to the gains. Positive global cues also supported the momentum.

The BSE Sensex rallied 477 points to 57,897, while the Nifty50 jumped 147 points to 17,233 and formed a bullish candle on the daily charts.

"On the daily chart, Nifty has formed a sizable bullish candle forming a higher high-low compared to the previous session and has closed above the previous session's high, indicating a positive bias. The bullish gap formed in the range of 17,161-17,112 levels will act as a crucial support zone," says Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

On the daily chart, "the index has witnessed a shift towards the upside, as the higher top and bottom formation is observed. Overall, the short-term trend has turned bullish within a broad range of 17,500-16,800 levels," he said.

One should use any pullback rally towards 17,100-17,000 levels as a buying opportunity with a stop loss of 16,900, Palviya advised.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,179.53, followed by 17,125.87. If the index moves up, the key resistance levels to watch out for are 17,268.53 and 17,303.87.

Nifty Bank

The Nifty Bank gained 125.90 points at 35,183.80 on December 28. The important pivot level, which will act as crucial support for the index, is placed at 35,030.33, followed by 34,876.86. On the upside, key resistance levels are placed at 35,344.83 and 35,505.86 levels.

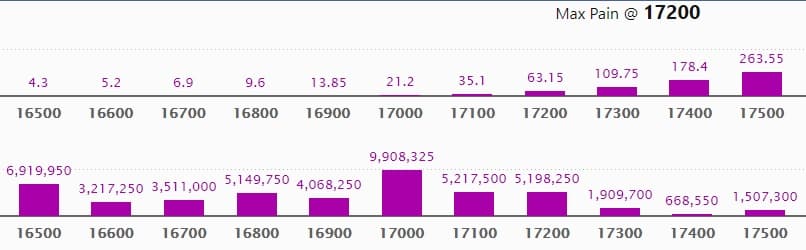

Call option data

Maximum Call open interest of 72.81 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the December series.

This is followed by 17500 strike, which holds 67.90 lakh contracts, and 17300 strike, which has accumulated 48.92 lakh contracts.

Call writing was seen at 17300 strike, which added 10.87 lakh contracts, followed by 17500 strike which added 8.8 lakh contracts, and 17600 strike which added 8.03 lakh contracts.

Call unwinding was seen at 17000 strike, which shed 19.67 lakh contracts, followed by 17100 strike which shed 18.24 lakh contracts and 18000 strike which shed 7.31 lakh contracts.

Put option data

Maximum Put open interest of 99.08 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the December series.

This is followed by 16500 strike, which holds 69.19 lakh contracts, and 17100 strike, which has accumulated 52.17 lakh contracts.

Put writing was seen at 17200 strike, which added 36.96 lakh contracts, followed by 17100 strike which added 19.95 lakh contracts and 17300 strike which added 10.04 lakh contracts.

Put unwinding was seen at 16700 strike, which shed 3.01 lakh contracts, followed by 18000 strike which shed 33,800 contracts and 17800 strike which shed 26,300 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

61 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

14 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

11 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

104 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

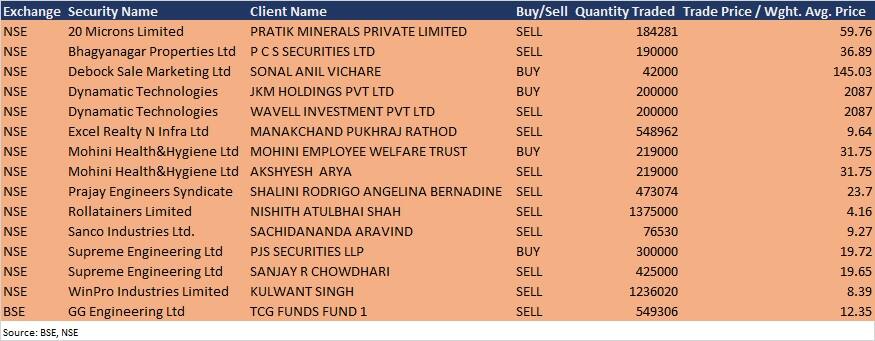

Bulk deals

(For more bulk deals, click here)

Analysts/Investors Meeting

CARE Ratings: The company's officials will meet Motilal Oswal on December 29.

Sharda Motor Industries: The company's officials will meet investors and analysts on December 29.

Bajaj Electricals: The company's officials will meet investors on December 29.

Nuvoco Vistas Corporation: The company's officials will meet Nomura Financial Advisory and Securities (India) on December 29, and Motilal Oswal Financial Services on December 30.

IIFL Finance: The company's officials will meet ICICI Securities on December 31.

Stocks in News

Aurobindo Pharma: The company announced the Drugs Controller General of India's permission to manufacture and market its generic version of Molnupiravir, to be sold as Molnaflu, licensed from MSD and Ridgeback.

India Grid Trust: The consortium of IndiGrid 1 and IndiGrid 2, wholly owned subsidiaries of India Grid Trust, has completed the acquisition of 100 percent paid-up capital and management control of Kallam Transmission, from REC Power Development and Consultancy.

Natco Pharma: The company received approval for the drug Molnupiravir, which will be sold under the brand name MOLNUNAT, for the treatment of Covid-19 in India.

GR Infraprojects: The company has emerged as L-1 bidder for the tender invited by Noida Metro Rail Corporation, for part design and construction of elevated viaduct and five elevated stations, of Noida-Greater Noida Metro Rail Project.

Mishtann Foods: The company signed a Memorandum of Understanding with the Government of Gujarat for the proposed project of manufacturing grain-based ethanol in Gujarat.

Dr Reddy's Laboratories: The company has received emergency-use authorisation from the Drugs Controller General of India to manufacture and market the oral anti-viral drug Molnupiravir capsules for the treatment of adult patients with COVID-19.

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 207.31 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 567.47 crore in the Indian equity market on December 28, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Indiabulls Housing Finance, Vodafone Idea, and RBL Bank - are under the F&O ban for December 29. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!