The market is unlikely to see firm direction in the coming sessions unless it decisively breaks the range of 21,950-22,300 on either side, experts said, adding the crossing 22,300 on the higher side may take the Nifty 50 towards the 22,400-22,500 area and the breakdown of the 21,950-22,000 zone can dampen the sentiment.

On February 27, the benchmark indices snapped a two-day correction. The BSE Sensex rallied 305 points to 73,095, while the Nifty 50 rose 76 points to 22,198 and formed a Bullish Engulfing kind of candlestick pattern on the daily charts, the bullish trend reversal pattern.

"The trend remains positive as the index has consistently stayed above the near-term moving average. Overall, the bulls may continue to exert control as the index has closed above the previous consolidation high," Rupak De, senior technical analyst at LKP Securities said.

He feels a decisive move above 22,200 might propel the index for a decent rally towards 22,400 in the near term. "Support on the lower end is situated at 22,000."

Meanwhile, the Bollinger bands are contracting indicating rangebound price action. "The hourly momentum indicator has triggered a positive crossover which is a buy signal and thus intraday dips are likely to be bought into," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

The pivot point calculator indicates that the Nifty is likely to take immediate support at 22,117 followed by 22,086 and 22,035 levels, while on the higher side, it may see immediate resistance at 22,218 followed by 22,249 and 22,300 levels.

Bank NiftyOn February 27, the Bank Nifty closed at 46,588, up 12 points after volatility, forming a bullish candlestick pattern with upper and lower shadows on the daily charts. The banking index snapped a four-day losing streak and defended 21-day EMA (exponential moving average placed at 46,350), but overall, it is expected to be rangebound in coming sessions.

"The battle between the bulls and bears may persist for a few more days or until a decisive breakout from the range of 46,500-47,000 on a closing basis," Rupak De, senior technical analyst at LKP Securities said.

He feels a significant decline below 46,500 could lead the index towards 45,500 in the short term. "Conversely, a sustained trade above 47,000 might propel the index towards 47,700."

As per the pivot point calculator, the Bank Nifty is expected to take support at 46,393 followed by 46,300 and 46,148 levels, while on the higher side, the index may see resistance at 46,697 followed by 46,791 and 46,942 levels.

On the monthly options data front, the maximum Call open interest remained at 23,000 strike with 1.3 crore contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,500 strike, which had 80.9 lakh contracts, while the 22,800 strike had 77.08 lakh contracts.

Meaningful Call writing was seen at the 22,800 strike, which added 24.17 lakh contracts followed by 22,500 and 22,700 strikes adding 12.9 lakh and 12.31 lakh contracts, respectively.

The maximum Call unwinding was at the 22,900 strike, which shed 17.97 lakh contracts followed by the 23,200 and 23,300 strikes, which shed 5.01 lakh contracts and 2.02 lakh contracts.

On the Put side, the 21,500 strike owned the maximum open interest, which can act as a key support level for Nifty, with 91.19 lakh contracts. It was followed by the 22,000 strike comprising 86.31 lakh contracts and then the 21,000 strike with 68.18 lakh contracts.

Meaningful Put writing was at 21,500 strike, which added 22.49 lakh contracts followed by the 22,000 strike and 22,100 strike, which added 19.98 lakh contracts and 17.02 lakh contracts, respectively.

Put unwinding was seen at the 21,000 strike, which shed 4.39 lakh contracts followed by the 21,300 strike shedding 3.47 lakh contracts, and then the 21,200 strike, which shed 1.83 lakh contracts.

A high delivery percentage suggests that investors are showing interest in the stock. ICICI Lombard General Insurance Company, Sun Pharmaceutical Industries, Dabur India, Ramco Cements and Britannia Industries saw the highest delivery among the F&O stocks.

A long build-up was seen in 34 stocks, which included ICICI Lombard General Insurance Company, Voltas, ICICI Bank, Havells India and Biocon. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 53 stocks saw long unwinding including Delta Corp, Jubilant Foodworks, Granules India, Canara Bank and Cholamandalam Investment & Finance. A decline in OI and price indicates long unwinding.

A short build-up was seen in 48 stocks including Gujarat Gas, GMR Airports Infrastructure, Muthoot Finance, Shriram Finance and Ipca Laboratories. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 52 stocks were on the short-covering list. This included Bata India, IndiaMART InterMESH, SBI Cards & Payment Services, Balrampur Chini Mills and Astral. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, rose to 1.00 on February 27 against 0.97 levels in the previous session. The PCR at 1.00 indicates that the trading volume of Call options is equal to Put options, which generally indicates a neutral trend in the markets.

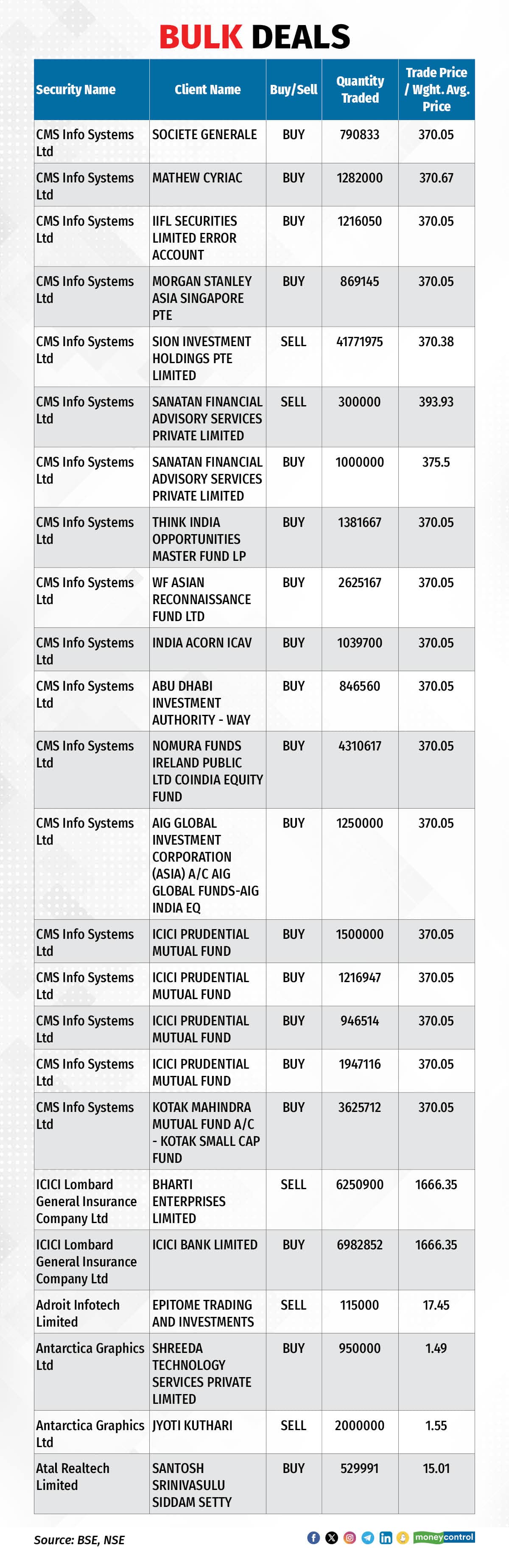

Bulk dealsCMS Info Systems: Promoter Sion Investment Holdings Pte Limited exited the company by selling its entire shareholding of 4,17,71,975 equity shares (equivalent to 26.69 percent of paid-up equity) via open market transactions, at an average price of Rs 370.38 per share, which is valued at Rs 1,547.15 crore.

Capital Small Finance Bank: The small finance bank has recorded a net profit of Rs 28.93 crore for the quarter ended December FY24, rising 2.4 percent over a year-ago period, partly supported by other income and lower bad loans provisions. Net interest income grew by 1.3 percent year-on-year to Rs 87.44 crore for the quarter.

SJVN: Subsidiary SJVN Green Energy (SGEL) has commissioned a 100 MW Raghanesda solar power project in Banaskantha, Gujarat. SGEL has bagged this 100 MW solar power project at a tariff of Rs 2.64 per unit.

Juniper Hotels: The luxury hotel development company is set to debut on the bourses on February 28. The final issue price has been fixed at Rs 360 per share.

Axis Bank: The Reserve Bank of India has approved the appointment of Munish Sharda as Executive Director of Axis Bank for three years with effect from February 27.

Vodafone Idea: The board of directors has approved a fundraising of up to Rs 20,000 crore via equity. Through a combination of equity and debt, the company plans to raise around Rs 45,000 crore.

Titan Company: The company acquired a balance of 1,19,489 equity shares (which is 0.36 percent of paid-up equity) held by the individual shareholders of CaratLane Trading in CaratLane, for Rs 60.08 crore. The company currently holds 99.64 percent of the total equity share capital of CaratLane.

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net sold shares worth Rs 1,509.16 crore, while domestic institutional investors (DIIs) bought Rs 2,861.56 crore worth of stocks on February 27, provisional data from the NSE showed.

Stocks under F&O ban on NSEThe NSE has added Indus Towers to the F&O ban list for February 28, while retaining Aditya Birla Fashion & Retail, Canara Bank, SAIL and Zee Entertainment Enterprises to the said list. Balrampur Chini Mills was removed from the list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.