It was a weak start for benchmark indices this week with the Sensex and Nifty losing nearly 1 percent each on March 25. This was the second consecutive session of decline for the market.

The 30-share BSE Sensex fell 355.70 points at 37,808.91, and the Nifty was down 102.65 points at 11,354.25.

The market breadth was negative throughout the day whereas Nifty closed lower by 102 points along with selling pressure in every sector. The index opened below 11,400 levels and ended lower forming an Opening Black Marubozu candlestick formation, indicating a continuation of existing down move; however, today's opening price of 11,395 will act as a crucial resistance ahead, said Shabbir Kayyumi, Head of Technical Research, Narnolia Financial Advisors.

As long as Nifty is trading below 5 EMA standing at 11,420 levels its correction sell leg can extend towards immediate support of ascending trend line placed around 11,280 and below that 11,250 levels. On the other side, a decisive close above 5 EMA (11,420) will change the current sentiments, he added.

India VIX moved up by 1.93 percent at 16.59 levels. Volatility fell down from highs but moved from its base of 14 zones so some volatile cues could be seen.

All the sectoral indices ended in the red. The Nifty Midcap index and Smallcap index fell 1 percent each.

We have collated top 10 data points to help you spot profitable trades:Key support and resistance level for NiftyThe Nifty closed at 11354.2 on March 25. According to the Pivot charts, the key support level is placed at 11,311.97, followed by 11,269.73. If the index starts moving upward, key resistance levels to watch out are 11,396.07 and 11,437.93.

Nifty BankThe Nifty Bank index closed at 29,281.2, down 301.1 points on March 25. The important Pivot level, which will act as crucial support for the index, is placed at 29,181.8, followed by 29,082.4. On the upside, key resistance levels are placed at 29,355, followed by 29,428.8.

Maximum Call open interest (OI) of 38.61 lakh contracts was seen at the 11,500 strike price. This will act as a crucial resistance level for the March series.

This was followed by the 11,600 strike price, which now holds 37.20 lakh contracts in open interest, and 11,700, which has accumulated 25.61 lakh contracts in open interest.

Significant Call writing was seen at the strike price of 11,400, which added 13.42 lakh contracts, followed by 11,500 strike, which added 9.36 lakh contracts and 11,700 strike that added 2.80 lakh contracts.

Call unwinding was seen at the strike price of 11,000 that shed 1.51 lakh contracts, followed by 11,600 strike that shed 1.37 lakh contracts and 11,900 strike that shed 1.04 lakh contracts.

Maximum Put open interest of 36.82 lakh contracts was seen at the 11,000 strike price. This will act as a crucial support level for the March series.

This was followed by the 11,200 strike price, which now holds 30.14 lakh contracts in open interest, and the 11,300 strike price, which has now accumulated 27.64 lakh contracts in open interest.

Put writing was seen at the strike price of 11,300, which added 4.50 lakh contracts, followed by 11,100 strike that added 3.62 lakh contracts and 11,200 strike that added 3.38 lakh contracts.

Put unwinding was seen at the strike price of 11,500, which shed 7.33 lakh contracts, followed by 11,400 strike that shed 3.51 lakh contracts and 11,600 strike that shed 3.11 lakh contracts.

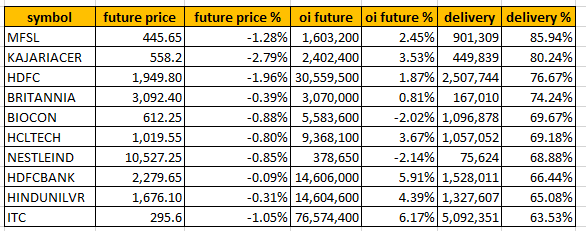

High delivery percentage suggests investors are accepting the delivery of the stock, which means that investors are bullish on it.

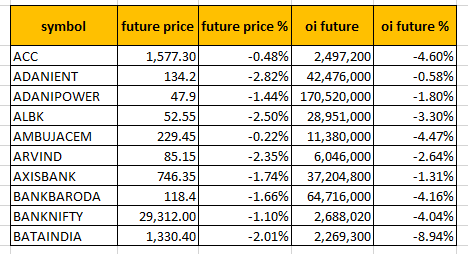

A decrease in open interest along with an increase in price mostly indicates short covering.

An increase in open interest along with a decrease in price mostly indicates a build-up of short positions.

Jet Airways’ Naresh Goyal & Anita Goyal step down from board

Newgen Software Technologies approved to incorporate a wholly-owned subsidiary in Australia and to make initial investment upto 1.5 million Australian dollars in the proposed subsidiary

Tourism Finance Corporation of India appoints Anirban Chakraborty as additional director and MD & CEO

Suzlon Energy sells balance stake in subsidiaries i.e. SE Solar and Gale Solarfarms for Rs 76.55 crore and Rs 22.54 crore respectively to CLP Wind Farms

DLF QIP opens, sets floor price at Rs 193.01 per share

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!