Sunil Shankar Matkar

The bulls managed to gain the upper hand on Dalal Street after a tussle with the bears on Friday. The Nifty50 closed marginally higher amid consolidation and weak global cues, continuing the uptrend for the fourth consecutive session.

The 30-share BSE Sensex was up 33.29 points at 35,962.93, while the 50-share NSE Nifty managed to close above 10,800 levels, up 14 points at 10,805.50, forming a bullish candle which closely resembles a 'Hanging Man' pattern on daily charts.

The 'Hanging Man' is a single candlestick pattern and is indicative of a price reversal. It signals a market high and is classified as a Hanging Man only if it is preceded by an uptrend in the aftermath of a high point on the charts.

"The Nifty's near term trend is positive. The market is currently showing sideways consolidation pattern at the highs. The study of the overall chart pattern as per daily and weekly timeframe, one may expect limited upside from here," Nagaraj Shetti, Technical Research Analyst at HDFC securities told Moneycontrol.

According to him, the Nifty is likely to encounter key overhead resistance at 10,900-11,100 levels in the next two weeks, where one may expect the emergence of weaknesses in the market at higher levels.

Hence, continuing long trading positions by placing a strict stop-loss is advisable, he said.

For the week ended December 14, the Sensex gained 0.8 percent while the Nifty inched up by a percent, forming a robust bullish candle on the weekly charts. The broader market outperformed as the BSE Midcap index rose 3.2 percent while the S&P BSE Smallcap index closed 2.8 percent higher.

"The Nifty rebounded from the weekly low of 10,334 and ended just above 10,800 mark. Ending the week with a bullish candle does not necessarily imply greater highs in coming sessions, considering the fact that global equity benchmark indexes are caught in the doldrums," said Jaydeb Dey of Stewart & Mackertich Wealth Management.

He added that a weak global outlook translate into the Nifty facing higher resistance around 10,840 and 10,940. "On an extended note, the Nifty's broader trading range is expected to be 10,540-10,940 this coming week."

We have collated top 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

The Nifty closed at 10,805.45 on December 14. According to Pivot charts, the key support level is placed at 10,766.47, followed by 10,727.43. If the index starts moving upwards, key resistance levels to watch out are 10,830.17 and then 10,854.83.

Nifty Bank

The Nifty Bank index closed at 26,826, up 9.65 points on December 14. The important Pivot level, which will act as crucial support for the index, is placed at 26,736.14, followed by 26,646.27. On the upside, key resistance levels are placed at 26,912.44, followed by 26,998.87.

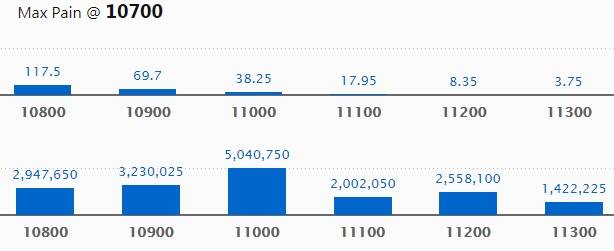

Call Options Data

Maximum Call open interest (OI) of 50.40 lakh contracts was seen at the 11,000 strike price. This will act as a crucial resistance level for the December series.

This was followed by the 10,900 strike price, which now holds 32.30 lakh contracts in open interest, and 10,800, which has accumulated 29.47 lakh contracts in open interest.

Meaningful Call writing was seen at 10,800, which added 1.17 lakh contracts, followed by 11,000 strike which added 0.98 lakh contracts and 10,900 strike which added 0.51 lakh contracts.

Call unwinding was seen at 11,100 strike, which shed 2.74 lakh contracts, followed by 10,600 strike which shed 1 lakh contracts and 10,500 strike which shed 0.71 lakh contracts.

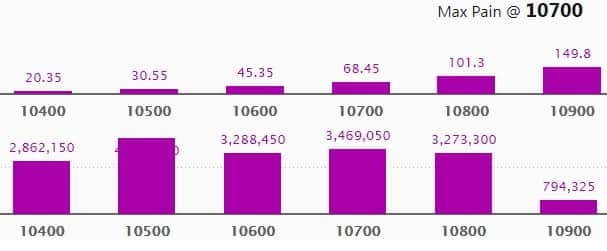

Put Options data

Maximum Put open interest of 40.29 lakh contracts was seen at the 10,500 strike price. This will act as a crucial support level for the December series.

This was followed by the 10,700 strike price, which now holds 34.69 lakh contracts in open interest, and the 10,600 strike price, which has now accumulated 32.88 lakh contracts in open interest.

Put writing was seen at the strike price of 10,800, which added 4.52 lakh contracts, followed by 10,700 strike which added 4.50 lakh contracts, and 10,400 which added 1.43 lakh contracts.

Put unwinding was seen at the strike of 11,000, which shed 0.57 lakh contracts, followed by 11,300 which shed 0.27 lakh contracts.

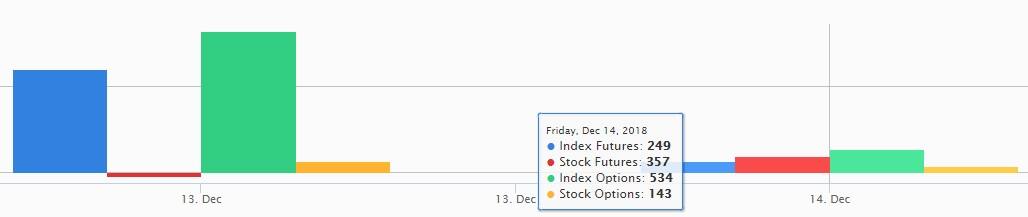

FII & DII data

Foreign Institutional Investors (FIIs) purchased shares worth Rs 861.94 crore while Domestic Institutional Investors sold Rs 302.52 crore worth of shares in the Indian equity market on December 14, as per provisional data available on the NSE.

Fund Flow Picture

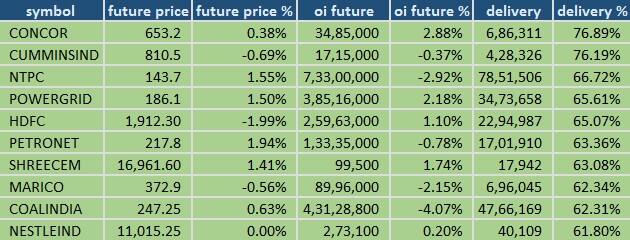

Stocks with high delivery percentage

High delivery percentage suggests that investors are accepting delivery of the stock, which means that investors are bullish on it.

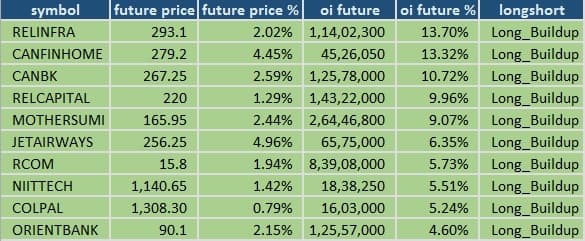

53 stocks saw a long buildup

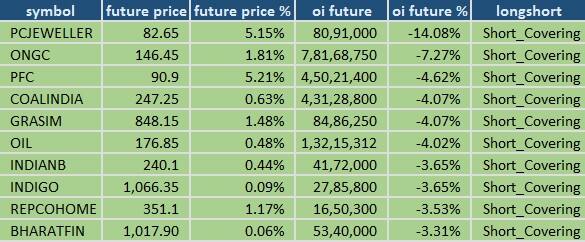

61 stocks saw short covering

A decrease in open interest along with an increase in price mostly indicates short covering.

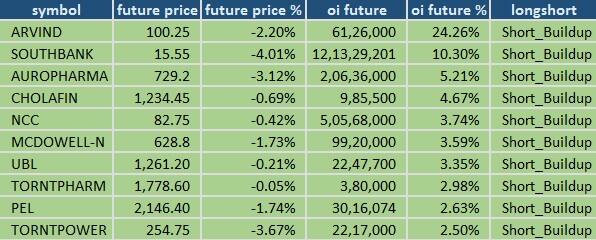

40 stocks saw a short build-up

An increase in open interest along with a decrease in price mostly indicates a build-up of short positions.

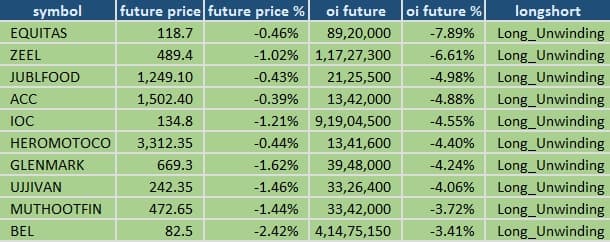

47 stocks saw long unwinding

Bulk Deals on December 14

Rolta India: Central Bank of India (Capital Market Services Branch) sold 11,65,855 shares of the company at Rs 9.93 per share on the NSE.

Marathwada Refractories: Sparrow Asia Diversified Opp Fund bought 3,830 shares of the company at Rs 290 per share on the BSE.

(For more bulk deals, click here)

Analyst or Board Meet/Briefings

Bharti Airtel: A board meeting is scheduled on December 20 to consider various fund raising options for the company.

Commercial Engineers & Body Builders: An extra ordinary general meeting (EGM) of the company will be held on January 7, 2019.

Allahabad Bank: An EGM of shareholders of the bank is scheduled to be held on January 10.

Galaxy Entertainment Corporation: A board meeting is scheduled on December 19 to consider various fund raising options including but not limited to issuance of equity/convertible securities on preferential basis.

Fine Organic Industries: Officials of the company will be meeting investors on December 17 in Mumbai.

Canara Bank: A board meeting is scheduled on December 19 to consider raising of additional Tier I bonds.

Finolex Industries: The company's officials will be meeting research analyst of Anand Rathi on December 17.

Shriram City Union Finance: The company's officials will be meeting Fidelity Investments Inc on December 17, TenCore Partners on December 18 and 19, and HDFC MF on December 19.

Infosys: Board meeting is scheduled on January 11, 2019 to consider quarterly financial results.

HPL Electric and Power: The company has scheduled a meeting with investors / analysts in Mumbai on December 17 and 18.

Crompton Greaves Consumer Electricals: The company's officials will be meeting analysts/institutional investors on December 17.

Mahindra Holidays & Resorts India: The company's officials will be meeting several funds/investors on December 17.

Eicher Motors: The company's officials will be meeting Think Invest on December 17 and select equity group on December 18.

Mahindra & Mahindra: The company's officials will be meeting RARE Enterprises on December 18.

Timken India: Representatives of the company are expected to join an analyst meet arranged by Spark Capital at Mumbai on December 18.

Stocks in the news

Vedanta: The National Green Tribunal allowed company to resume operations of copper smelter at Thoothukudi and directed the Tamil Nadu Pollution Control Board (TNPCB) to pass fresh order of renewal of consent and restoration of electricity supply for operations within 3 weeks from the date of the order.

Teva Pharma gets US FDA nod for Herzuma, biosimilar to Herceptin, for treatment of HER2 - CNBC-TV18.

Cadila Healthcare: Zydus gets US FDA nod for Albendazole tablets & Pregabalin capsules.

Vodafone Idea: The company issued a clarification on a report by the Telecom Tribunal that set aside TRAI's predatory pricing issues. The Telecom Disputes Settlement and Appellate Tribunal (TDSAT) impugned the tariff amendment on predatory pricing due to a lack of "transparency".

IL&FS Transportation Networks: The company issued a clarification pertaining to allegations by the promoter of Enso Infra which filed a petition before the NCLT on similar grounds.

Tata Sponge Iron: The company got shareholders' nod to increase the borrowing limit, and also to issue preference shares to Tata Steel on a private placement basis.

Wipro: The company announced strategic partnership with Saxo Bank.

NTPC: The company acquired Barauni Thermal Power Station (720 MW) in Bihar's Begusarai district from the Bihar State Power Generation Company Limited.

Infosys: The company signed an agreement to divest its shares in CloudEndure Limited for a total consideration of approximately $15.3 million.

IL&FS Engineering and Construction Company: Company received a letter from the Maharashtra Metro Rail Corporation Limited informing the company of the decision of the competent authority to terminate a contract for the construction of seven elevated metro stations, and three at-grade stations (North South Corridor) of the Nagpur Metro Rail Project.

Triveni Turbine: A buyback Committee of the company approved December 28 as the record date to determine the eligibility of shareholders who are eligible to participate in the proposed buyback of the equity shares of the company.

Security and Intelligence Services (India): The company signed definitive agreements to acquire an initial 51 percent shareholding in Uniq Detective and Security Services Private Limited.

UFO Moviez India: Company says except for 1 equity share of Scrabble Digital (associate company of company's subsidiary), which is in the process of being acquired, its subsidiary Scrabble Entertainment completed the acquisition of 3,95,427 equity shares of Scrabble Digital.

Dilip Buildcon: Subsidiary DBL Rewa Sidhi Highways Private Limited received the appointed date i.e. December 14, 2018 by the National Highways Authority of India.

Sumeet Industries: The status of accounts of various credit facilitates sanctioned by the banks under a consortium to the company has been categorised under non-performing assets (NPA)-sub standard assets. The company is functioning smoothly even though its financial strength is under scrutiny. It submitted a resolution plan with a leading banker.

Shalimar Paints: A Rights Issue Committee of the board, in order to provide an opportunity to shareholders to exercise their rights in the Rights Issue, extended the closure date for making an application under the captioned issue from December 17, 2018 to December 24, 2018.

Future Consumer: The company sold its stake in Amar Chitra Katha Private Limited for Rs 44.39 crore.

Datamatics Global Services: The company is set to de-merge and separately list its subsidiary Lumina Datamatics.

Talwalkars Better Value Fitness: The company made investments in Firstnutri Weight Loss Private Limited.

HPL Electric & Power: The company issued commercial paper worth Rs 85 crore.

Techno Electric & Engineering Company: The board fixed January 3 as the record date for determining the members of the company who are eligible to participate in the buyback.

Solara Active Pharma Sciences: Solara Research Centre completes USFDA inspection with zero 483s.

OCL Iron and Steel Q2: Loss at Rs 84.8 crore versus loss at Rs 55.2 crore; Revenue falls to Rs 86 crore versus Rs 99 crore YoY.

Alliance Integrated Metaliks Q2: Loss at Rs 6.42 crore versus loss at Rs 27.51 crore; Revenue rises to Rs 24.5 crore versus Rs 9.19 crore YoY.

IL&FS Investment Managers Q2: Consolidated loss at Rs 23 crore versus profit at Rs 1.6 crore; Revenue drops to Rs 24.6 crore versus Rs 26.74 crore YoY.

Kwality Limited Q2: Loss at Rs 950.7 crore versus profit at Rs 21 crore; Revenue falls to Rs 351.12 crore versus Rs 1,670.66 crore YoY.

4 stocks under ban period on NSE

Securities which are in the ban period for the next day's trade under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

For December 14, 2018, Adani Enterprises, Adani Power, Jet Airways and Reliance Capital are present in this list.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.