The market closed the April 23 session in the red as traders continued to cautious amid COVID-19 infections hitting record levels day-after-day. The possibility of an increase in capital gains tax in the US also dented the sentiment.

The BSE Sensex fell 202.22 points to 47,878.45, while the Nifty50 corrected 64.80 points to 14,341.40 and formed Doji kind of pattern on the daily charts as the closing was near its opening levels.

For the full week, the index fell 1.9 percent and witnessed Doji kind of pattern formation on the weekly scale, too.

"Technically, on daily and weekly charts, the index has formed lower top formation, and the non-directional intraday activity clearly indicates indecisiveness between bulls and bears which will continue in the short run. The short term texture of the Nifty is still bearish and likely to continue in the near future," Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities said.

"We are of the view that, 14,250 would be the immediate support level for the bulls, below the same we can expect one more leg of correction up to 14,150. Further downside may also be possible which could drag the index till 14,000-13,900," he added.

On the flip side, 14,500 would be the immediate hurdle for the Nifty, above the same uptrend structure will continue up to 14,700," he said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,256, followed by 14,170.7. If the index moves up, the key resistance levels to watch out for are 14,443.9 and 14,546.5.

Nifty Bank

The Nifty Bank index declined 60.30 points to 31,722.30 on April 23. The important pivot level, which will act as crucial support for the index, is placed at 31,350.21, followed by 30,978.1. On the upside, key resistance levels are placed at 32,121.41 and 32,520.5 levels.

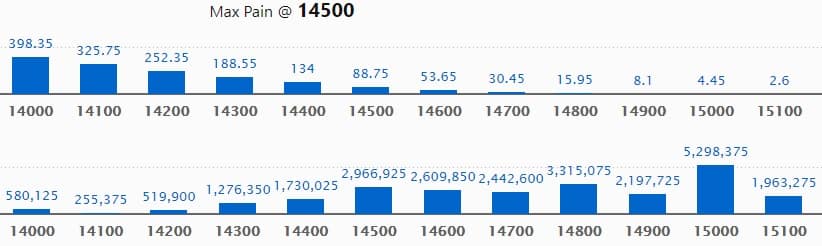

Call option data

Maximum Call open interest of 52.98 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 14,800 strike, which holds 33.15 lakh contracts, and 14,500 strike, which has accumulated 29.66 lakh contracts.

Call writing was seen at 15,000 strike, which added 11.54 lakh contracts, followed by 14,800 strike which added 8.38 lakh contracts and 14,600 strike which added 7.36 lakh contracts.

Call unwinding was seen at 13,500 strike, which shed 22,050 contracts, followed by 13,600 strike which shed 2,175 contracts.

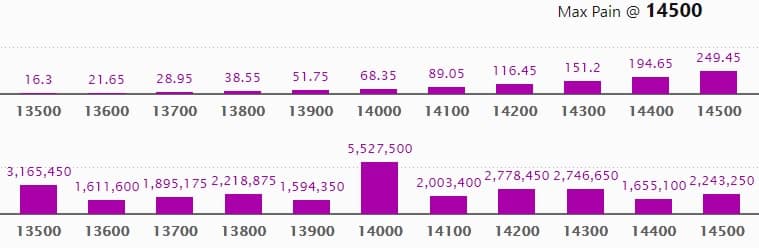

Put option data

Maximum Put open interest of 55.27 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the April series.

This is followed by 13,500 strike, which holds 31.65 lakh contracts, and 14,200 strike, which has accumulated 27.78 lakh contracts.

Put writing was seen at 14,000 strike, which added 6.74 lakh contracts, followed by 14,100 strike which added 4.43 lakh contracts and 14,300 strike which added 4.35 lakh contracts.

Put unwinding was seen at 14,500 strike, which shed 1.08 lakh contracts, followed by 14,600 strike which shed 98,175 contracts, and 14,700 strike which shed 66,525 contracts.

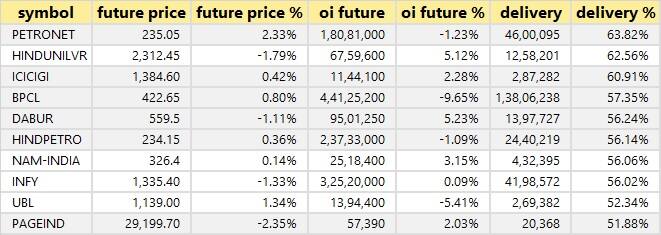

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

34 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

42 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

49 stocks saw short build-up

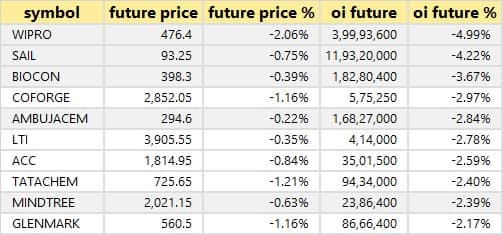

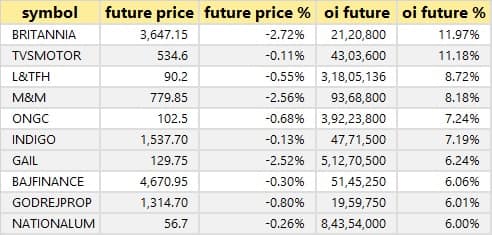

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

33 stocks witnessed short-covering

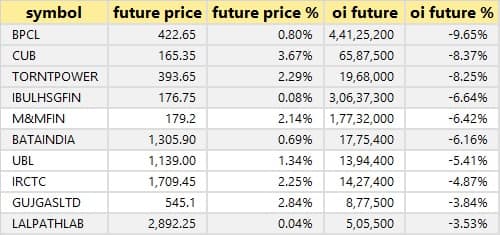

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

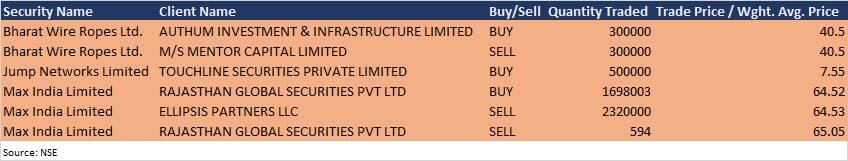

Bulk deals

(For more bulk deals, click here)

Results on April 26

Tech Mahindra, HDFC Life Insurance Company, SBI Cards and Payment Services, Castrol India, Delta Corp, Alok Industries, Automotive Stampings & Assemblies, Benares Hotels, Kedia Construction, National Standard (India), Roselabs Finance, Schaeffler India, Snowman Logistics, Suraj, Tata Teleservices (Maharashtra) and Welcure Drugs & Pharmaceuticals will declare quarterly earnings on April 26.

Stocks in the News

ICICI Bank: The bank reported sharply higher profit at Rs 4,402.6 crore in Q4FY21 against Rs 1,221.4 crore in Q4FY20, net interest income jumped to Rs 10,431 crore from Rs 8,928 crore YoY.

HCL Technologies: The company reported lower consolidated profit at Rs 2,962 crore in Q4FY21 against Rs 3,982 crore in Q3FY21, revenue rose to Rs 19,642 crore from Rs 19,302 crore QoQ. The company expects FY22 revenue to grow in double digits in constant currency terms and EBIT margin between 19-21%.

Indiabulls Real Estate: The company reported consolidated profit at Rs 94.5 crore in Q4FY21 against loss of Rs 109.7 crore, revenue rose to Rs 731.7 crore from Rs 116.3 crore YoY.

Shalby: Shah Family Trust, one of the promoters of Shalby, proposed to sell up to 58.1 lakh equity shares of the company (representing 5.38% of total paid-up equity) via offer for sale on April 26 and April 27. The floor price for the offer has been fixed at Rs 111 per share.

Federal-Mogul Goetze (India): Promoter IEH FMGI Holdings LLC proposed to sell 55,38,101 equity shares of the company (representing approximately 9.95% of total paid-up equity), via offer for sale on April 26-27, with an option to additionally sell 55,38,100 equity shares (representing approximately 9.95% of total paid-up equity).

Ramkrishna Forgings: The company has started commercial production of 7000 tonnes press from its Plant-V, at Saraikala, Jamshedpur from April 22, increasing the production capacity of the company by 17,000 tonnes per annum.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,360.76 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 1,695.59 crore in the Indian equity market on April 23, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Indiabulls Housing Finance and Sun TV Network - are under the F&O ban for April 26. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!