Kshitij Anand

The carnage in the broader market in 2018 can’t go unnoticed and is one of the prime reason why portfolios of most mutual fund investors are still in the red. The S&P BSE Midcap and BSE Smallcap nosedived 14 percent and about 24 percent, respectively, in 2018.

The sell-off in the broader market was caused by selling owing to the new categorization of MF schemes, additional surveillance measure by SEBI, change in equity taxation, increase in a number of corporate governance issues, as well as liquidity crisis in NBFC space.

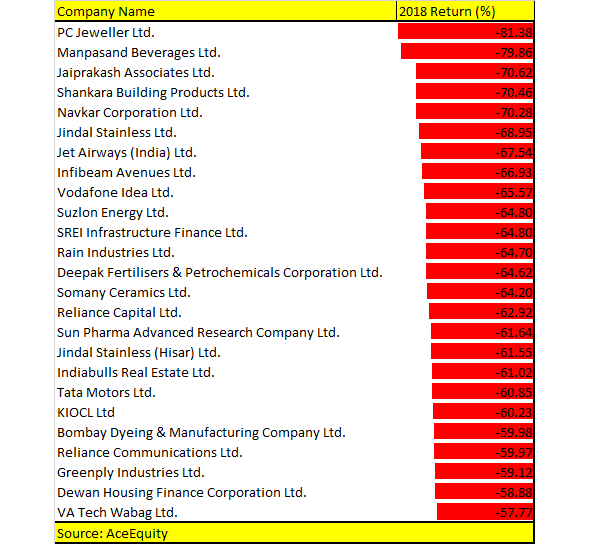

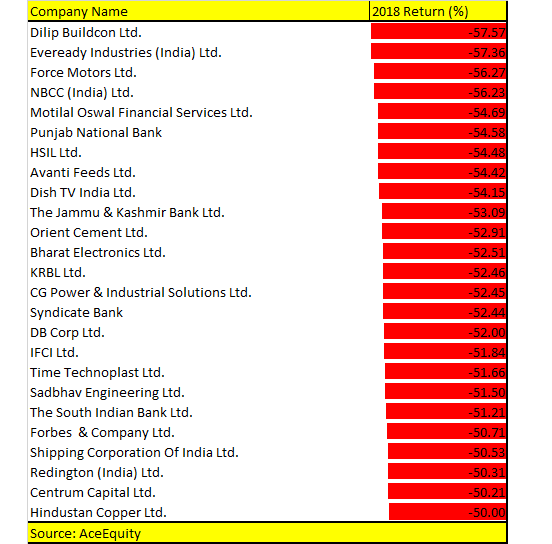

As many as 377 stocks recorded negative returns in the S&P BSE 500 index in 2018. Among the S&P BSE 500 index, as many as 50 companies fell 50-80 percent last year.

Stocks that fell over 50 percent in 2018 include PC Jeweller, Jet Airways, Jindal Stainless, Suzlon Energy, Reliance Capital, Tata Motors, Indiabulls Real Estate, Dewan Housing Finance, Dilip Buildcon, Punjab National Bank.

As small and midcaps are down by more than 50 percent, one can start to bottom fish good quality companies but avoid averaging stocks whose fundamentals have deteriorated significantly, suggest experts.

“Small & midcaps are an ocean and one can do bottoms-up stock picking at current levels. Within these beaten down midcaps, one needs to clearly avoid companies having a poor corporate governance track record. Look at only companies having a clean track record in financial and management ethics,” Rusmik Oza, Sr. VP (Head of Fundamental Research), Kotak Securities told Moneycontrol.

“Though it is difficult to forecast the earnings of small and midcaps, one needs to identify companies where the probability of earnings growth is high. It is also ideal to look at valuations because if a company’s earnings have eroded by >50% then the stock would still remain at elevated valuations even after a price correction of more than 50 percent,” he said.

Oza further added that from now till election results, one should avoid unknown and poor quality small & midcaps. Post Lok Sabha elections, one can revisit beaten down small and midcaps based on the election outcome.

Yes, there exists an opportunity to dive in to select stocks but experts are of the view that stocks which have corrected by more than 50 percent in a year have severe structural challenges both internal as well as external; hence, one should be more careful while picking stocks.

“Most of the stocks that fell severely in CY18 had corporate governance or capital allocation issues with which investors were not comfortable. Such companies may see sell on rises as long as the people responsible for this situation remain in control,” Deepak Jasani, Head of Retail Research, HDFC Securities told Moneycontrol.

“Disruption due to technology, e-commerce etc. also impacted the business models of quite a few companies. Rising interest rates accompanied by lower availability of credit affected the working capital cycle of some companies,” he said.

Jasani is of the view that in a country like India where a number of companies are many, entrepreneurship is highly prevalent, and regulations are in place, investors can ill-afford to ignore mid and small caps though they carry higher risks in market downturns.

He added that investors can hope to gain alpha only in small and midcaps where enough due diligence has been done and reasonable care has been taken to enter and book profits at or near the right times. In H2CY19 we may see small and midcap space starting to perform and beginning to make good the underperformance seen in 2018.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!