Quant Small Cap Fund has been the outlier among all smallcap funds in the month of May with the scheme attracting as much as 43% of the cumulative inflows that the category witnessed in the month of May.

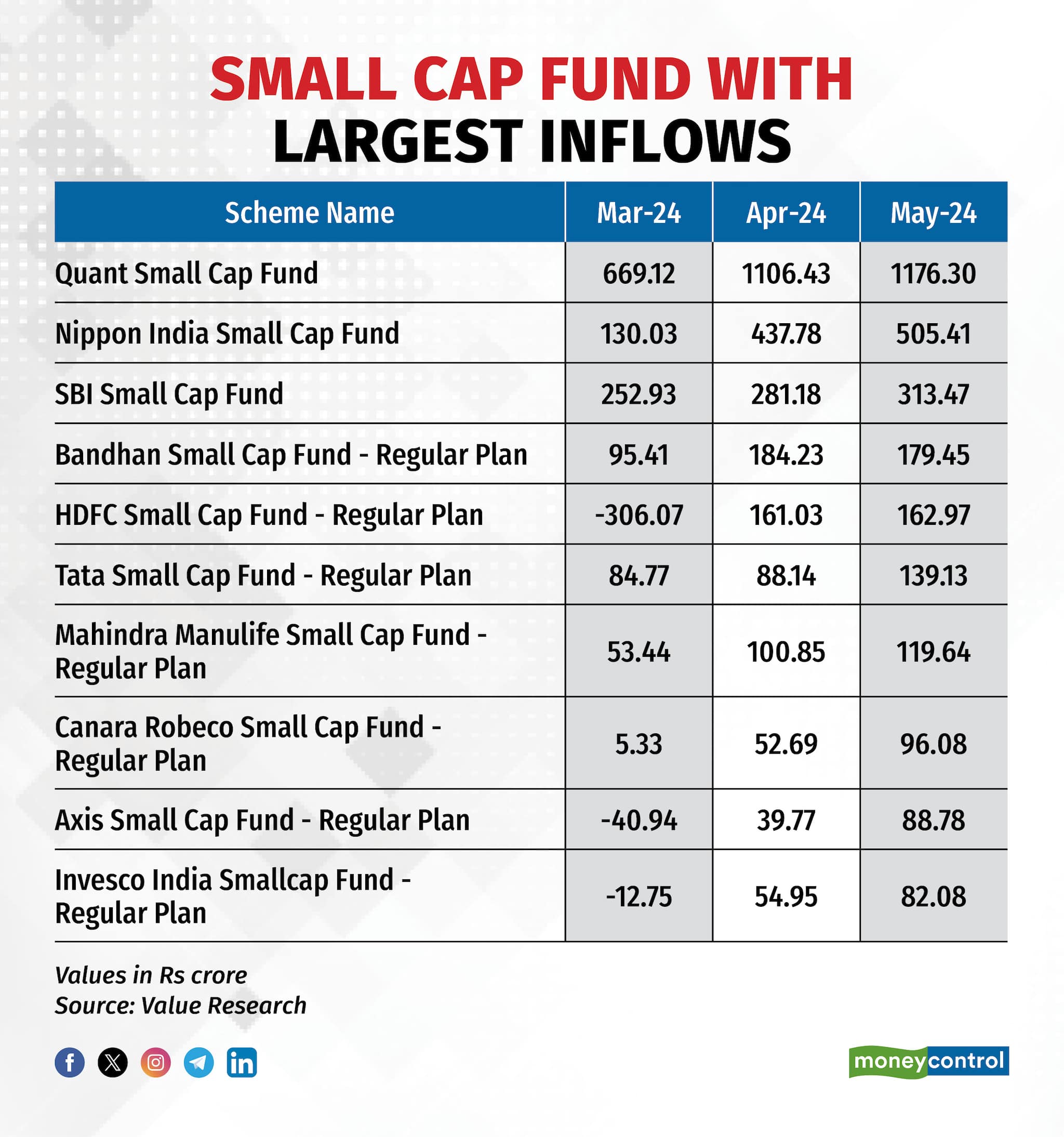

Data from Value Research shows that Quant Small Cap Fund saw net inflows totalling Rs 1,176.30 crore in May, which was significantly higher than its previous month’s inflows of Rs 1,106 crore and also that of March when it was pegged at just Rs 669.12 crore.

The fund has given returns of around 20 percent since inception -- higher than the 13.08 percent return of the Nifty Small Cap 250 TRI benchmark index.

Data further showed that apart from Quant Small Cap Fund, the top schemes in terms of monthly inflows were Nippon India Small Cap Fund, which registered inflows of Rs 505.41 crore in May followed by SBI Small Cap Fund with net flows of Rs 313.47 crore.

Since inception, Nippon India Small Cap Fund and SBI Small Cap Fund have generated returns of 22.7 percent and 21.34 percent, respectively.

Interestingly, a recent report by Elara Capital highlighted the fact that despite a temporary pause in March, following SEBI's comments on concerns about froth in the smallcap sector, investor interest in smallcap funds has rebounded even as bulk of the flows within the category was cornered by just three schemes in May.

While inflows within small cap funds have increased, more than 60 percent of the monthly flows went into just three schemes for the month of May 2024, stated the report.

In May 2024, smallcap funds saw inflows of Rs 2,725 crores, which was slightly below the one-year average of Rs 3,350 crores, as per the report.

According to data from Association of Mutual Funds in India (AMFI), inflows into equity mutual fund grew 83.42 percent in May to Rs 34,697 crore – a new record high. It was also the 39th month in a row wherein inflows into open-ended equity funds remained positive. It was also the first instance of net inflows into equity crossing Rs 30,000 crore mark in a single month.

Sectoral and Thematic Funds see increasing interest

Investor enthusiasm, as per the Elara report, has notably surged for Sectoral and Thematic funds, particularly those focused on infrastructure, power, manufacturing, and PSU sectors with the funds receiving almost 42 percent of the active equity inflows, excluding ETFs and Index funds, over the past four months.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.