Harshad Mehta was the pied piper and many first-time investors followed him and bought stocks; some of which with dodgy financials and at elevated prices. When the scam broke out, there was a vertical drop in prices, and these novice investors were caught on the wrong side and had to book huge losses, Dipan Mehta, Director at Elixir Equities Pvt Ltd, said in an interview with Moneycontrol’s Kshitij Anand.

Edited excerpts:

Q) We have a new web series coming up on the scam of 1992 where Harshad Mehta allegedly committed a fraud of over Rs 1,000 crore from the banking system of India to buy stocks on the Bombay Stock Exchange causing a market crash. It was multiple scams all rolled in one. What was the scam all about?

A) Harshad Mehta and a few other nefarious brokers in the debt market sold government securities to SBI and other banks.

In those days, such transactions could also be settled by the issuance of Bill Receipt (BR) by brokers to the banks. A BR so issued was a confirmation that they (brokers) were holding the underlying G-Secs. Based on receipt of a Bill Receipt (BR) the banks would release payment to the broker.

The scam was that these BRs were not backed by any G-Secs and were as such bogus. The banks also trusted the brokers and did not verify if the BRs were backed by G-Secs and released the money for G-Secs to Harshad and others for their purchases.

Since there was no counter sale party for such fraudulent transactions (to whom proceeds had to be paid), Harshad Mehta used these funds received from the Banks to buy shares in the market.

Such was the scale of duplicity that they were even able to fund other speculators through decades-old Vyaj-Badla system.

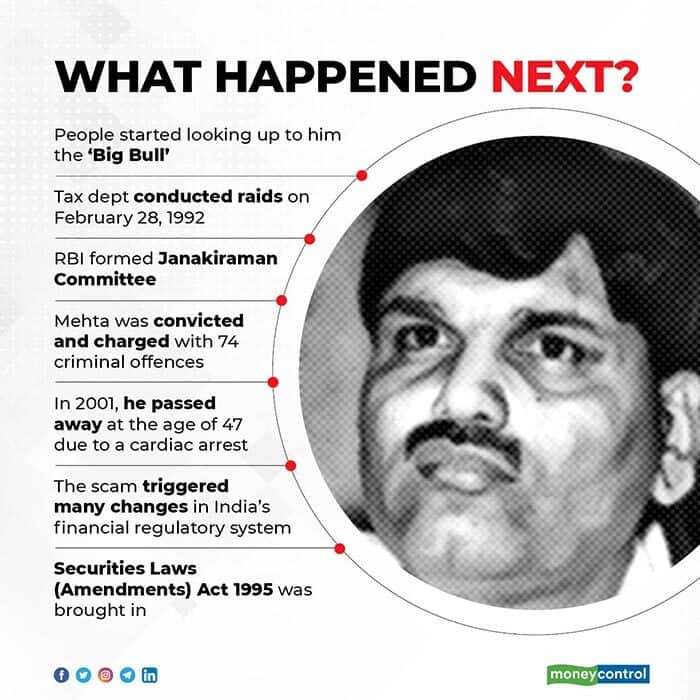

This led to a fabulous bull market in the stocks and earned him the nickname “Big Bull” as he was the largest speculator on the long side. You can imagine how easy it was to buy stocks with interest-free funds received through forged BRs.

Just to be clear, the scam was in the Debt Market in which some Stock Brokers were involved. There was no scam in the stock market which was in fact quite safe and I don’t recollect any investors losing a large amount because of broker fraud or insolvency.

Q) What was the bigger damage post the 1992 scam – money lost by shareholders or the investor sentiment?

A) Both! Harshad Mehta was the pied piper and many first-time investors followed him and bought stocks; some of which with dodgy financials and at elevated prices.

When the scam broke out, there was a vertical drop in prices, and these novice investors were caught on the wrong side and had to book huge losses.

Many were saddled with shares of sham companies as well. There was collateral damage across all scrips, even blue-chip ones, which were not on Harshad Mehta’s buy list.

Q) What was your experience? Anything you remember which you would like to share?

A) I had entered the market Just a year ago and obtained a badge to go into the trading ring when the scam broke out. Even at that time, I used to trade and invest in stocks based on my personal research.

I was heavily leveraged and long in many counters, some of which were favoured by the “Big Bull”. But, call it a premonition or just pure beginners luck, I had exited most of my long positions just before the carnage started.

It was the first time when I had sold at the proverbial TOP of the market. I was elated, to say the least.

Soon thereafter, the brokers went on strike over registration with SEBI and everyone in the market was on holiday; I was happy because I was sitting on cash.

The profits earned in that bull phase funded the purchase of my BSE membership. So unlike most, I was not much affected although many associates I knew had to bear huge losses.

Q) Has the investment environment now changed in 2020 compared to what we saw in 1992? Do you think the systems are more robust now, and there is a transparent communication flow to investors?

A) The Harshad Mehta scam led to a slew of reforms in the stock market which have made our systems the best in the world. It was the catalyst for change and in less than a decade we had electronic trading and paperless settlement with shorter cycles.

The risk factor in equities reduced considerably and investors have since then been only increasing their exposure directly or through mutual funds.

The transparency levels from the intermediaries and issuers have been gradually increasing.

Q) According to you what were the key learning for investors from the Harshad Mehta scam?

A) When Harshad was buying shares in such volumes and even funding other long speculators, everyone in the market (with the exception of his insiders) did not know the source of funds. It led to a bubble!

It was only after the scam broke out that we understood the mechanism which he used for funding. The logic provided by that group to support such ridiculous valuations was just complete baloney. One important learning is that if the valuation logic does not make sense, avoid.

Unfortunately, such lessons are not learned and we had a bubble in tech stocks just 8 years later. Even now, there are many who are of the opinion that digital plays on Nasdaq are in bubble territory.

Bubbles are part and parcel of every market and the most valuable understanding is have your own internal risk management system and curb your greed (easier said than done).

Q) What would you advise investors of 2020 especially the Robinhood ones who have joined the D-Street part this year? How to spot those manipulations and avoid taking exposure in the stocks?

A) Investors should trade with a plan. There is no harm in attempting to trade but if you are consistently making losses in trading/investing then go-to experts.

Do not commit a large part of your own savings to invest/trading on your own unless you have seen one complete bull and bear market cycle; and more importantly, emerged confident and in the money after that.

Read our entire coverage on Harshad Mehta here

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!