Shabbir KayyumiNarnolia Financial Advisors

Volume in stock indicates how many number of stocks have traded in the stock exchange. Volume is the most important indicator used in technical analysis to understand the underlying strength of the price movement of any financial instruments. We can try to understand sentiments with help of volume and make right decision in trading.

What is Volume?

Volume is simply the number of shares or contracts that trade over a given period – usually a day. Often times, volume is expressed as a bar chart directly below the price chart with the bars height illustrating how many shares have traded on that day or per period.

The transactions are measured on majorly financial instruments like stocks, bonds, options contracts, futures contracts and commodities.

Calculations of Volume

Many people mistake while calculating volume in trading, check illustration given below, to understand it in details.

Volume Analysis

Volume is a very important data and we can get following details from it. Volume analysis is used to confirm the strength of a buy or sell signal.

1. Low Volume: Low volume means there are less number of stocks traded in exchange. We should stay away from such stocks as there is a liquidity risk involved. Also such stocks do not have a good reputation hence less number of people shows interest in it.

2. High Volume: Generally good stocks have high volume, which reduces liquidity risk. More people are trading these stocks indicate more people want them in their portfolio. Trading volume is usually higher when the price of a security is changing. News about a company's financial status, products, or plans, whether positive or negative, will usually result in a temporary increase in the trade volume of its stock.

3. Change in volume: One of the important indicators is change in volume. If volume is increasing and price is also increasing, this is a strong buy signal. If price is decreasing and volume is increasing, interpret as sell signal & Sell your stock.

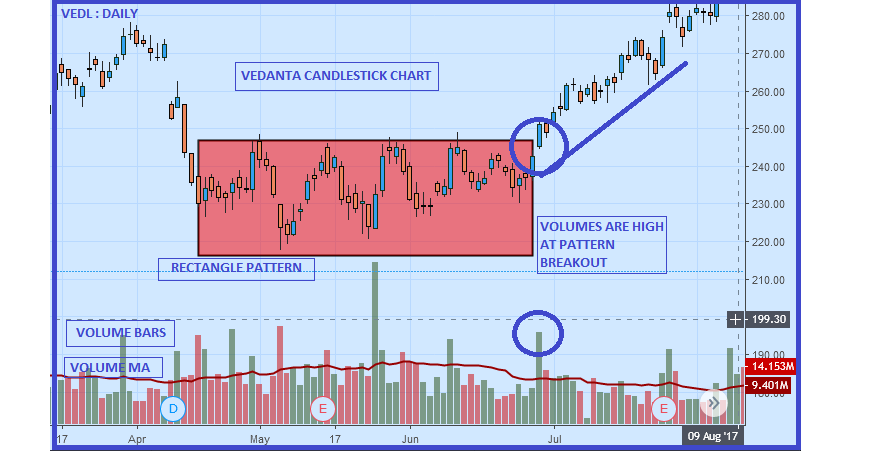

4. False Breakout: On the initial breakout from a range or other chart pattern breakout, a rise in volume indicates strength in the move. Little change in volume or declining volume on a breakout indicates lack of interest and a higher probability for a false breakout.

Liquidity

Buyers and sellers help determine the price of each stock, and the more buyers and sellers a particular stock has interested in it, the more liquid the market will be. Liquidity can have a profound impact on just how violently stock prices can move in either direction, and the reasons have to do with the nature of the market in a stock's shares. Higher volume for a stock is an indicator of higher liquidity in the market and shows more interest of buyers and sellers. Highly liquid shares have lower impact cost as reflected in tightness of their bid-ask spread.

Volume and Chart pattern

Volume is invaluable when confirming chart patterns, such as head and shoulders, triangles, flags, and other patterns. If volume isn’t present alongside these chart patterns, then the resulting trading signal isn’t as reliable. False breakout of pattern is witnessed in absent of volume while pattern completion.

Volume is important to consider in bullish breakouts; however one should not give more importance to volume in bearish price patterns, which pushes prices lower.

Volume and Market Interest

A rising market should see rising volume. Buyers require increasing numbers and increasing enthusiasm in order to keep pushing prices higher. When prices rise or fall, an increase in volume acts as confirmation whether the rise or fall in price is real and that the price movement had strength.

Volume and exhaustion Moves

In a rising or falling market, we can see exhaustion moves. These are generally sharp moves in price combined with a sharp increase in volume, which signal the potential end of a trend. Participants who waited and are afraid of missing more of the move pile in at market tops, exhausting the number of buyers for further period. Increasing price and decreasing volume show lack of interest and this is a warning of a potential reversal.

Conclusion

• In the context of a single stock trading on a stock exchange, the volume is commonly reported as the number of shares that changed hands during a given day.

• Important concept to understand is that price is preceded by volume.

• It is one of the few indicators that are not based on price. High volume points to a high interest in an instrument at its current price and vice versa

• Having an understanding of the entire market’s trading volume versus the volume of a single holding can be one important comparison that helps analysts to discern volume trends.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!