Indian technology giants are always in a fray, but the recent trends indicate that Infosys has outplayed its immediate rivals TCS and HCL Tech, for yet another quarter.

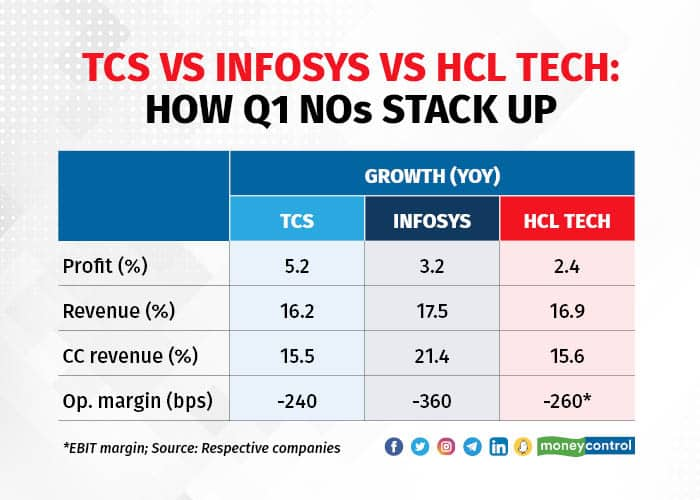

Infosys, the second largest IT company in the country, delivered 21.4 percent year-on-year (YoY) constant currency revenue growth, while in rupee terms, the growth was 17.5 percent – more than Tata Consultancy Services and HCL Tech, the other two companies in the Top 3 league.

In terms of operating margins, however, Infosys' performance was worst with a contraction of 360 basis points on-year to 20 percent. TCS reported a 240-basis-point cut in margins to 23.1 percent and HCL Tech margin shrank 260 basis points to 17 percent.

“The Q1 earnings report suggests strong revenue growth with Infosys leading the Tier I techs on growth, though margins disappointed relative to expectations with a 150-bps sequential drop,” said Manik Taneja, Vice-President, JM Financial Services.

Analysts largely do not see any change in the trend.

Aniket Pande, Lead Analyst at ICICI Securities, said Infosys will remain the fastest growing in its IT coverage universe. “We do believe Infosys is well positioned to gain market share and is suitably equipped for industry-leading growth,” he said.

Broadly speaking, Pande is underweight on the IT sector and believes deployment in the sector should be very slow and gradual. However, he said that his pecking order in the IT space remains TCS, Infosys, Coforge and Persistent Systems.

Analysts have turned cautious on the IT sector recently as, after a bout of high growth, the numbers have started moving towards the mean. They see recession in the US and Europe as one of the key risks.

Also Read: Pessimism grips metal, IT stocks most after recent spate of downgrades by analysts

Most IT companies have also slowed down their hiring, at the same time attrition level remains high. All three companies discussed here reported attrition rate of IT services employees between 20 percent and 29 percent, with Infosys being on the higher end and TCS on the lower end. Hiring is considered as the lead indicator of demand as companies hire more when they believe there will be more demand in the future.

The management, however, has shrugged off these worries. Rajesh Gopinathan, the TCS chief executive, said one should not read too much into hiring numbers, and contended that hiring remains strong. He committed that the company will hire 40,000 freshers in FY23. HCL Tech also said its target to hire 30,000-35,000 freshers is intact.

What has been a positive surprise is that despite talks of slowdown management have either maintained or increased their revenue growth guidance. HCL Tech kept guidance at 12-14 percent CC growth in revenue and EBIT Margins to be in the 18-20 percent range.

Infosys increased FY23 revenue guidance to 14-16 percent while retaining margin guidance at 21-23 percent. Though analysts said both companies will likely see margins at the lower end of the guidance. TCS does not give any guidance but the management assured string growth.

Also Read: Midcaps or largecaps? Where should you invest in IT now that the report cards are in

“It (Infosys) expects to see benefits of utilisation improvement, pricing leverage, pyramid optimisation along with moderation in subcontracting expenses to aid margins going forward,” Taneja.

These factors will also work for other companies.

Talking about TCS, Pande said he believes margins have bottomed out and will improve hereon as subcontractor costs and supply-side cost pressures subside gradually given normalisation of demand going forward. “Besides, levers of pyramid optimisation, utilisation and INR depreciation will benefit margins, though impact of these will be backended.”

Analysts’ ratings have been mixed on all three stocks. However, most are neutral with some saying ‘buy’ on these counters given the headwinds and growth trajectory from hereon.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!