Along with its second quarter earnings on October 11, Tata Consultancy Services (TCS) is set to announce its fifth share buyback in six years, rewarding investors with the increasing cash in its reserves.

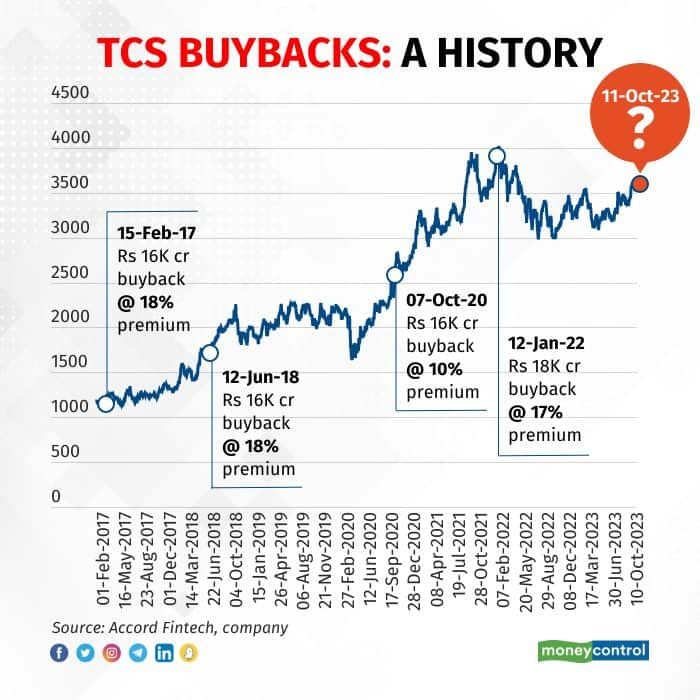

Before this, TCS has bought back its shares in 2017, 2018, 2020, and 2022. The IT behemoth, valued at over Rs 13 lakh crore, has bought back shares worth Rs 66,000 crore in the last six years.

In a share buyback, a company buys back shares from its shareholders, usually at a premium to prevailing prices, giving shareholders the option to fully or partly exit a stock at a profit. A buyback signals the management’s confidence in its business.

Earlier buybacks

TCS bought back its shares for the first time in 2017. The company announced a buyback worth Rs 16,000 crore in February 2017 at an 18 percent premium to prevailing prices. This was followed by two buybacks of Rs 16,000 crore each in June 2018 and October 2020, at an 18 and 10 percent premium, respectively. The last buyback was announced in January 2022. The company decided to buy shares worth Rs 18,000 crore at a premium of 17 percent.

A buyback also indicates how a company sees its fair value (the buyback price). More often than not, the stock price eventually moves in that direction. However, such movements have been slower than expected in case of TCS.

It took 228 sessions, or nearly a year, for TCS’s stock price to top the buyback price announced in 2017. Following the 2018 buyback, it took 69 sessions for the same, and after the 2020 buyback, it took 61 sessions. But TCS’s stock is yet to breach the 2022 buyback price of Rs 4,500. The scrip hit an all-time high of Rs 4,019.10 on January 17, 2023, just five days after the buyback announcement, but has moved downhill since.

Thus, it can be seen that a buyback announcement is no guarantee that the stock will outperform in the following period. Morgan Stanley in its note on the buyback announcement shares this analysis.

The 2023 buyback

As of June 30, 2023, TCS had cash and cash equivalent of Rs 7,123 crore on its balance sheet. This is likely to go higher given its track record of generating more than Rs 10,000 crore in cash from its operations during a quarter.

Extrapolating from trends and market expectations, the 2023 buyback is likely to be around Rs 18,000 crore. It will be interesting to see the premium it offers as the previous buyback price (Rs 4,500) is 24 percent higher than its current price.

JP Morgan said it expects a buyback size of Rs 18,000 crore, while Morgan Stanley pegs it between Rs 18,000 and 22,500 crore. IIFL sees it being between Rs 18,000 and 20,000 crore.

Other buybacks and taxability

In the past, buybacks by TCS have usually been followed by similar announcements by other major IT firms, especially Infosys and Wipro. For instance, in the last seven years, Wipro has bought back shares worth Rs 45,499 crore from shareholders in five tranches. Similarly, Infosys has bought Rs 39,760 crore worth of shares in the last six years over four instances. Understandably, investors will be hoping for these companies to follow suit and announce their buybacks.

A buyback is one of the most tax efficient ways to reward shareholders, as profits on tendering shares during a buyback are tax-free unlike when it's sold in open market. This is the reason even promoter groups participate extensively in buybacks. Dividends, on the other hand, are taxed in the hands of investors at their respective slab rate, which can be as high as 37 percent for high earners.

Disclaimer: The views and investment tips expressed by experts are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before making any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.