Struggling with low revenue during the lockdown, several states allowed the sale of alcohol and increased taxes to make up for the loss.

The move, however, may hit the prospects of alcohol companies and brokerages have started downgrading them, sensing headwinds.

In a report, brokerage firm Dolat Capital Market said it downgraded India's alcohol sector to “neutral” from “positive” due to tax hikes by state governments to shore up revenue and a higher risk of receivables cycle stretching working capital for all players and impacting cash flow.

The possibility of a delay in consumption recovery and risk of down-trading by consumers and focus on essential consumption are also the risks facing the sector, the brokerage said.

Alcohol, cigarettes and fuels are the items that contribute heavily to the government's kitty. An increase in taxes negatively impacts consumer demand, leads to down-trading and shift in consumer share to the government.

As per Dolat Capital, revenues from alcohol as the percentage of states’ own tax revenue is about 21 percent and as the percentage of revenue receipt is about 10 percent, or Rs 2.25 lakh crore.

As some of the state governments, including Delhi, Rajasthan, West Bengal, Andhra Pradesh and Goa, have increased tax on liquor, other states may follow their lead.

While the move is aimed at replenishing coffers, there are slim chances of a rollback after the pandemic is brought under control and the economic engine starts. So, the challenges triggered by the coronavirus are expected to linger.

"The reversal of tax increases, once initiated, is the rarest of the phenomenon. One, it is seen as politically and socially challenging for a government to be aiding alcohol consumption. Secondly, once the state treasury gets a taste of higher tax inflows, giving it up it is difficult," said Dolat Capital.

"Clearly, the longer term impact of COVID-led increase could well play over 12-18 months."

As per the brokerage, beer, as a category, is likely to be more severely hit on two counts – the first quarter of the financial year is the peak season and accounts for about 40 percent of annualised PAT and secondly, the likely cancellation of IPL, the domestic T20 tournament.

"Indian-made foreign liquor (IMFL), too, would be impacted. However, with situation likely to stabilise by the key season of the second half of the financial year, it may be less than impacted," said Dolat Capital.

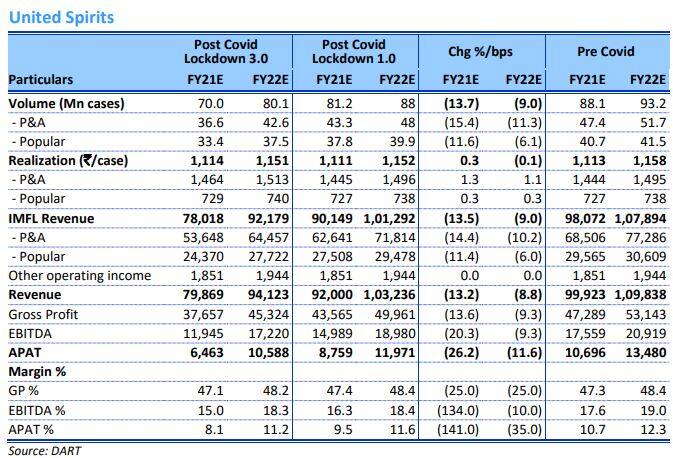

Dolat has reduced its earnings estimate by about 26-49 percent for FY21 and about 12 percent for FY22 for United Breweries, United Spirits and Radico Khaitan.

With short-term prognosis likely to remain significantly weak, Dolat has maintained "buy" recommendation on Radico (target Rs 352) and has downgraded United Spirits (target Rs 531) to "accumulate" and United Breweries (target Rs 910) to "reduce".

While the challenges remain, Dolat is positive on the long-term fundamentals of the sector on low penetration, increasing social acceptance, inelastic nature of industry and high-barriers to entry.

"Price increases from the state government would be positive whereas distribution expansion (online, home delivery, shop expansion, etc) could be game-changer," Dolat said.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!