Stock Market LIVE Updates: Among sectoral indices, Nifty Private Bank was the biggest loser, down 0.7 percent, followed by Nifty Pharma, Nifty IT, and Nifty Bank, which fell 0.6 percent each. Nifty Metal, PSU Bank, Auto, and FMCG indices were also down 0.5 percent each.

LiveNow

Closing Bell: Sensex down 590 pts, Nifty below 25,900; Bharti Airtel, PowerGrid, Tech Mahindra, Infosys top losers

Stock Market LIVE Updates: Among sectoral indices, Nifty Private Bank was the biggest loser, down 0.7 percent, followed by Nifty Pharma, Nifty IT, and Nifty Bank, which fell 0.6 percent each. Nifty Metal, PSU Bank, Auto, and FMCG indices were also down 0.5 percent each.

Sensex Today| Sudeep Shah, Head - Technical and Derivatives Research at SBI Securities

The benchmark index Nifty ended Thursday’s session below the 25,900 mark, declining 0.68%, as investor sentiment turned cautious following hawkish comments from U.S. Federal Reserve Chair Jerome Powell. His remarks rekindled concerns over the possibility of interest rates remaining higher for longer, triggering profit booking across sectors.

Adding to the global uncertainty, market participants keenly tracked the outcome of the high-stakes meeting between U.S. President Donald Trump and Chinese President Xi Jinping, which reportedly extended beyond the scheduled duration, fuelling hopes of constructive discussions around trade deal.

On the domestic front, Coal India and Larsen & Toubro (L&T) emerged as the top gainers within the Nifty pack, while Dr. Reddy’s Laboratories and Cipla led the list of top laggards.

Sectorally, the market breadth was largely weak, with all indices except Nifty Realty closing in the red. The broader markets mirrored the headline index’s performance, as both the Nifty Midcap 100 and Nifty Smallcap 100 indices registered losses.

The overall market tone remained subdued, reflected in the Advance/Decline ratio, which was skewed in favour of decliners — with 328 out of Nifty 500 stocks ending the day in negative territory.

For Nifty, the zone of 25800-25750 will act as an important support for the index. While, on the upside, the zone of 26030-26050 will act as a crucial hurdle. Any sustainable move above the level of 25050 will lead to a sharp upside rally 25200 level, followed by 25350 level.

Sensex Today| Views from Umesh Sharma, CIO Debt, The Wealth Company Mutual fund

The FOMC reduced policy rates by 25 bps and announced the end of Quantitative Tightening effective December, both widely anticipated by markets. However, in the post-meeting press conference, Fed Chair Jerome Powell struck a hawkish tone, emphasizing that a December rate cut is not a foregone conclusion given inflation remains above target and labor-market uncertainties persist. He noted that a balance between lower labor supply and moderating labor demand is still evolving, suggesting the Committee may prefer to pause in December while assessing incoming data.

Following Powell’s remarks, market expectations of a December rate cut fell from over 90% to around 60%, prompting a rise in U.S. Treasury yields and a stronger dollar.

Domestically, Indian bond yields have edged higher in line with global moves. The RBI MPC, in its recent policy, indicated that policy space has opened up to support growth if needed. By the next meeting, more clarity is expected on tariffs and the impact of prior fiscal and monetary actions. Given benign headline and core inflation amidst growth concerns, we continue to expect a 25-bps policy rate cut in the upcoming review. For investors, shorter to intermediate duration funds remain preferable, while long-end positions suit only experienced, non-risk-averse investors.

Sensex Today| Views from Ashika Institutional Equities – Ashika Stock Broking part of Ashika Group

Indian markets witnessed a lacklustre session on Thursday as benchmark indices slipped below the 26,000 mark and extended losses through the day. The Nifty struggled to hold higher levels, with persistent selling dragging it lower. Sectorally, major weakness was seen in Healthcare, Metal, Pharma, and IT indices, all ending in the red. On the technical front, the Nifty has formed an immediate support zone near 25,800, while resistance is capped around 26,000. Globally, sentiment remained cautious after the U.S. Federal Reserve cut rates by 25 basis points while signaling a pause in further easing this year. In the derivatives segment, as of 2:30 p.m., 48 stocks were advancing against 167 declines, indicating a clear negative bias. Open interest build-up was notable in Dr. Reddy’s Laboratories, LICHSGFIN, CIPLA, BHEL, and Dabur, reflecting active positioning in these counters..

Sensex Today| Ponmudi R, CEO of Enrich Money, a SEBI - registered online trading and wealth tech firm

Markets witnessed broad-based selling on Thursday as uncertainty over the U.S. Federal Reserve’s future rate-cut trajectory outweighed earlier optimism, dampening global risk sentiment and prompting investors to turn cautious. FIIs continued to book profits, while DIIs extended selective buying support, helping cushion the market from a deeper decline. Meanwhile, a mild weakening of the rupee against the U.S. dollar added to the cautious undertone among investors.

The Nifty once again struggled to sustain above the key resistance zone of 26,050–26,100, forming a mild double-top pattern on the hourly chart—a sign of hesitation at higher levels. The price action reflects repeated rejection at higher levels, with immediate support placed at 25,900 and a stronger base near 25,800 — the previous higher low that also coincides with the earlier breakout zone around 25,666. A sustained move above 25,900 could trigger a short-term rebound toward 26,050–26,100

Sensex Today: Vinod Nair, Head of Research, Geojit Investments

As expected, the U.S. Fed cut interest rates by 25 bps. However, the market consolidated after Powell indicated that this might be the last rate cut of 2025, tempering hopes of further monetary easing. The resulting strength in the U.S. dollar contributed to a risk-off sentiment across emerging markets, including India. Domestically, mixed Q2 earnings and the F&O expiry led to market volatility. Meanwhile, investors remain watchful of the Trump–Xi trade negotiations, as the prevailing uncertainty around the discussions continues to keep market sentiment cautious.

Closing Bell| Sensex down 590 pts, Nifty slips below 25,900; Bharti Airtel, Power Grid, Tech Mahindra, Infosys among top losers

Among sectoral indices, Nifty Private Bank was the biggest laggard, down 0.7 percent, followed by Nifty Pharma, Nifty IT, and Nifty Bank, which declined 0.6 percent each. Nifty Metal, PSU Bank, Auto, and FMCG indices were also lower by 0.5 percent each.

Currency Check| Rupee ends at 88.70/$ against Wednesday’s close of 88.20/$

Earnings Watch| Jain Irrigation Q2 net profit at Rs15.3 Cr Vs loss of Rs9 Cr (YoY)

#1 Revenue up 20.2% at Rs1,432 Cr Vs Rs1,192 Cr (YoY)

#2 EBITDA up 43.30% at Rs199 Cr Vs Rs134 Cr (YoY)

#3 Margin at 13.90% Vs 11.65% (YoY)

Earnings Watch| Sharda Cropchem reports Q2 net profit up 75.2% YoY

#1 Net profit at Rs74.3 Cr Vs Rs42.4 Cr (YoY)

#2 Revenue up 19.6% at Rs929 Cr Vs Rs777 Cr (YoY)

#3 EBITDA up 32% at Rs132.7 Cr Vs Rs100.7 Cr (YoY)

#4 Margin at 14.3% Vs 13% (YoY)

Sensex Today | Vintage Coffee and Beverages rated 'new buy' at Edelweiss Professional Investor

Target price has been set at Rs 250 which implies a 53% increase from last price

Block Deal | True North may exit Fedbank Financial via block deal: CNBCTV-18 Report

As per CNBC-TV 18, True North Fund VI is planning to sell its entire 8.6% stake in Fedbank Financial Services Ltd through a block deal.

Sensex Today | Hyundai Motor India Q2 FY26 Results

- Net income Rs 15.7 billion, +14 percent higher Year-on-Year

- Revenue Rs 174.6 billion, 1.2 percent higher Year-on-Year

- Total costs Rs 155.7 billion, 0.2 percent lower Year-on-Year

- Raw material costs Rs 121.8 billion, 7.8 percent lower Year-on-Year

Sensex Today | Exide postpones board meet for results as I-T Dept is conducting survey at co's offices & manufacturing units in India since October 29 2025

Markets@2 | Nifty under 25,900, Sensex down 500 pts

Sensex Today | IEX shares fall after market coupling hearing at APTEL likely deferred to November 28

Sensex Today | ITC shares lower ahead of Q2 show

Sensex Today | Cipla Q2 net profit up 3.8% at Rs 1,351 crore vs Rs 1,303 crore YoY

OpenAI lays groundwork for juggernaut IPO at up to $1 trillion valuation: Report

A successful offering would mark a major win for investors such as SoftBank, Thrive Capital and Abu Dhabi's Microsoft, one of its biggest backers, now owns about 27% of the company after investing $13 billion...Read More

"Our biggest advantage is understanding our customers well," says Lalit Keshre, co-founder and CEO, Groww

"The overall potential of the market is pretty big. On 2016 we started. The penetration investing in MFs back then was very low. But then, with the evolution of tech engagement (KYC, etc,). The penetration intensified and strengthened financial assets. We continue investing in technology. Everything we have done is in-house, that gives us an advantage to provide ouuru customers better. We continue to invest in our brand. Groww is the default brand for investing for a lot of these cities. Broking and wealth management are a large area of our operations."

Sensex Today | Canara Bank's Q2 net profit is up 19% at Rs 4,774 crore vs Rs 4,014 crore

Sensex Today | Gopal Snacks operationalises new manufacturing facilities in Modasa, Gujarat

Sensex Today | United Breweries falls 4% as Q2 profit sinks 64%

Sensex Today | HPCL rises 1% as net profit surges over six-fold

Markets@12 | Nifty continues to remain below 25,950

At 11:58 hrs IST, the Sensex was down 460.98 points or 0.54 percent at 84,536.15, and the Nifty was down 145.75 points or 0.56 percent at 25,908.15. About 1643 shares advanced, 1930 shares declined, and 168 shares unchanged.

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 25903.90 -0.58 | 9.55 0.05 | 5.25 6.42 |

| NIFTY BANK | 58147.75 -0.41 | 14.33 0.12 | 6.43 12.24 |

| NIFTY Midcap 100 | 60057.20 -0.15 | 5.00 1.16 | 6.24 6.60 |

| NIFTY Smallcap 100 | 18474.45 -0.07 | -1.57 1.00 | 5.19 0.45 |

| NIFTY NEXT 50 | 69985.80 -0.36 | 2.94 0.79 | 3.16 -0.40 |

India's gold investment demand surges above $10 bn in Sept quarter, says WGC

Spot gold prices are up 50% so far this year after hitting a record high on October 20 on safe-haven demand driven by geopolitical tensions, US tariff uncertainty and more recently a wave of fear-of-missing-out or 'FOMO' buying...Read More

Stock Market LIVE Updates | Price shockers of past 3 days: Eurotex, Megastar Foods, Hb Stockhol

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Eurotex | 18.72 | 28.93 | 14.52 |

| Megastar Foods | 282.21 | 28.31 | 219.94 |

| Hb Stockhol | 100.40 | 27.57 | 78.70 |

| Blue Dart | 6,920.00 | 24.33 | 5,566.00 |

| Vaibhav Global | 288.30 | 23.44 | 233.55 |

Sagility rallies over 10 percent on 69 percent QoQ profit growth and higher guidance, 'no tangible impact' of Trump tariffs

The strong earnings has come at a time of 'normalisation of tariffs as a policy measure' by USA, Sagility said. The company sees 'no tangible impact' as tariff-driven cost increase of imported medical equipment and pharmaceuticals 'will impact providers more than the payers'....Read More

Stock Market LIVE Updates | L&T, Bharat Electronics top Sensex gainers

Markets@11 | Nifty slips over 100 pts, below 25,900

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 25914.95 -0.53 | 9.60 0.09 | 5.30 6.47 |

| NIFTY BANK | 58164.30 -0.38 | 14.36 0.15 | 6.46 12.27 |

| NIFTY Midcap 100 | 59987.20 -0.27 | 4.87 1.04 | 6.12 6.47 |

| NIFTY Smallcap 100 | 18454.40 -0.18 | -1.68 0.89 | 5.08 0.35 |

| NIFTY NEXT 50 | 69907.25 -0.47 | 2.82 0.68 | 3.04 -0.51 |

Stock Market LIVE Updates | L&T, Dr Reddy's, HDFC Bank most active stocks at this hour

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| Larsen | 4,011.50 1.35 | 2.87m | 1,157.97 |

| Dr Reddys Labs | 1,194.50 -4.51 | 4.39m | 523.49 |

| HDFC Bank | 1,004.25 -0.36 | 4.50m | 452.26 |

| SBI | 942.25 0.27 | 3.16m | 297.26 |

| ICICI Bank | 1,363.80 -0.48 | 2.00m | 273.34 |

Vodafone Idea shares fall 12% on SC's written order on AGR dues; other telecom stocks also face pressure

The Supreme Court’s order permitting the government to revisit the AGR demands applies only to Vodafone Idea Ltd and is restricted to the additional AGR dues raised for the period up to FY2016-17, as per the order copy...Read More

Sensex Today| Easemytrip wins Punjab mandate to oversee pilgrimage travel

Sensex Today| Shaily Engineering Plastics Falls 13%

Shares of Shaily Engineering Plastics Ltd. plunged as much as 13 percent in Thursday’s trade — the sharpest single-day decline since May 2022 — after developments linked to a key client weighed on sentiment.

The sell-off followed Dr. Reddy’s Laboratories’ disclosure of a delay in receiving approval for its Semaglutide injection in the Canadian market. According to Shaily Engineering’s FY25 annual report, Dr. Reddy’s is among its major clients in the pharmaceutical segment, heightening concerns over revenue visibility tied to the drugmaker’s regulatory setback.

Sensex Today| PB Fintech stock surge 5% after profit jumps 164% YoY

PB Fintech, the parent of Policybazaar and Paisabazaar, reported a consolidated revenue of Rs 1,613.5 crore for the quarter ended September 30, 2025 (Q2 FY26), marking a 38 percent year-on-year (YoY) rise from Rs 1,167 crore previous year. Sequentially, the revenue grew 20 percent from Rs 1,348 crore in Q1.

The company’s profit after tax (PAT) surged 164 percent YoY to Rs 134.89 crore, up from Rs 51 crore in the same quarter last year, while growing about 59 percent QoQ from Rs 84.69 crore. (Read more)

Sensex Today| L&T stock surges 2 percent after strong Q2 earnings

Engineering major Larsen & Toubro (L&T) on October 29 reported 16% rise in consolidated net profit at Rs 3,926 crore for the quarter ended September 30, 2025. Its net profit in the year-ago period was Rs 3,395 crore. Its revenue from operations rose 10% to Rs 67,984 crore as against Rs 61,555 crore in Q2FY25. (Read more)

Sensex Today| Dr Reddy's down 5% after co gets notice of non-compliance from Canada drug authority for Semaglutide

Sensex Today| Vodafone Idea Slumps Over 5% After Supreme Court Order Clarifies AGR Scope

Shares of Vodafone Idea fell more than 5 percent on Thursday, October 30, after the Supreme Court issued its written order on the telecom operator’s additional adjusted gross revenue (AGR) plea, triggering market uncertainty.

Earlier, on October 27, the Court had allowed the Centre to reassess Vodafone Idea’s AGR dues. However, the written order clarified that the relief applies only to Vodafone Idea, citing the specific facts and circumstances of the case. The Court also noted that the plea pertained solely to the additional AGR demand of ₹9,450 crore.

Notably, the order made no mention of Vodafone Idea’s earlier request seeking a waiver on penalty interest and interest on penalties, indicating that the Court’s review was limited strictly to the reassessment of the additional AGR liability.

Sensex Today| Sagility jumps 5% after strong Q2 results

Sensex Today: Le Travenues Technology fell 16% after posting Q2 loss

Sensex Today| Indian Markets Open Lower

Indian equities opened on a weak note. At 9:20 am, the Sensex declined 250 points (0.27%), while the Nifty slipped 85 points (0.30%) to 25,965, reflecting a soft start for the broader market.

Sensex Today| Sensex, Nifty Edge Lower in Pre-Open Trade

Benchmark indices were subdued in the pre-opening session, mirroring cautious sentiment. The Sensex declined 245 points (0.29%) to 84,750, while the Nifty slipped 70 points (0.30%) to 25,984, indicating a flat-to-weak market start.

Currency Check| Rupee Opens Softer at 88.40 per Dollar

Sensex Today| Views from Prashanth Tapse, Senior VP (Research), Mehta

Indian equities are set for a modestly weak start this morning as FIIs turned net sellers in yesterday’s otherwise positive session. Wall Street’s overnight pause added to the cautious tone, with the Dow slipping after briefly crossing 48,000, while Fed Chair Jerome Powell’s remarks pushing back expectations of a December rate cut further dampened sentiment. Still, Nifty’s reclaiming of the 26,000 mark and broad-based sectoral gains signalled strong underlying domestic momentum. Key stocks in focus include Coal India, Varun Beverages, CAMS, M&M Financial, BHEL, Blue Dart, and Adani Green Energy, following their Q2 results. Meanwhile, traders will keep an eye on major earnings due from ITC, Pidilite, Cipla, and Maruti later this week. Overall, expect a soft start amid global caution, but domestic resilience remains a key anchor.

Stocks to Watch Today: Wipro, Dr Reddys Labs, CONCOR, Dilip Buildcon, SAIL, Sagility India, NTPC Green, Ixigo, PB Fintech, BHEL, L&T in focus on 30 October

Stocks to Watch, 30 October: Stocks like Larsen & Toubro, LIC Housing Finance, Bharat Heavy Electricals, PB Fintech, United Breweries, Le Travenues Technology, RailTel Corporation of India, NTPC Green Energy, Sagility, Steel Authority of India, Brigade Enterprises, Mahanagar Gas, VST Industries, Wipro, and Zydus Lifesciences will be in focus on October 30....Read More

Sensex Today| Indian IT Stocks Poised for Gains After Cognizant’s Strong Results

Shares of Indian IT services companies are expected to see upward momentum after Cognizant posted stronger-than-expected third-quarter earnings and raised its full-year outlook.

Key names to watch include Infosys, Tata Consultancy Services, HCL Technologies, Wipro, and Tech Mahindra.

Morgan Stanley analysts Gaurav Rateria, Sulabh Govila, and Shreshtha Chopra noted a likely positive sentiment spillover for Indian IT, citing early signs of improved client spending, particularly in select industry verticals. Cognizant’s stock rose 6.2% in pre-market U.S. trading, reinforcing optimism for the sector.

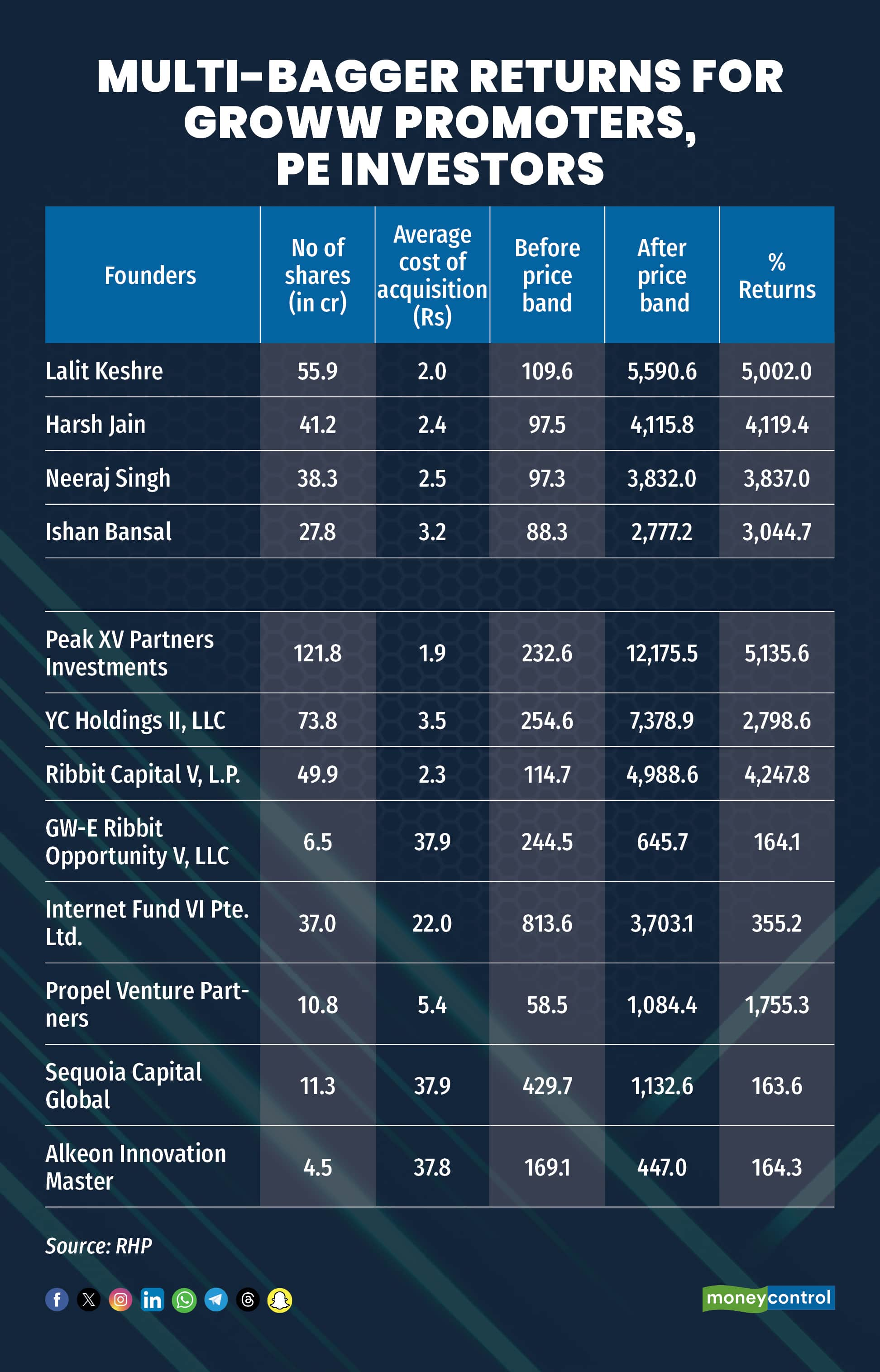

Sensex Today| Groww founders, early investors set for multi-bagger payday as IPO values firm at Rs 61,700 crore

Early backers and promoters of Groww parent Billionbrains Garage Ventures Ltd are set for substantial gains as the Bengaluru-based investment platform prepares for its much-anticipated initial public offering. The company has fixed its price band at Rs 95–100 per share, valuing it at around Rs 61,735 crore at the upper end.

The four co-founders — Lalit Keshre, Harsh Jain, Neeraj Singh and Ishan Bansal — who together hold over 26.6 percent stake in the company, are set to earn stellar returns from the listing.

Lalit Keshre, Whole-time Director and Chief Executive Officer, holds 55.91 crore shares amounting to a 9.12 percent stake. These shares were acquired at an average cost of Rs 1.96 per share. At the upper price band, his holding is valued at Rs 5,591 crore, compared with Rs 110 crore before the price announcement, translating into a gain of more than 5,000 percent. (Read More)

Global markets: Asia Wavers as Fed Cuts Rates; Markets Await Trump–Xi Talks

Asian markets traded mixed Thursday after the Federal Reserve delivered a quarter-point rate cut, while investors waited for a key meeting between U.S. President Donald Trump and China’s Xi Jinping.

MSCI Asia ex-Japan was flat, with S&P 500 futures up 0.1% following a modest pullback on Wall Street. The Nikkei slipped 0.1% ahead of the Bank of Japan decision, where rates are expected to remain unchanged.

The dollar held steady at ¥152.70 as U.S. Treasury Secretary Scott Bessent pushed for faster rate hikes to support the currency.

The Fed flagged data uncertainty amid the U.S. government shutdown, and Chair Jerome Powell signaled a cautious stance moving forward. Markets now look to the Trump–Xi meeting for signs of progress toward restoring a fragile trade truce.

Global Markets: Stocks Reverse After Record High as Powell Signals Pause in 2025 Rate Cuts

Overnight, the Dow Jones Industrial Average staged a sharp intraday turnaround, retreating from a fresh record high after Federal Reserve Chair Jerome Powell suggested the central bank may halt additional interest-rate cuts in 2025.

The blue-chip index slipped 74.37 points, or 0.2%, to close at 47,632.00. The S&P 500 finished slightly lower at 6,890.59, while the Nasdaq Composite advanced 0.55% to a new closing high of 23,958.47, supported by strength in Nvidia shares. Earlier in the session, the Dow climbed as much as 334 points to an all-time high before surrendering gains.

The policy-driven reversal followed the Fed’s decision to trim its benchmark rate by 25 basis points, setting the federal funds target range at 3.75% to 4%. This marks the second rate cut of the year. Prior to Powell’s remarks, markets had been pricing in an additional quarter-point cut at the Fed’s December meeting.

Markets on Wednesday| Sensex rises 369 points, Nifty above 26000

Indian equity indices ended on strong note with Nifty above 26,000 on October 29. At close, the Sensex was up 368.97 points or 0.44 percent at 84,997.13, and the Nifty was up 117.70 points or 0.45 percent at 26,053.90.

Good morning and welcome to the live coverage of all the action from D-Street. Stay tuned to this blog for all live updates from the market in India and around the world.