LiveNow

Closing Bell: Nifty around 19,700, Sensex down 140 pts; IT stocks outperform

Benchmark indices ended lower for the second consecutive session on November 20 with Nifty around 19,700. At close, the Sensex was down 139.58 points or 0.21 percent at 65,655.15, and the Nifty was down 37.80 points or 0.19 percent at 19,694.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

The Nifty opened on a flat note and consolidated during the day to close down ~38 points. On the daily charts we can observe that since last three trading sessions the Nifty is trading within the range 19875 – 19627. On the downside the Nifty is approaching the crucial support zone of 19650 – 19600 where multiple support parameters in the form of the 40 hour moving average and the lower end of the rising channel is placed. We expect Nifty to hold on to this support. The hourly momentum indicator has a negative crossover and has reached the equilibrium line indicating that the correction has matured and can start a new cycle on the upside. In terms of levels, 19610 – 19650 is the crucial support zone while 19900 – 19930 is the immediate resistance zone.

Bank Nifty also witnessed a correction, however it is now approaching crucial support zone 43400 – 43300 where we can expect buying interest. The hourly momentum indicator has triggered a positive crossover which is a buy signal. We expect the support to hold and resume its upmove. On the upside, 44000 – 44100 shall act as an immediate hurdle from short term perspective.

Prashanth Tapse, Senior VP (Research), Mehta Equities

Markets lingered in negative territory in a listless trading session and extended its losing streak amid selling in select frontline stocks. Investors continue to trade with caution amid uncertainty over the ongoing West Asia conflict, and global economic slowdown concerns. While markets struggled to capitalize on positive global cues, investors also shrugged off hopes for more stimulus from China. Technically, Nifty needs to reclaim the 19889 mark to unleash fresh upside, while the biggest support is placed at 19471 mark.

Vinod Nair, Head of Research at Geojit Financial Services:

Elevated long-term interest rate trends and a weakening global economy continue to hurt inflows and market movement. While the recent softening of inflation in the US & India and the negative trend of crude are expected to help the view on global equity and India in the short term.

In that context, the ease in FIIs selling is helping the domestic markets but continues to consolidate primarily due to India's premium valuation relative to global peers.

In this scenario, the IT sector is benefiting; however, valuation continues to be on the higher side compared to long-term history, suggesting a cautious approach in the sector in the medium term.

Ajit Mishra, SVP - Technical Research, Religare Broking

Markets started the week on a subdued note and closed almost unchanged. After the flat start, Nifty oscillated in a narrow range and finally settled at 19,694 levels.

Meanwhile, a mixed trend was witnessed on the sectoral front wherein IT posted decent gains while auto and metal ended in the red. The broader indices also witnessed some consolidation and closed on a flat note.

We are seeing a time-wise correction in Nifty so far despite the underperformance of the banking pack. Besides, the pause in the US markets is also capping the move. Amid all, we reiterate our bullish view on the index and suggest continuing with the “buy on dips” approach. Traders should stick with the other performing sectors and utilise this phase to gradually add quality names.

Sensex Today | Aditya Gaggar Director of Progressive Shares:

As anticipated, the markets remained rangebound post the tepid opening and finally settled at 19,694.00 with a loss of 37.80 points. Sector-wise, the IT sector kept on strengthening its uptrend while the Auto sector witnessed a pressure of profit booking.

The index has made a small negative candle in the middle of the range (19,850-19,550). We believe that the index is heading towards forming a right shoulder of an Inverted Head and Shoulder formation.

Rupee Close:

Indian rupee ended lower at 83.34 per dollar on Monday versus Friday's close of 83.27.

Market Close: Benchmark indices ended lower for the second consecutive session on November 20 with Nifty around 19,700.

At close, the Sensex was down 139.58 points or 0.21 percent at 65,655.15, and the Nifty was down 37.80 points or 0.19 percent at 19,694. About 1784 shares advanced, 1864 shares declined, and 146 shares unchanged.

Top losers on the Nifty included Adani Enterprises, M&M, Bajaj Finance, SBI Life Insurance and UltraTech Cement, while gainers were Divis Labs, Bharti Airtel, HCL Technologies, Wipro and ONGC.

On the sectoral front, Information Technology index up 0.6 percent and healthcare index up 0.3 percent, while selling is seen in the metal, auto, capital goods, FMCG, realty names.

BSE midcap index ended flat, while smallcap index rose 0.4 percent.

Stock Market LIVE Updates | UBS View On Indian Hotels

-Buy call, target raised to Rs 500 from Rs 410 per share

-Market appears sceptical about companies ARR (average room rate)/ occupancy growth

-There is a surge in luxury supply from competitors

-Remain positive on overall market supply/demand balance

-Think company can continue to surprise on rooms, ARR & occupancy

-Upgraded EBITDA is 9 percent/18 percent ahead of consensus for FY25/26e

Sensex Today | Mankind Pharma hits all-time high on FTSE Global inclusion, jumps 4%

Shares of Mankind Pharma Limited surged close to four percent to touch an all-time high of Rs 1,998 after the pharmaceutical company was added to the FTSE All-World, Large-Cap, Total-Cap, and All-Cap indices, marking a significant recognition for the Indian company.

The Index is a market-capitalisation-weighted index representing the performance of large, mid and small-cap stocks globally. The index covers developed and emerging markets and is suitable as the basis for investment products, such as funds, derivatives and exchange-traded funds. Read More

Sensex Today | Oil edges up on expectations of further OPEC+ supply cuts

Oil futures edged higher on Monday, extending gains on the prospect of OPEC+ deepening supply cuts to shore up prices that have fallen for four weeks on demand concerns and Middle East supply disruption owing to the Israel-Hamas conflict.

Brent crude futures rose 34 cents to $80.95 a barrel by 0915 GMT. U.S. West Texas Intermediate crude was up 31 cents at $76.20.

The front-month December WTI contract expires later on Monday while the more active January futures gained 38 cents to $76.42.

Stock Market LIVE Updates | Macquarie View On Persistent Systems:

-Outperform call, target Rs 7,390 per share

-Management focussed on its USD 2 billlon plan in four years and pure dig positioning & margin upside potential

-Challenger positioning, high quality of responses, helping it gain against larger peers

-Key hires at CEO-1 level show ambitions to become a much larger firm

Sensex Today | BSE FMCG Index down 0.3 percent dragged by Foods and Inns, AVT Natural Products, Share India Securities:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Foods and Inns | 172.80 | -4.13 | 19.04k |

| Share India | 1,717.80 | -2.85 | 10.38k |

| AVT Natural | 87.75 | -2.72 | 26.23k |

| Bectors Food | 1,291.80 | -2.69 | 21.74k |

| Som Distillerie | 295.00 | -2.19 | 21.52k |

| Dodla Dairy | 814.65 | -2.03 | 31.23k |

| Assoc Alcohol | 450.00 | -1.89 | 4.45k |

| Linc | 661.00 | -1.75 | 4.96k |

| Kaveri Seed | 588.65 | -1.69 | 14.98k |

| Patanjali Foods | 1,389.55 | -1.51 | 21.38k |

Sensex Today | IREDA IPO opens on November 21

Indian Renewable Energy Development Agency (IREDA) IPO is set to open on November 21. The 67.19 crore shares IPO comprises a fresh issue of 40.32 crore equity shares by the company and an offer-for-sale of 26.88 crore shares by the Government of India.

Analysts at Reliance Securities, Choice, Nirmal Bang and Mehta Equities have assigned a ‘Subscribe’ rating to the issue owing to low base, demonstrated track record of high growth, improvement in asset quality and cheap valuations.

Stock Market LIVE Updates | Jefferies View On Consumer Staples

-Wait continues as Indian staple firms are yet to show a volume growth pick-up

-Most of our coverage reporting <5 percent YoY volume growth during Q2

-Gross margin made a smart recovery

-Competition picked-up too which warranted a rise in A&P spends

-EBITDA growth still was a strong 16 percent YoY

-Most management sound hopeful on a better festive season ahead

-Management highlighting a pick-up at the exit

Stock Market LIVE Updates | Sharekhan View on Carborundum Universal

Expect growth momentum to sustain, driven by sustainable demand across segments in the long term. The company stands to benefit from multiple factors such as an uptick in capex in its end-user industries, China +1 strategy, strong government initiatives to support domestic manufacturing, and increasing demand prospects for specialty products driven by clean energy initiatives.

Moreover, all segments are witnessing healthy profitability. The stock trades at ~29xFY26E EPS and the rich valuations are justified given strong earnings growth outlook and a healthy balance sheet and improving return ratios. Therefore, retain Buy on the stock with an unchanged price target (PT) of Rs 1,315.

Sensex Today | Market at 3 PM

The Sensex was down 110.58 points or 0.17 percent at 65,684.15, and the Nifty was down 31.30 points or 0.16 percent at 19,700.50. About 1644 shares advanced, 1675 shares declined, and 125 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bharti Airtel | 961.80 | 1.5 | 581.75k |

| HCL Tech | 1,326.40 | 1.36 | 51.93k |

| Wipro | 400.05 | 1.18 | 374.92k |

| Tech Mahindra | 1,213.80 | 0.79 | 70.03k |

| IndusInd Bank | 1,508.50 | 0.7 | 71.88k |

| Kotak Mahindra | 1,772.50 | 0.48 | 38.66k |

| TCS | 3,519.00 | 0.47 | 68.22k |

| Maruti Suzuki | 10,573.20 | 0.47 | 4.05k |

| SBI | 564.95 | 0.32 | 558.17k |

| NTPC | 251.90 | 0.12 | 288.33k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| M&M | 1,554.00 | -1.9 | 74.69k |

| Bajaj Finance | 7,090.00 | -1.79 | 31.01k |

| Bajaj Finserv | 1,593.10 | -1.37 | 91.48k |

| UltraTechCement | 8,680.70 | -1.28 | 2.80k |

| JSW Steel | 761.15 | -0.96 | 12.70k |

| Tata Motors | 674.75 | -0.92 | 408.29k |

| Asian Paints | 3,138.80 | -0.91 | 8.80k |

| HUL | 2,509.50 | -0.79 | 20.87k |

| Larsen | 3,086.40 | -0.76 | 59.94k |

| Nestle | 24,257.80 | -0.47 | 396 |

Stock Market LIVE Updates | RBI approves appointment of Arun Khurana as IndusInd Bank ED for 3 years

The Reserve Bank of India has approved an appointment of Arun Khurana as Whole-time Director (Executive Director) of IndusIndia Bank for three years with effect from November 16. Arun was the Deputy CEO of the bank and also the overall head of Global Markets Group (GMG).

| Company | Price at 14:00 | Price at 14:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Shristi Infra | 27.00 | 25.25 | -1.75 100 |

| Veejay Lakshmi | 49.35 | 46.25 | -3.10 3.05k |

| Inducto Stl | 50.00 | 47.01 | -2.99 0 |

| Glance Fin | 91.65 | 86.18 | -5.47 257 |

| Ushakiran Fin | 26.50 | 25.00 | -1.50 2 |

| Colab Cloud | 51.95 | 49.05 | -2.90 149 |

| Kemistar Corp | 43.00 | 41.00 | -2.00 782 |

| Sangam Finserv | 72.70 | 69.32 | -3.38 0 |

| Centennial Sutu | 102.55 | 98.00 | -4.55 35 |

| Fine-line Circ | 67.15 | 64.50 | -2.65 14 |

| Company | Price at 14:00 | Price at 14:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Ace Men Engg Wo | 52.94 | 58.50 | 5.56 1.62k |

| Unison Metals | 22.58 | 24.90 | 2.32 54.09k |

| Phyto Chem | 37.06 | 40.83 | 3.77 38 |

| TIHIL | 32.25 | 35.50 | 3.25 14.80k |

| Nova Iron | 19.91 | 21.60 | 1.69 2.25k |

| Dolat Algotech | 63.75 | 68.62 | 4.87 18.05k |

| Archidply Decor | 86.01 | 92.00 | 5.99 25 |

| Chennai Meenaks | 30.00 | 31.98 | 1.98 1.23k |

| B and A | 310.05 | 330.00 | 19.95 547 |

| Optimus Finance | 81.75 | 86.89 | 5.14 0 |

Stock Market LIVE Updates | BofA Securities View On Zee Entertainment Enterprises:

-Buy call, target Rs 400 per share

-Zee-Sony merger talks locked over leadership issue

-Fundamentals steady; Dec 20 key date to watch out for

-An interim CEO could be a good near-term solution

-Interim CEO would help complete the merger

-Interim CEO Will give both sides more time to iron out any potential differences

-Fundamentally, think business momentum remains steady

Expect recovery in both advertisement & subscription revenues

-See room for better margin in next few years on reducing OTT content competition

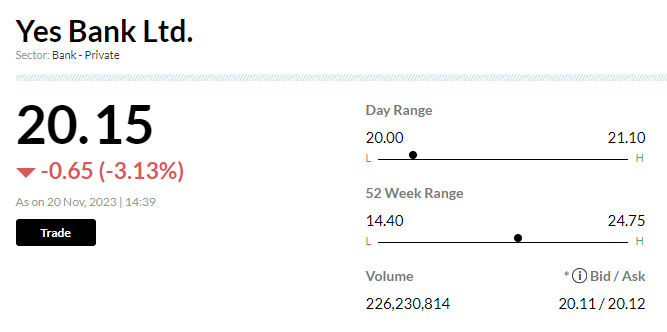

Stock Market LIVE Updates | Yes Bank names Tushar Patankar as chief risk officer for 3 years

Stock Market LIVE Updates | Aditya Birla Sun Life AMC collects Rs 200 crore for its US treasury bond NFO

Reflecting an appetite for US government bonds as the US yields go up, Aditya Birla Sun Life Mutual Fund on November 20 said it collected nearly Rs 200 crore for its Aditya Birla Sun Life US Treasury Bond ETFs Fund of Funds NFOs (new fund offers) that opened from 16th October 2023 to 30th October 2023.

"I am happy to share that almost 7,000 investors have capitalized on this unique opportunity and invested in Aditya Birla Sun Life US Treasury Bond ETFs Fund of Funds NFO,” said A Balasubramanian, Managing Director & CEO, Aditya Birla Sun Life AMC.

There are two funds with similar profile but catering to different type of investors. Aditya Birla Sun Life US Treasury 1-3 Year Bond ETFs Fund of Funds is suitable for investors with a shorter investment horizon and who have a relatively conservative risk profile, the company said. Aditya Birla Sun Life US Treasury 3-10 Year Bond ETFs Fund of Funds is suitable for investors with a long term investment horizon and who have a higher risk profile.

Stock Market LIVE Updates | Motilal Oswal View on Oberoi Realty

Broking firm believe Oberoi Realty much-awaited foray into NCR provides further growth visibility. However, retain pre-sales and cash flow estimate as firm await clarity on launch timelines of this project

At current valuations, company's residential business implies a value of Rs 360-370 billion, while the estimated value of the existing pipeline, including the Gurugram project, is Rs 230 billion, implying 50-60% of going concern premium.

Motilal Oswal believe with seven new projects (two projects in Thane, GSK-Worli, Peddar Road, Tardeo redevelopment, potential MHADA redevelopment in Andheri and Gurugram) already tied up, the management is unlikely to be aggressive on new project acquisitions in the near term.

Thus, implied going concern premium already accounts for near-term growth visibility. Reiterate Neutral rating with an unchanged Target Price of Rs 1,200, indicating 11% downside potential.

| Company | CMP | High Low | Gain from Day's Low |

|---|---|---|---|

| Tata Inv Corp | 4,534.05 | 4,575.00 3,967.05 | 14.29% |

412.85

3,198.85

1,565.05

1,749.05

265.05

1,197.00

1,530.50

5,947.00

510.00

Sensex Today | Gold holds ground as dollar slips on Fed rate cut bets

Gold prices held steady on Monday, as the dollar extended its slide on expectations that the Federal Reserve was done raising interest rates, while investors awaited for minutes of the Fed's latest meeting due this week.

Spot gold was little changed at $1,978.89 per ounce as of 0739 GMT, after rising 2.2% last week. U.S. gold futures edged down 0.2% to $1,981.10.

Stock Market LIVE Updates | BofA Securities View On Bajaj Finance

-Buy call, target Rs 8,845 per share

-Temporarily suspends new EMI cards issuance

-Fee income to be impacted in near term

-Proactive temporary suspension of new EMI cards, is not material

-Company confirmed that it does not impact its customer acquisition engine

-Will continue to offer financing to new/existing customers at dealer stores

Stock Market LIVE Updates | RBI approves appointment of Arun Khurana as IndusInd Bank ED for 3 years

The Reserve Bank of India has approved an appointment of Arun Khurana as Whole-time Director (Executive Director) of IndusIndia Bank for three years with effect from November 16. Arun was the Deputy CEO of the bank and also the overall head of Global Markets Group (GMG).

Sensex Today | Market at 2 PM

The Sensex was down 148.77 points or 0.23 percent at 65,645.96, and the Nifty was down 36.60 points or 0.19 percent at 19,695.20. About 1626 shares advanced, 1667 shares declined, and 130 shares unchanged.

| Company | Price at 13:00 | Price at 13:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Cubex Tubings | 72.00 | 68.50 | -3.50 3.81k |

| EQUIPPP | 26.25 | 25.05 | -1.20 34 |

| Sharp Chucks | 81.75 | 78.30 | -3.45 - |

| AGI Greenpac | 1,061.75 | 1,018.50 | -43.25 178.94k |

| Hi-Green Carbon | 150.00 | 145.00 | -5.00 - |

| D P Wires | 638.00 | 617.50 | -20.50 12.75k |

| Dodla | 847.15 | 820.95 | -26.20 6.66k |

| Crop Life Sci. | 41.20 | 40.05 | -1.15 4.17k |

| Sejal Glass | 264.90 | 258.00 | -6.90 634 |

| Sungarner | 217.50 | 212.05 | -5.45 200 |

| Company | Price at 13:00 | Price at 13:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Tokyo Plast | 110.80 | 130.20 | 19.40 1.84k |

| Williamson Mago | 30.70 | 33.65 | 2.95 2.16k |

| V-Marc | 150.95 | 164.30 | 13.35 16.47k |

| Magson Retail | 115.00 | 121.90 | 6.90 1000 |

| Sundaram Brake | 590.25 | 624.00 | 33.75 206 |

| Sunrest | 79.80 | 84.00 | 4.20 - |

| SML Isuzu | 1,481.75 | 1,546.00 | 64.25 55.98k |

| Pritish Nandy | 47.65 | 49.50 | 1.85 65.76k |

| Vertoz Advertis | 362.00 | 376.00 | 14.00 47.63k |

| Maitreya Medica | 121.00 | 125.65 | 4.65 1.49k |

Stock Market LIVE Updates | General Tax Authority, Qatar imposes a penalty of Rs 238.95 crore on Larsen & Toubro

The General Tax Authority, Qatar has imposed a penalty of 4,86,80,120 QAR (around Rs 111.31 crore) on Larsen & Toubro for tax period for FY17 and 5,58,22,856 QAR (around Rs 127.64 crore) for tax period of FY18. An appeal has been filed against the levy of this penalty as the company believes it is arbitrary and unjustified.

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Prataap Snacks | 975.75 20% | 1.50m 1,541.20 | 97,230.00 |

| Garnet Intl | 49.00 -2.97% | 255.05k 3,966.40 | 6,330.00 |

| KPIL | 651.55 -2.11% | 818.84k 14,511.60 | 5,543.00 |

| Narmada Agrobas | 19.42 0.67% | 65.39k 1,276.80 | 5,021.00 |

| Gayatri Sugars | 21.53 -4.99% | 832.67k 18,663.00 | 4,362.00 |

| Quasar India | 30.52 4.99% | 317.34k 7,615.00 | 4,067.00 |

| Ethos | 2,001.85 -4.53% | 232.32k 7,926.80 | 2,831.00 |

| BF Investment | 570.80 12.52% | 30.92k 1,903.00 | 1,525.00 |

| Hubtown | 70.60 5% | 198.31k 12,932.80 | 1,433.00 |

| Coromandel Engg | 41.18 0.81% | 216.59k 15,082.20 | 1,336.00 |

Stock Market LIVE Updates | American Petroleum Institute grants license to Birla Corporation's cement plant at Chanderia to use official API monogram

The American Petroleum Institute has granted license to Birla Corporation's cement plant at Chanderia namely, Birla Cement Works, to use official API monogram on manufactured products viz API Well Cement Class G at Grade(s) HSR with effect from November 17. Company intends to participate in the tender process for sale of API Well Cement Class G at Grade(s) HSR to cater to the needs of the oil exploration entities.

Stock Market LIVE Updates | Electrosteel Castings to carry out repairs & maintenance of blast furnace at Khardah unit

Electrosteel Castings will carry out repairs and maintenance of its blast furnace at its Khardah unit tentatively from November 24. It is expected that the blast furnace would be operational after 3 to 4 weeks. All other units of the company will operate normally during this period.

Stock Market LIVE Updates | Elara Capital View on Eureka Forbes

Broking house trim FY24E/25E EPS estimates 9%/1% due to lower growth and margin. It reiterate Buy with a raised Target Price of Rs 630 (from Rs 600) on 36x September 2025E earnings as optimistic on the company scripting a turnaround, led by growth and sharp margin uptick on various cost measures.

Expect an earnings CAGR of 76% in FY23-26E, with FY24E-26E ROE/ROCE at 12%/9%, respectively.

Stock Market LIVE Updates | Vinayak Kudtarkar resigns as General Manager (Finance) & Chief Financial Officer of Gujarat Alkalies

Vinayak Kudtarkar has resigned as General Manager (Finance) & Chief Financial Officer of Gujarat Alkalies & Chemicals with effect from November 18. The company has appointed Ram Gianani as CFO with effect from same date. Ram was working an Additional General Manager (Finance) with the company since December 2013.

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| BSE Auto | 38178.46 -0.88 | 32.00 2.34 | 1.89 30.43 |

| BSE CAP GOODS | 48827.91 -0.59 | 46.44 1.81 | 3.42 46.31 |

| BSE FMCG | 19024.67 -0.27 | 18.35 0.98 | 1.47 19.46 |

| BSE Metal | 23762.30 0.02 | 13.94 1.00 | 3.48 19.97 |

| BSE Oil & Gas | 19433.76 -0.07 | -4.78 0.96 | 4.56 -1.73 |

| BSE REALTY | 5476.10 -0.25 | 58.87 4.24 | 14.64 53.28 |

| BSE IT | 33020.27 0.61 | 15.17 5.48 | 3.38 10.75 |

| BSE HEALTHCARE | 29594.02 0.35 | 28.48 2.45 | 5.69 26.44 |

| BSE POWER | 4656.73 -0.1 | 6.29 0.85 | 4.13 -0.79 |

| BSE Cons Durables | 45695.05 -0.18 | 15.04 1.68 | 0.45 12.14 |

Stock Market LIVE Updates | The Department of Telecommunications, Andhra Pradesh LSA, Hyderabad has imposed a penalty on Bharti Airtel of Rs 1.07 lakh for alleged violation of subscriber verification norms.

Stock Market LIVE Updates | Kotak Mahindra Bank gets GST demand order worth Rs 35 lakh from GST Department, Maharashtra

Kotak Mahindra Bank has received an order from the Government of Maharashtra Department of Goods and Service Tax, levying an amount of Rs 34,99,796 towards Goods and Services Tax (GST) and interest and a penalty of Rs 1,64,936, for the alleged excess claim of GST credit and non-payment of GST under reverse charge in certain instances during the assessment period July 2017 – March 2018.

Sensex Today | BSE Smllcap index touched fresh high, adding 0.3 percent led by Talbros Automotive Components, Tata Investment Corporation, Prataap Snacks:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Prataap Snacks | 966.40 | 18.85 | 1.50m |

| Talbros Auto | 279.00 | 18.77 | 366.71k |

| Tata Inv Corp | 4,474.45 | 14.58 | 147.22k |

| Goldiam Inter | 163.25 | 13.72 | 593.14k |

| MOIL | 302.50 | 12.41 | 1.08m |

| BF Investment | 570.00 | 12.36 | 25.50k |

| Kopran | 276.05 | 11.09 | 268.96k |

| Summit Sec | 1,276.00 | 10.04 | 4.76k |

| JSW Holdings | 5,221.85 | 9.9 | 2.28k |

| SML Isuzu | 1,501.80 | 9.76 | 22.50k |

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Natura Hue | 12.44 | 68.34 | 7.39 |

| PRO CLB GLOBAL | 11.30 | 67.90 | 6.73 |

| Natural Biocon | 14.91 | 42.54 | 10.46 |

| BCPL Railway In | 114.00 | 38.25 | 82.46 |

| Tata Inv Corp | 4,466.00 | 37.55 | 3,246.90 |

| Artson Engg | 207.75 | 32.24 | 157.10 |

| Hb Stockhol | 89.09 | 28.67 | 69.24 |

| Kay Power | 12.24 | 28.17 | 9.55 |

| Retro Green Rev | 11.80 | 27.43 | 9.26 |

| Bang Overseas | 71.99 | 27.28 | 56.56 |

Stock Market LIVE Updates | Morgan Stanley View On Bajaj Finance

-Overweight Call, target Rs 10,300 per share

-Reported that it is temporarily discontinuing issuance of new EMI cards

-Continues to expect non-material financial impact

-Company is in the process of implementing requisite actions to make good deficiencies

-Will continue to engage with RBI to ensure compliance on all parameters

Sensex Today | Market at 1 PM

The Sensex was down 173.30 points or 0.26 percent at 65,621.43, and the Nifty was down 45.60 points or 0.23 percent at 19,686.20. About 1654 shares advanced, 1625 shares declined, and 124 shares unchanged.