LiveNow

Closing Bell: Sensex gains 627 pts, Nifty at 24,800; IT, FMCG, banks shine

Sensex gains 627 pts, Nifty at 24,800; IT, FMCG, banks shine

Indian equity market ended higher for the fourth straight session on July 18 with Nifty at 24,800. At close, the Sensex was up 626.91 points or 0.78 percent at 81,343.46, and the Nifty was up 187.80 points or 0.76 percent at 24,800.80.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices for all the global market action.

Shrikant Chouhan, Head Equity Research, Kotak Securities

The benchmark indices continued positive momentum, the Nifty ends 188 points higher while the Sensex was up by 627 points. Among Sectors, IT index outperformed, rallied over 2.20 percent whereas Media index corrected sharply and shed 3.5 percent. Technically, after a weak open market successfully surpassed the short-term resistance of 24700/81000 and post breakout it intensified positive momentum. On daily charts it has formed bullish candle on intraday charts it is holding breakout continuation formation which is largely positive.

For the trend following traders now, 24700/81000 would act as a sacrosanct support zone. Above 24700/81000, the market could continue the positive momentum till 24900-24950/81600-81800. On the flip side, below 24700/81000 traders may prefer to exit out from the trading long positions. Below which it could retest the level of 24500-24475/80400-80300.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas

Nifty opened gap down however as the day progressed it gained momentum and closed at a new All time high. It closed with gains of 188 points. On the daily charts we can observe that after two days of consolidation the Nifty has witnessed a sharp upmove. The hourly moving averages placed at 24500 provided support and helped resume its upmove. We expect the rally to continue towards 24840 and above that towards the psychological level of 25000. Support base shifts higher towards 24550 – 24600.

Bank Nifty held on to the 20-day moving average and resumed its upmove towards 53000. The gap down today tested the support zone of 52100 and held on thereby increasing its importance. Going ahead we expect the rally to continue 53000 – 53200.

Vinod Nair, Head of Research, Geojit Financial Services

The frontline indices firmed up in the second half, reaching fresh highs driven by renewed buying in IT stocks. Investor optimism for the sector grew after strong performance reports from the country's leading IT firms in the June quarter, coupled with a weakening rupee. However, the broader market lagged the major indices due to high valuations and sectoral rotation, which is influenced by anticipated improvements in private consumption, particularly in rural areas.

Rupak De, Senior Technical Analyst, LKP Securities

The index remained volatile during the session, engulfing previous doji pattern. The trend and momentum remain positive, with the index staying above critical short-term moving averages and a positive crossover in the daily RSI. In the short term, the trend is likely to remain positive as long as the index stays above 24,500. On the higher end, the current trend might take the index towards 25,000 in the near term.

The Bank Nifty formed a bullish engulfing pattern following a consolidation. Additionally, the index found support at the 21 EMA, and the RSI has entered a bullish crossover. The trend is likely to remain positive as long as the index stays above 52,000. On the higher end, it might move towards 53,000/53,300 in the short term.

Aditya Gaggar Director of Progressive Shares

Extreme volatility was seen in the morning trade as the Index swung on both sides. From the mid-session, one-way upmove was witnessed in the Index with the support of FMCG and IT counters and helped to end the session at a fresh record level of 24,800.85 with gains of 187.85 points. On a sectoral front, Media was the top loser by ending the day with a loss of over 3% followed by Metal. Recovery was seen in the Broader markets as well but not enough to outperform the Frontline Index as Mid and Smallcap shed by 0.96% & 1.22% respectively.

By engulfing the previous candle, the Index has formed a big green candle which implies a strong comeback of bulls and now the psychological level of 25,000 will be considered as an immediate hurdle while on the lower side, 24,500 will serve as strong support.

Currency Check | Rupee ends lower

Indian rupee closed lower at 83.65 per dollar on Thursday against Tuesday's close of 83.58.

Sensex Today | Infosys Q1 profit at Rs 6368 crore and rupee revenue at Rs 39,315 crore

Market Close | Sensex gains 627 pts, Nifty at 24,800; IT, FMCG, banks shine

Indian equity market ended higher for the fourth straight session on July 18 with Nifty at 24,800.

At close, the Sensex was up 626.91 points or 0.78 percent at 81,343.46, and the Nifty was up 187.80 points or 0.76 percent at 24,800.80. About 1192 shares advanced, 2194 shares declined, and 75 shares unchanged.

TCS, LTIMindtree, ONGC, Bajaj Finserv and Wipro were among the top gainers on the Nifty, while losers included Asian Paints, Hero MotoCorp, Grasim, Coal India and Bajaj Auto.

Among sectors, bank, auto, IT, FMCG and telecom rose 0.3-2 percent, while capital goods, metal, power, media down 1-3.5 percent.

The BSE midcap and smallcap index shed 1 percent each.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Zee Entertain | 142.55 | -8.35 | 48.49m |

| CG Power | 689.45 | -5.63 | 6.07m |

| Oil India | 584.00 | -5.58 | 12.30m |

| Rail Vikas | 586.55 | -5.42 | 34.65m |

| Dixon Technolog | 11,948.50 | -4.81 | 762.49k |

| Mazagon Dock | 5,195.00 | -3.89 | 2.13m |

| NHPC | 108.89 | -3.82 | 83.83m |

| BHEL | 308.30 | -3.66 | 21.16m |

| Fert and Chem | 1,073.15 | -3.62 | 720.94k |

| One 97 Paytm | 444.40 | -3.45 | 2.66m |

Stock Market LIVE Updates | Power Mech bags order worth Rs 209.50 crore from Hindustan Zinc

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| TCS | 4324.30 | 4324.30 | 4,318.00 |

| Wipro | 574.40 | 574.40 | 573.50 |

| HUL | 2750.00 | 2750.00 | 2,735.65 |

| Infosys | 1764.70 | 1764.70 | 1,759.95 |

| Tech Mahindra | 1544.85 | 1544.85 | 1,539.00 |

| ICICI Bank | 1256.00 | 1256.00 | 1,248.60 |

Brokerage Call | CLSA keeps 'underperform' call on Eicher Motors, target Rs 4157

#1 Launched Guerrilla 450, priced between Rs 2.39 lakh-2.54 lakh in India

#2 Bookings have commenced in India, with test rides & retail sales scheduled to begin on August 1

#3 Royal Enfield holds market-leading position in premium motorcycle segment with 29.5 percent market share

#4 Royal Enfield dominates >250cc motorcycle segment with 88.3 percent market share in FY24

#5 Royal Enfield is losing market share in the segment as competitors continue to scale up

#6 Maintain underperform call on expensive valuations

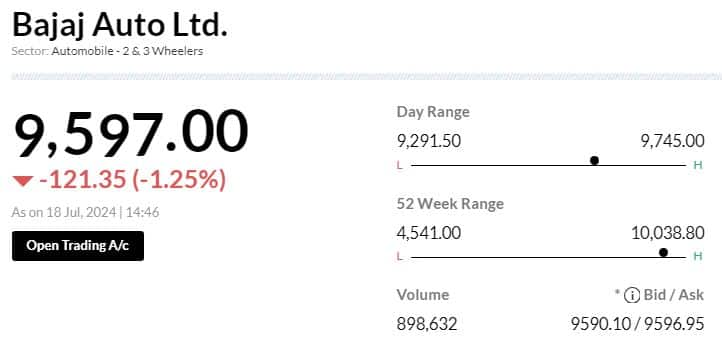

Brokerage Call | Macquarie keeps 'neutral' rating on Bajaj Auto, target Rs 9,655

#1 Q1 PLI accrual drives headline gross margin beat

#2 Multiple growth drivers including CNG motorcycle

#3 Growth drivers include expansion of E2W portfolio with launch of less than Rs 1 lakh model, manufacturing footprint in LATAM

#4 Ramp of E3W volumes & distribution for EVs & premium motorcycle should lend growth support

Stock Market LIVE Updates | LTIMindtree gets mutli-million dollar contract extension from Absa Bank

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| TCS | 4324.00 | 4324.00 | 4,314.25 |

| SBI Life Insura | 1664.95 | 1664.95 | 1,661.50 |

| ONGC | 331.60 | 331.60 | 330.20 |

| Wipro | 573.90 | 573.90 | 572.35 |

| HUL | 2751.20 | 2751.20 | 2,740.15 |

| Infosys | 1765.40 | 1765.40 | 1,754.15 |

| Tech Mahindra | 1545.70 | 1545.70 | 1,536.65 |

| Britannia | 5920.00 | 5920.00 | 5,876.35 |

Earnings Watch | Tata Communications Q1 net profit down 13% at Rs 333 crore Vs Rs 382 crore, YoY

Stock Market LIVE Updates | Zee Entertainment Enterprises to raise fund via FCCBs

The board has approved raising funds by issuing 5% foreign currency convertible bonds (FCCBs) up to USD 239 million (Rs 1,997.22 crore) maturing in 10 years on a private placement basis to proposed investors - Resonance Opportunities Fund, St. John’s Wood Fund, and Ebisu Global Opportunities Fund. The FCCB issue opened on July 16.

Stock Market LIVE Updates | Zydus Life in non-exclusive patent licensing agreement with Takeda for Vonoprazan in India

Zydus Lifesciences has entered into a non-exclusive patent licensing agreement with Takeda Pharmaceutical Company to market the novel Potassium Competitive Acid Blocker (P-CAB) Vonoprazan in India.

The drug will be marketed under the brand name of Vault in India.

Earnings Watch | Premier Explosives Q1 net profit down at Rs 7.3 crore Vs Rs 8.2 crore, YoY

Brokerage Call | Goldman Sachs maintains 'neutral' rating on Asian Paints, target Rs 2,750

#1 EBITDA decline of 20 percent YoY in Q1, demonstrates increasing headwinds

#2 Sharp growth slowdown, management expects a modest recovery ahead

#3 EBITDA margin impacted by increase in staff costs and advertising

#4 Impact of increased competitive intensity likely to create further pressure going forward

Sensex Today | 6.3 million shares of Jio Financial traded in a block: Bloomberg

Spot USDINR to trade between 83.40-83.90: Anuj Choudhary – Research Analyst at Sharekhan by BNP Paribas

Indian Rupee declined by 0.05% on strong US Dollar today and overnight surge in crude oil prices. US Dollar strengthened on weak Pound amid disappointing labour market data from UK. However, positive domestic markets and FII inflows cushioned the downside.

We expect Rupee to trade with a slight negative bias on strong US Dollar weak Asian and European currencies. A bounce back in crude oil prices may further pressurise the Rupee. However, record high domestic equities and fresh foreign inflows may support the Rupee at lower levels. Any intervention by the RBI may as the Rupee is trading near record-low levels may also support the local unit.

Traders may take cues from weekly unemployment claims data from the US. ECB is also expected to announce monetary policy decision today. USDINR spot price is expected to trade in a range of Rs 83.40 to Rs 83.90.

Sensex Today | 1 million shares of Samvardhana Motherson International traded in another block: Bloomberg

Brokerage Call | UBS keeps 'sell' rating on Bajaj Auto, target Rs 6,250

#1 PLI incentives & spares aid 20 percent margin in Q1

#2 Mix moderation ahead, margin tailwinds behind

#3 Believe market is assigning 25x P/E to 3W business

#4 Market also seems to be ignoring muted response to triumph moderating 3W volumes, and slippage in 2W market share despite launch of multiple models

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| SBI | 891.90 | 1.27 | 14.47m |

| Kotak Mahindra | 1,825.65 | 1.13 | 6.10m |

| ICICI Bank | 1,252.60 | 1.02 | 7.59m |

| Federal Bank | 196.95 | 0.82 | 7.32m |

| IndusInd Bank | 1,456.50 | 0.73 | 2.71m |

| Axis Bank | 1,310.10 | 0.47 | 5.41m |

Stock Market LIVE Updates | Techno Electric lauches QIP

The firm launched its Qualified Institutions Placement (QIP) issue on July 16 and fixed the floor price for QIP at Rs 1,506.58 per share.

Stock Market LIVE Updates | GMR Airports' passenger traffic up 8% in June

Passenger traffic in June this year grew by 8% YoY, with domestic traffic up 6.4% and international traffic up 12.8%. Aircraft movements increased by 6% YoY in June.

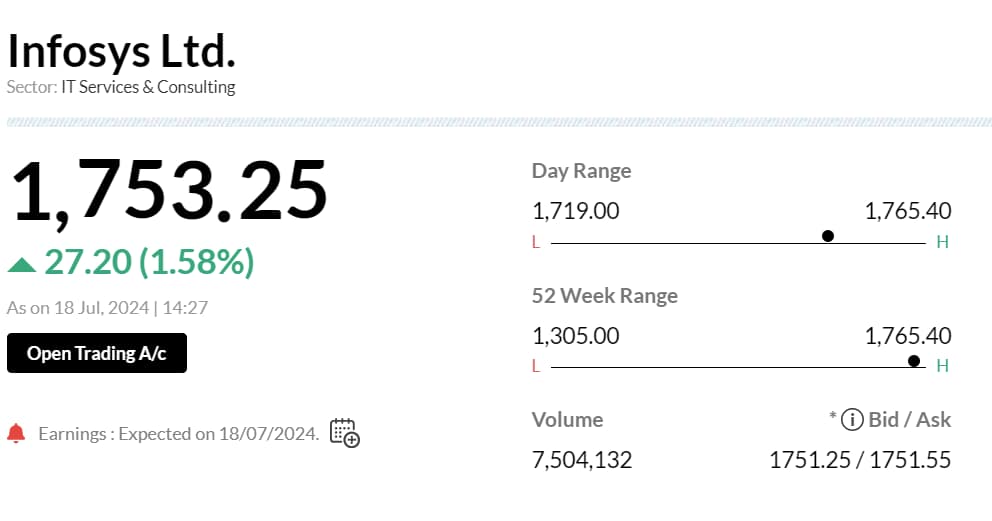

Sensex Today | Infosys at 52-week high ahead of reporting its Q1 results today, up 1.6%

Sensex Today | Polycab India Q1 net profit Rs 396 crore, down 0.8% y/y

#1 Q1 revenue Rs4700 crore, up 21% y/y

#2 Wires and cable revenue Rs3940 crore, up 12% y/y

#3 FMEG revenue Rs385 crore, up 22% y/y

#4 Other revenue Rs519 crore vs Rs153 crore y/y

#5 Total costs Rs4220 crore, up 23% y/y

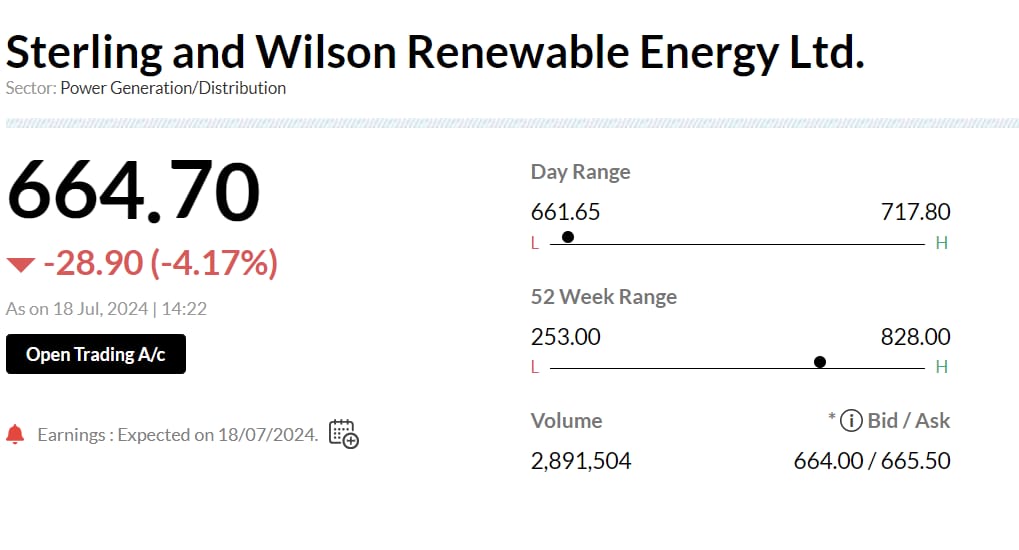

Sensex Today | Sterling & Wilson net profit Rs 4.2 crore in Q1

#1 Net Profit at Rs4.2 cr Vs loss of Rs95.5 cr (YoY)

#2 Revenue up 78% At Rs915 cr Vs Rs515 cr (YoY)

#3 EBITDA at Rs25 cr Vs EBITDA loss of Rs38 cr (YoY)

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| LTIMindtree | 5,763.00 | 3.61 | 2.13m |

| TCS | 4,298.90 | 2.88 | 4.06m |

| COFORGE LTD. | 6,032.45 | 2.3 | 540.05k |

| Wipro | 572.50 | 2.29 | 8.86m |

| Infosys | 1,764.85 | 2.25 | 7.07m |

| MphasiS | 2,854.00 | 1.95 | 703.96k |

| Persistent | 4,910.05 | 1.86 | 407.06k |

| Tech Mahindra | 1,544.15 | 1.84 | 1.85m |

| HCL Tech | 1,596.60 | 1.72 | 2.92m |

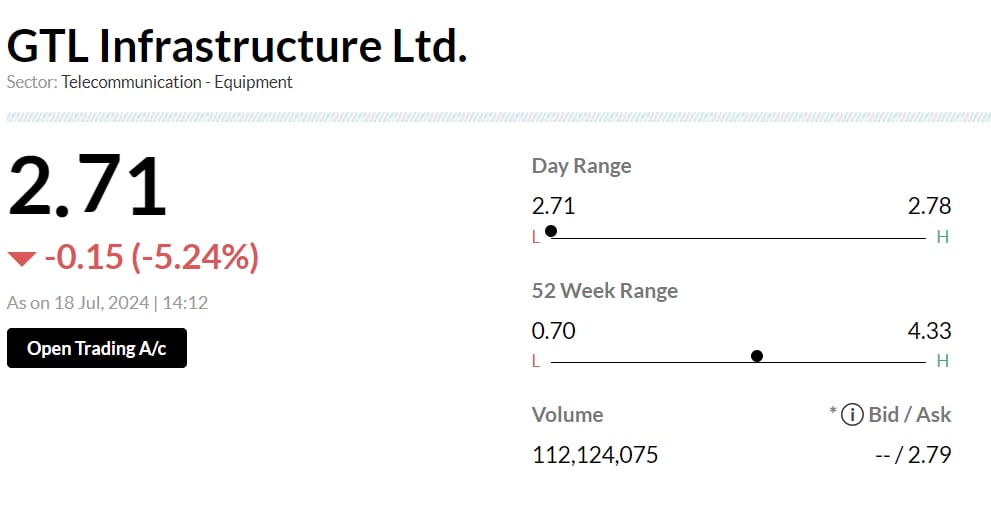

Sensex Today | GTL Infrastructure falls for eight day

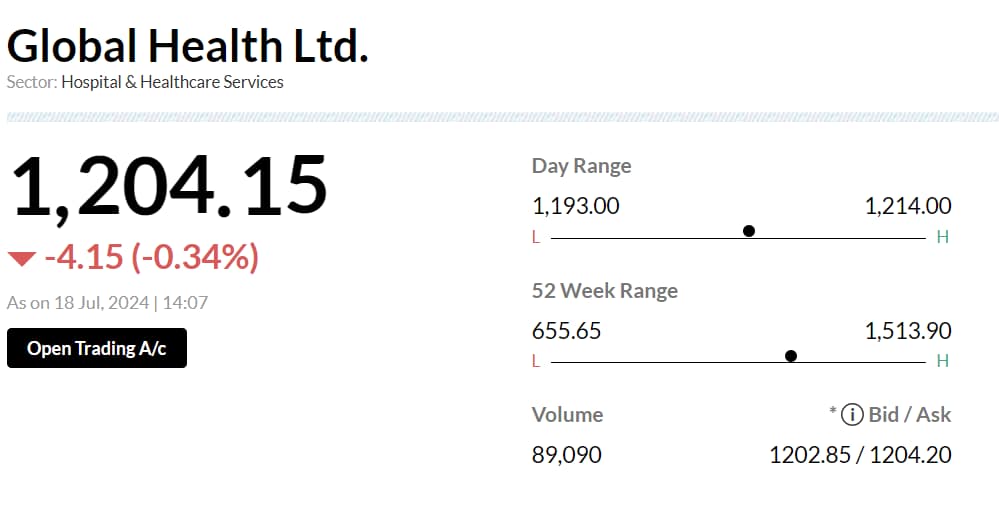

Sensex Today | Global Health falls for sixth day

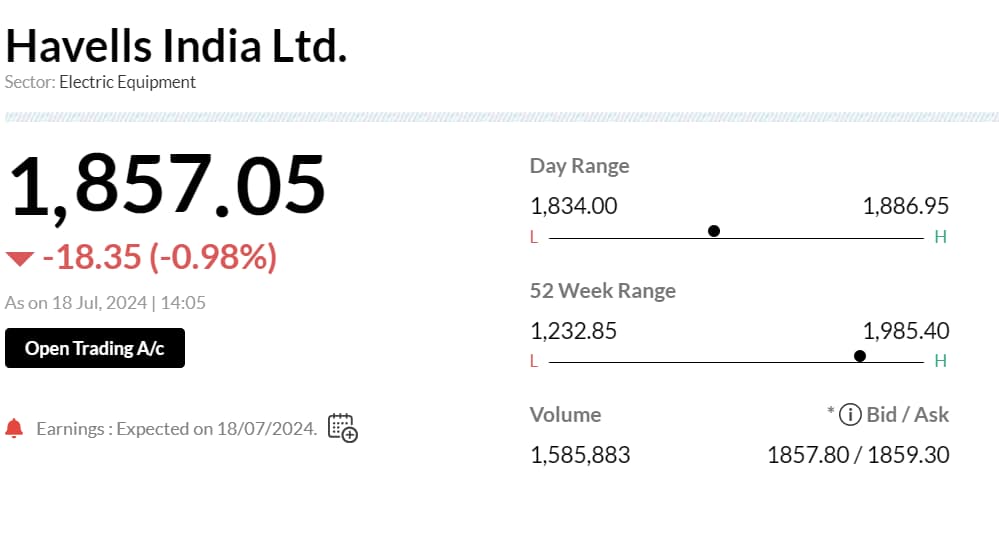

Earnings Watch | Havells Q1 net profit at Rs 411.2 crore

#1 Revenue Rs5800 crore, up 20% YoY

#2 Total Costs Rs 5320 crore, 18% YoY

#3 Other Income Rs 77.03 crore, up 19% YoY

Brokerage Call | Nomura keeps 'reduce' rating on Eicher Motors, target Rs 4,119

#1 Royal Enfield Guerrilla 450 launched at a starting price of Rs 2.39 lakh

#2 Segment above 400cc has not seen much increase in its share despite interesting products

#3 Believe reason for no rise could be that large section of customers use bikes for commuting

#4 These bikes are not only expensive, but more difficult to ride in traffic as they tend to heat up

#5 Despite the launch, do not expect much improvement in overall growth for Royal Enfield

Stock Market LIVE Updates | ONGC starts production from CBM block in Bokaro, Jharkhand

ONGC has commenced production from its coal bed methane (CBM) block in Bokaro, Jharkhand. The initial production stands at 1,70,000 SCMD and is expected to ramp up to 3,00,000 SCMD by the end of the current financial year.

Stock Market LIVE Updates | IRDAI imposes penalty of Rs 2 crore on Bajaj Finance

The Insurance Regulatory and Development Authority of India (IRDAI) has levied a penalty of Rs 2 crore on the company for violating provisions of IRDAI Regulations. IRDAI conducted an onsite inspection of Bajaj Finance during March 3 and March 5, 2021, for the period FY18 to FY20. IRDAI has also advised the company to comply with those directions in a time-bound manner.

| Company | Bid Qty | CMP Chg(%) | Today Vol 20D Avg Vol |

|---|---|---|---|

| MTNL | 7335712.00 | 64.0820 | 13997347015754347.65 |

| Krebs Biochem | 199534.00 | 102.0820 | 105484873136.80 |

| Guj Raffia Ind | 12816.00 | 48.6210 | 12689715942.75 |

| Oriental Carbon | 127639.00 | 396.0510 | 126836206774.70 |

| RETAIL | 44785.00 | 49.779.99 | 1956460.00 |

| Nagreeka Export | 82761.00 | 38.789.98 | 30354168913.35 |

| Sagardeep Alloy | 461207.00 | 33.079.98 | 73865181517.60 |

| KPIGREEN | 108255.00 | 1070.305 | 1453158250525.25 |

| E2E Networks | 151151.00 | 1692.105 | 1496550109.60 |

| Apollo Micro Sy | 546966.00 | 121.005 | 139542682167961.80 |

Stock Market LIVE Updates | Ashish Kumar resigns as Head of Finance and CFO of SpiceJet

Ashish Kumar has resigned as Head of Finance and Chief Financial Officer of the company to pursue other opportunities. The company has appointed Joyakesh Podder as the Head of Finance and designated him as the Deputy Chief Financial Officer, effective July 15.

Stock Market LIVE Updates | Andhra Cement to invest Rs 19 crore for 6 MW Solar Power Plan

The Board of Andhra Cement at its meeting held on July 18, 2024 had accorded its approval for implementation of 6 MW Solar Power Plant at the Company's Cement manufacturing plant at Dachepalli, Palnadu District in the State of Andhra Pradesh at a cost of around Rs 19 crores and the said project will be expected to be completed in 7 months. The cost for the above said project will be met through lease finance and internal accruals.

Stock Market LIVE Updates | TVS Motor will invest 200 million pounds in its subsidiary

The company will invest 200 million pounds in its subsidiary Norton Motorcycles for international expansion, with an initial focus on the USA, Germany, France, Italy, and India.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| MTNL | 64.02 | 20 | 8.49m |

| TataTeleservice | 93.50 | 14.96 | 12.00m |

| OnMobile Global | 87.11 | 10.13 | 852.76k |

| INDUS TOWERS | 420.15 | 3.31 | 586.27k |

| Tejas Networks | 1,444.50 | 1.17 | 62.48k |

| Vindhya Telelin | 2,679.70 | 0.9 | 7.45k |

| Bharti Airtel | 1,477.50 | 0.78 | 70.54k |

Brokerage Call | JPMorgan keeps 'neutral' rating on Asian Paints, target Rs 2,800

#1 Q1 earnings miss on weak margin print & tepid revenue growth

#2 Poor mix and subdued demand weigh on revenue

#3 Price hikes, rural to aid better growth Q2 onwards

#4 Lower FY25-27 EPS by 3-5 percent by further lowering margin assumptions

#5 Marginal tweak down in revenue growth

Stock Market LIVE Updates | Glenmark Pharma gets USFDA approval; stock gains

The pharma company has received final approval from the United States Food & Drug Administration (US FDA) for Topiramate capsules USP, 15 mg, and 25 mg. Topiramate is used in the treatment of epilepsy.

Stock Market LIVE Updates | Sarda Energy & Minerals board meet on August 3

The board of directors will meet on August 3 to consider unaudited results for the first quarter of FY25 and seek shareholder consent for fundraising.

The board of directors will meet on August 3 to consider unaudited results for the first quarter of FY25 and seek shareholder consent for fundraising.

Earnings watch | Swaraj Engines Q1 net profit up 5% at Rs 43 crore Vs Rs 41 crore, YoY

Sensex Today | Infosys shares gains ahead of Q1 numbers