Closing Bell: Nifty at 19,650, Sensex rises 364 pts; all sectors in the green

-330

October 06, 2023· 16:22 IST

-330

October 06, 2023· 16:20 IST

Rupak De, Senior Technical analyst at LKP Securities:

Nifty ended the week with a modest gain despite the selling in the banking sector. Overall, sentiment is expected to stay positive as long as it maintains above the critical support level of 19,500, as put writers are likely to offer support at this level. On the upside, resistance is positioned around 19,750-19,800. A strategy of buying on dips would be favorable as long as it holds above 19,500.

-330

October 06, 2023· 16:09 IST

Aditya Gaggar, Director of Progressive Shares

On the weekly chart, Nifty50 has made a Dragonfly DOJI candlestick pattern which indicates a strong comeback of the bulls and a potential reversal of the trend. The zone of 19,530-19,330 will be a strong support area while on the higher side, the Index has to breach the 19,750-19,800 zone to ensure a reversal of the trend. BankNifty has tested its support level of 43,850 and reversed but it lacks momentum. A convincing close above 44,800 is a must for confirming trend reversal.

At the lower end of the rising channel, the FMCG sector has made a DOJI pattern which suggests a probable reversal of the trend. A sharp turnaround was seen in the IT sector and plenty of the components are hinting towards a reversal of trend (Quarterly numbers may affect the trend). As indicated in the previous edition, the PSU Banking sector has formed a Spinning Top candle which indicates a pause in its northward journey. Frontline Realty stocks are giving a sign of a consolidation breakout, one should keep an eye on the sector. From our fundamental coverage universe, some of the stocks that look strong (technically) include Punjab Chemicals, Supreme Petro, HBL Power, Ultramarine & Pigments. Volatility is anticipated due to the quarterly results around the corner.

-330

October 06, 2023· 16:07 IST

Amol Athawale, Vice President - Technical Research, Kotak Securities:

While positive Asian market cues helped local gauges maintain upward bias for the second straight session, RBI keeping policy rates steady in the MPC meet also cheered investors and lifted the market sentiment. Realty shares hogged the limelight after taking the hammering in recent trades amid hopes that no change in interest rates may boost home sales, especially during the festive season.

Technically, after a sharp fall the Nifty took support near 19350 and bounced back sharply. Currently, the index is trading near the 50-day SMA (Simple Moving Average), and on weekly charts it has formed a Hammer kind of formation which is largely positive.

As long as the index is trading above the 50-day SMA or 19575 level, the positive sentiment is likely to continue. Above the same, it could move up till 20-day SMA or 19800 and on further upside the index may also continue upsurge till 19850. On the flip side, a fresh selloff is possible only after the dismissal of 19575 and below the same, the index could retest the level of 19450-19350.

For Bank Nifty, 44000 would act as a key support zone and above the same, it could rally till the 50-day SMA or 44800-45000 levels. On the other hand, below 44000, the uptrend would be vulnerable.

-330

October 06, 2023· 16:05 IST

Ajit Mishra, SVP - Technical Research, Religare Broking:

Markets extended rebound amid volatility and gained over half a percent. After the gap-up start, Nifty inched gradually higher however the existence of a hurdle at 20 EMA capped the momentum. Finally, it managed to close around the day’s high at 19,653.50 level; up by 0.55%. All key sectors contributed to the move wherein realty, financials and pharma were the top performers.

The broader indices also edged higher and gained over half a percent each.

The recent bounce has certainly eased some pressure but we are now again at the hurdle of the short term moving average (20 EMA). We need sustainability above the same for a further recovery towards 19800 else the decline would resume. Meanwhile, traders should remain focused on stock selection and position management until we see clarity over the next directional move.

-330

October 06, 2023· 15:57 IST

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

The Nifty opened gap up for the second consecutive day and traded with a positive bias throughout the day to close with gains of ~107 points. On the daily charts we can observe that the Nifty has managed to close above the 40-day moving average (19610) which is a Bullish sign. On the weekly charts we can observe that the Nifty has closed in the green and in term of pattern it has formed a Dragonfly Doji which has bullish implications.

We expect this pullback to continue till 19778 – 19800 where resistance in the form of the 50% Fibonacci retracement level and the 20-day moving average is placed. In the case of a dip towards 19530 – 19580 it should be used as a buying opportunity.

Bank Nifty opened gap up and thereafter consolidated for most part of the day. On the hourly momentum indicator, we can observe positive divergence and crossover which is a bullish sign. We expect the Bank Nifty to provide a pullback till 44800 – 45000 from short term perspective. In case of a dip we it should be used as a buying opportunity.

-330

October 06, 2023· 15:54 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Both Nifty and Sensex were flat to marginal positives in the past week. Nifty Midcap Index lost around 0.7% while BSE SmallCap Index gained around 0.6%. Macro sentiments remained volatile as frailties in European and US amid volatile crude oil prices and rising US bond yields. Concerns about elevated interest rates weighed on the sentiment, although falling crude oil prices gave some relief. Brent crude fell 10% in the past week to US$88.3/bbl.

Indian equity markets remained concerned about slowdown, higher interest rates and valuation.

Major sectors were mixed on week-on week basis with Nifty Reality, Nifty IT, Media and Consumption gaining the most. While key sectors that lost were Bank Nifty, Nifty Pharma, Energy, Auto and Metals. Within the Nifty Index, Bajaj Finserve (+4.6%), Titan (+4.1%) and Bajaj Finance (+3.8%) gained the most, while ONGC (-5.3%), NTPC (-4.1%) and Hindalco (-4.0%) lost the most.

FPIs were net sellers, in the past week, similar to the trend seen in other emerging markets. While DIIs were net buyers in the same period. On the economy front, GST collections for August (collected in September) were 10.2% higher YoY at Rs 1.63 tn (July: Rs1.59 tn).

We expect the market to take cues from the upcoming earnings season. We expect the Q2FY24 net income of the Nifty-50 Index to increase 23% YoY and remain flat QoQ.

In International news, the U.S. nonfarm payrolls report expected today is expected to provide a major test for Wall Street, with investors fearful that if the tight labor market holds up the Federal Reserve could keep interest rates higher for longer. Many market participants are hoping a somewhat softer jobs report will break the fever in bond yields, which have risen sharply and weighed on equities.

The 10-year U.S. Treasury yield hit a 16-year high this week, rising as much as 4.884%. It last hovered above 4.7%. In Europe, data releases for today includes German industrial orders for August, French trade data and Italian retail sales data for the same month. In Asia, Chinese authorities are signaling a softer stance on once-stringent data rules, among recent moves to ease regulation for business, especially foreign ones.

-330

October 06, 2023· 15:45 IST

Vinod Nair, Head of Research at Geojit Financial Services:

The risk of higher inflation led the RBI to become more realistic in their policy approach. The central bank maintained a hawkish tone on liquidity management, as they may consider OMO to contain liquidity in the system, which led to India's 10-year yield inching higher. The market, however, reacted positively, as the status quo on the growth rate and a further drop in oil prices provided near-term support.

-330

October 06, 2023· 15:33 IST

Rupee Close:

Indian rupee ended flat at 83.24 per dollar versus previous close of 83.25.

-330

October 06, 2023· 15:30 IST

Market Close

: Benchmark indices ended higher for the second consecutive session on October 6 with Nifty around 19,650.

At close, the Sensex was up 364.06 points or 0.55 percent at 65,995.63, and the Nifty was up 107.70 points or 0.55 percent at 19,653.50. About 2229 shares advanced, 1291 shares declined, and 156 shares unchanged.

Bajaj Finserv, Bajaj Finance, Titan Company, IndusInd Bank and Tata Consumer Products are among the top gainers on the Nifty, while losers included HUL, ONGC, Coal India, Bharti Airtel and Asian Paints.

All the sectoral indices ended in the green with realty index up 3 percent, while Information Technology, FMCG, Metal, Auto, Power, Healthcare up 0.4-1 percent.

Broader indices performed inline with main indices with BSE midcap and smallcap indices rising 0.5 percent each.

-330

October 06, 2023· 15:27 IST

Sensex Today | Piyush Baranwal, Sr. Fund Manager (Fixed Income), WhiteOak Capital Asset Management:

Status quo in today’s policy indicates MPC’s comfort with moderating trajectory for CPI and RBI is now using tighter liquidity including through OMO sales to accelerate transmission of past policy measures to drive inflation towards its 4% target. As a side benefit, this should also help ward off pressure on the external front as global markets adjust to the ‘higher for longer’ rates and tighter financial conditions.

-330

October 06, 2023· 15:25 IST

Stock Market LIVE Updates | Morgan Stanley View On Manappuram Finance

-Overweight, target price Rs 183 per share

-Proposed fresh equity issue of Rs 1,500 crore in subsidiary Asirvad Microfinance via IPO

-This is potentially a positive development as it could unlock some value for MGFL

-Company is trading at one-year forward P/BV of 1x (1 S.D. below its five-year mean)

-Company is trading at P/E of 5.3x for FY23-26 EPS CAGR of 24 percent

-Company is trading at FY24-26 RoE of average 19.5 percent

-330

October 06, 2023· 15:22 IST

Sensex Today | Srikanth Subramanian, CEO, Kotak Cherry:

It comes as no surprise that policy rates remained unchanged. This is in-line with the expectations and markets are happy about it. One of the major concerns with the current macro situation is to maintain the right balance of liquidity and inflation in the system, without compromising the growth engines of the economy.

Jul – Sep inflation is seen at 6.4% vs earlier projected 6.2% with FY24 projection at 5.4%. These figures still show uncertainties due to dependency on food prices, monsoons and crude prices. All the major central banks of the world have retained their rates in their latest decisions except for ECB which hiked the rates by 25 bps but indicated rates might be peaking out.

Indian equity and debt markets will now be anchored by economic data around the world and majorly US. Fed commentary has been crucial over the past few months with the Fed chair sounding resilient to tame the inflation even if it demands increasing rate further. In the current week, labor market data dictated both US markets as well as Asian markets including India. Markets are actively looking for cues for the trajectory of future interest rates. It will be a wait and watch for both central banks as well as the markets.

-330

October 06, 2023· 15:20 IST

Sensex Today | BSE Realty Index rose 3 percent supported by Godrej Properties, DLF, Macrotech Developers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Godrej Prop | 1,674.80 | 4.64 | 48.11k |

| DLF | 548.15 | 4.43 | 370.25k |

| Macrotech Dev | 777.65 | 3.82 | 67.92k |

| Brigade Ent | 593.40 | 2.21 | 14.33k |

| Indiabulls Real | 82.10 | 2.18 | 844.18k |

| Oberoi Realty | 1,111.75 | 1.89 | 80.63k |

| Sobha | 714.75 | 0.87 | 105.75k |

| Phoenix Mills | 1,784.50 | 0.67 | 5.06k |

| Prestige Estate | 673.00 | 0.25 | 48.33k |

-330

October 06, 2023· 15:18 IST

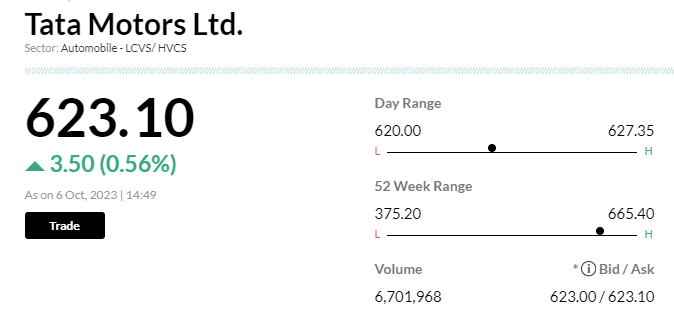

Stock Market LIVE Updates | Morgan Stanley View on Tata Motors

-Overweight rating, target price Rs 711 per share

-JLR posted strong Q2 volumes

-Wholesales up 29 percent YoY, & guided for FCF of £300mn for quarter

-A strong mix should support Q2 margins

-Q2 forms upside risk to FY24 EBIT margin estimate of 6.6 percent

-Tata should be a de-leveraging play in FY24 & India EV play in FY25

-330

October 06, 2023· 15:10 IST

Stock Market LIVE Updates |Jefferies On Godrej Consumer Products

-Buy call, target price Rs 1,200 per share

-India Q2 volume growth moderated to a mid-single digit

-Volume growth impacted by adverse weather conditions

-Home care did better versus personal care, while acquired Raymond portfolio saw QoQ improvement

-International business saw double-digit growth across Indonesia & GAUM in CC terms

-GAUM saw the impact of naira depreciation in rupee terms

-Margin expansion should be robust YoY across businesses

-Margin expansion supports earning growth despite a weak volume print

-330

October 06, 2023· 15:05 IST

Stock Market LIVE Updates | Arbitral Tribunal has passed an award of Rs 72.34 crores in favour of HFCL.

-330

October 06, 2023· 15:02 IST

Sensex Today | Market at 3 PM

The Sensex was up 405.12 points or 0.62 percent at 66,036.69, and the Nifty was up 117 points or 0.60 percent at 19,662.80. About 2001 shares advanced, 1116 shares declined, and 98 shares unchanged.

| Company | Bid Qty | CMP Chg(%) | Today Vol 20D Avg Vol |

|---|---|---|---|

| Manorama Indust | 7999.00 | 2251.50 5 | 16512 11839.50 |

| Eimco Elecon | 7594.00 | 985.60 5 | 18506 7820.30 |

| Mirza Intl | 102615.00 | 50.45 4.99 | 5233063 - |

| ICE Make Refrig | 22028.00 | 648.65 4.99 | 133685 38417.90 |

| HPL Electric & | 130759.00 | 218.75 4.99 | 344225 378540.75 |

| Arrow Greentech | 56833.00 | 400.80 4.99 | 9081 23379.95 |

| Electronics Mar | 322831.00 | 150.45 4.99 | 2398698 1331871.85 |

| Focus Lighting | 116347.00 | 177.60 4.99 | 258123 281848.00 |

| Genus Power | 157530.00 | 257.90 4.99 | 316165 728506.45 |

| Jayaswal Neco | 2544.00 | 39.00 4.98 | 784791 - |

| Company | Offer Qty | CMP Chg(%) | Today Vol 20D Avg Vol |

|---|---|---|---|

| Pudumjee Ind | 22403.00 | 28.95 -4.93 | 34332 23029.45 |

| Winsome Yarns | 1307503.00 | 7.25 -2.03 | 4490 10442.70 |

-330

October 06, 2023· 14:56 IST

Stock Market LIVE Updates | Tata Motors Group global wholesales at 3,42,376 in Q2 FY24

The Tata Motors Group global wholesales in Q2 FY24, including Jaguar Land Rover were at 3,42,376, higher by 7%, as compared to Q2 FY23.

Global wholesales of all Tata Motors’ commercial vehicles and Tata Daewoo range in Q2 FY24 were at 106,620, higher by 3%, over Q2 FY23.

Global wholesales of Tata Motors passenger vehicles in Q2 FY24 were at 1,38,939, lower by 3% as compared to Q2 FY23.

Global wholesales for Jaguar Land Rover were 96,817 vehicles, higher by 29%. Jaguar wholesales for the quarter were 13,560 vehicles, while Land Rover wholesales for the quarter were 83,257 vehicles.

-330

October 06, 2023· 14:50 IST

Stock Market LIVE Updates | Zydus Lifesciences gets final USFDA nod for Sugammadex Injection

Zydus Lifesciences has received final approval from the United States Food and Drug Administration (USFDA) for Sugammadex Injection, 200 mg/2 mL (100 mg/mL) and 500 mg/5 mL (100 mg/mL), Single-Dose Vial (USRLD: Bridion Injection, 200 mg/2 mL (100 mg/mL) and 500 mg/5 mL (100 mg/mL)).

-330

October 06, 2023· 14:50 IST

Stock Market LIVE Updates | Tata Motors Reports Q2 FY24 Global Wholesale Numbers: 7% Increase Led by Jaguar Land Rover

In Q2 FY24, Tata Motors Group's global wholesales, including Jaguar Land Rover, reached 342,376 units, up by 7% compared to Q2 FY23. Commercial vehicle wholesales were 106,620 units, up by 3% over Q2 FY23. Tata Motors' passenger vehicle wholesales in Q2 FY24 were 138,939 units, down by 3% compared to Q2 FY23. Jaguar Land Rover's global wholesales were 96,817 vehicles, a 29% increase, with Jaguar wholesaling 13,560 vehicles and Land Rover wholesaling 83,257 vehicles in the quarter.

-330

October 06, 2023· 14:47 IST

Sensex Today | Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas

Indian Rupee appreciated slightly as RBI maintained status quo and kept repo rate unchanged at 6.5% in its monetary policy meeting so as to achieve its medium-term target of 4% inflation. According to RBI, Indian economic activity has shown resilience, and the overall macroeconomic indicators remain favourable with strong manufacturing and services PMI numbers. GDP and CPI inflation projections too were maintained. RBI Governor’s statement did not raise major red flags for the Indian economy except for concerns over food price spike due to lower acreage of pulses and El Nino conditions. Further, positive domestic markets and decline in crude oil prices also supported Rupee. US Dollar declined as traders trimmed the positions ahead of the monthly job report today. US weekly unemployment claims was higher than the prior week but lower than consensus.

We expect Rupee to trade with a slight positive bias on positive Asian and European markets and softening of global crude oil prices. Softness in US Dollar may also support Rupee. A no-surprise monetary policy by the RBI may also support the domestic currency. However, FII outflows may cap sharp upside. Traders may take cues from US non-farm payrolls report, average hourly earnings and unemployment rate data. USDINR spot price is expected to trade in a range of Rs 82.80 to Rs 83.70.

-330

October 06, 2023· 14:45 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 15996.65 0.51 | 26.84 -1.16 | 0.47 25.12 |

| NIFTY IT | 32304.85 0.56 | 12.87 1.64 | -0.02 15.67 |

| NIFTY PHARMA | 15128.20 0.71 | 20.09 -1.91 | -1.48 14.71 |

| NIFTY FMCG | 51646.05 0.51 | 16.92 0.08 | -0.80 17.12 |

| NIFTY PSU BANK | 5223.25 0.36 | 20.95 -0.67 | 12.66 72.61 |

| NIFTY METAL | 6747.70 0.58 | 0.36 -1.34 | -3.38 13.27 |

| NIFTY REALTY | 583.40 2.36 | 35.11 1.35 | 2.23 33.46 |

| NIFTY ENERGY | 26777.45 0.33 | 3.51 -1.99 | -0.16 3.53 |

| NIFTY INFRA | 6232.45 0.37 | 18.67 -0.17 | 2.03 24.19 |

| NIFTY MEDIA | 2286.35 -0.03 | 14.77 0.80 | -5.21 6.21 |

-330

October 06, 2023· 14:37 IST

-330

October 06, 2023· 14:32 IST

Stock Market LIVE Updates | RBI monetary policy by Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

The RBI maintained the status quo on policy rates and stance, aligning with the market expectations. The headline CPI projection for FY24 remains unchanged at 5.4%, despite uncertainties around production due to the lower kharif sowing, low reservoir levels, and volatile global food and energy prices. The RBI governor reiterated the intention to bring inflation to a level of 4% on a durable basis. In line with its monetary policy stance, the RBI may need to consider OMO-sales to manage liquidity as necessary.

Given recent inflationary pressures driven by food & vegetable prices in India, the extended tightening measures by global central banks, and the RBI's commitment to lower domestic inflation to 4%, the outlook for interest rates appears cautious in the near term. The possibility of OMO-sales to manage liquidity may pose short-term pressure on interest rates. We believe that the RBI's future actions will depend on evolving data, and we continue to expect a long pause.”

-330

October 06, 2023· 14:29 IST

-330

October 06, 2023· 14:25 IST

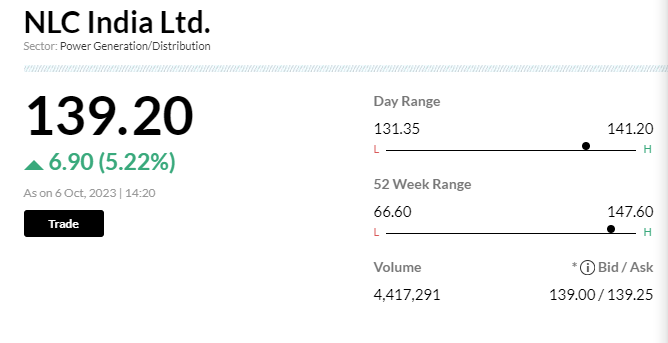

Stock Market LIVE Updates | NLC India gains over 5% after approving new unit for renewable power ops

Shares of NLC India surged over 5 percent amid higher volumes. The stock informed exchanges that it approved a new unit for renewable power energy business.

-330

October 06, 2023· 14:19 IST

-330

October 06, 2023· 14:13 IST

Stock Market LIVE Updates | Morgan Stanley View On Godrej Consumer Products

-Overweight, target price Rs 1,072 per share

-India's Q2 organic volume growth of mid-single digits is lower

-Growth lower than 10-11 percent over the last two quarters

-Management indicated Q2 demand, in general, was affected by weak macro conditions

-Management indicated that Q2 demand was affected by adverse weather

-International, RCCL, margin improvement – on track

-GCPL will register healthy YoY EBITDA margin expansion across markets

-330

October 06, 2023· 14:07 IST

Sensex Today | BSE Smallcap index rose 0.5 percent led by PNB Gilts, Monarch Networth Capital, Quick Heal Technologies

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| PNB Gilts | 90.62 | 18.23 | 1.08m |

| Monarch Net | 403.05 | 17.47 | 82.18k |

| Quick Heal Tech | 323.85 | 13.97 | 209.83k |

| Global Surfaces | 203.90 | 13.53 | 123.42k |

| Kalyan Jeweller | 256.45 | 9.45 | 575.97k |

| Punjab Chemical | 1,204.45 | 9.43 | 3.67k |

| Sasken Tech | 1,311.90 | 8.56 | 15.61k |

| Royal Orchid | 333.45 | 8.42 | 17.18k |

| Paisalo Digital | 68.65 | 8.2 | 425.55k |

| OnMobile Global | 115.65 | 7.98 | 220.47k |

-330

October 06, 2023· 14:03 IST

-330

October 06, 2023· 14:01 IST

Sensex Today | Market at 2 PM

The Sensex was up 395.14 points or 0.60 percent at 66,026.71, and the Nifty was up 116.40 points or 0.60 percent at 19,662.20. About 1951 shares advanced, 1130 shares declined, and 109 shares unchanged.

-330

October 06, 2023· 13:55 IST

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Diamond Power | 45.50 | 2233.33 | 1.95 |

| Softtech Engine | 269.20 | 48.32 | 181.50 |

| Rajshree Polypa | 250.25 | 34.58 | 185.95 |

| Mindteck | 203.50 | 27.67 | 159.40 |

| Ahlada Engineer | 128.05 | 26.03 | 101.60 |

| Sasken Tech | 1,322.25 | 23.55 | 1,070.20 |

| Shera Energy | 162.05 | 23.47 | 131.25 |

| Pioneer | 58.05 | 20.69 | 48.10 |

| Cybertech | 164.45 | 19.69 | 137.40 |

| Kotyark Ind | 816.50 | 19.16 | 685.20 |

-330

October 06, 2023· 13:47 IST

Stock Market LIVE Updates | Nomura View On Tata Motors

-Buy call, target price Rs 786 per share

-JLR Q2 retail volumes up 21 percent YoY, EBIT margin estimate at 7 percent

-JLR expects positive FCF of GBP 300 mn in Q2FY24 (approximately GBP 450 mn in Q1)

-See a strong orderbook & healthy growth of retail demand

-Believe with improved production in H2FY24, JLR is on track to meet estimate

-Estimate is of 4.06 lakh (Ex-China JV) units for FY24

-Stock is currently trading at 4.3x FY25 EV/EBITDA

-330

October 06, 2023· 13:42 IST

Sensex Today | European indices gained on Friday as market participants brace themselves for U.S. jobs data later in the session.

-330

October 06, 2023· 13:38 IST

Sensex Today | Gold pauses declines as investors hold breath for US payrolls report

Gold edged up from seven-month lows on Friday as the U.S. dollar and bond yields, which scaled fresh highs this week, took a breather as investors awaited U.S. non-farm payrolls data that could affect the interest rate outlook.

Spot gold rose 0.1% to $1,820.94 per ounce by 0559 GMT but was on track to extend losses to a second consecutive week, shedding 1.5% so far. U.S. gold futures firmed 0.2% to $1,834.80.

-330

October 06, 2023· 13:33 IST

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| Suzlon Energy | 29.23 -1.55 | 33.18m | 96.57 |

| One 97 Paytm | 925.25 3.25 | 517.73k | 47.89 |

| HDFC Bank | 1,540.00 0.27 | 230.96k | 35.58 |

| Bajaj Finance | 8,069.20 2.8 | 41.35k | 33.08 |

| Zomato | 105.65 0.19 | 3.10m | 32.79 |

| Yes Bank | 17.28 0.64 | 18.77m | 32.51 |

| IOB | 46.17 -1.66 | 6.95m | 32.07 |

| PNB | 77.21 0.13 | 4.11m | 31.73 |

| Infosys | 1,481.00 1.27 | 191.08k | 28.18 |

| Reliance | 2,317.50 0.16 | 115.57k | 26.80 |

-330

October 06, 2023· 13:29 IST

Stock Market LIVE Updates | EaseMyTrip partners with Cover Genius

EaseMyTrip.com announced its strategic partnership with Cover Genius, the insurtech for embedded protection. By integrating with XCover, Cover Genius’ award-winning global distribution platform, EaseMyTrip customers can add Cancel For Any Reason (CFAR) travel protection along with the embedded

comprehensive travel protection when they book their tickets.

-330

October 06, 2023· 13:25 IST

Stock Market LIVE Updates | CLSA On NHPC

-Buy call, target price Rs 63 per share

-Was NHPC hurt by Teesta river floods which breached Teesta 3 project’s dam?

-We do not see any material impact on NHPC

-No impact from the glacial lake outburst flood

-Flood driven flash flood as none of its projects were materially impacted

-NHPC’s Teesta 5 project shut-down during the off-season

-Shut-down project will have seen a minuscule impact

-Project will be fully recovered via its insurance policy

-NHPC is at cornerstone of India net zero

-At cornerstone providing clean-green despatchable green power

-Company growing its return earning equity (Exminority) of 110 percent over CL23-28

-Return earning equity at 14 percent growth over past 5-years

-330

October 06, 2023· 13:19 IST

-330

October 06, 2023· 13:16 IST

Sensex Today | Ajit Kabi, Banking analyst at LKP Securities:

RBI kept the policy rate unchanged at 6.5%. This is the fourth consecutive time the RBI maintained the status quo. Additionally, the retail inflation is projected at 5.4% (unchanged) for FY24. RBI has raised the limit of gold loan given by urban cooperative banks to 4 lakhs from 2 lakhs earlier. To manage liquidity, RBI may enter into OMO sales.

-330

October 06, 2023· 13:10 IST

Stock Market LIVE Updates | Citi View On IT Services:

-EBIT growth required to meet consensus FY24 (H2 Over H1) is 5 percent-78 percent

-Tough ask in a slow growth set up

-Weaker seasonality & with wage hikes pending for a decent part of coverage

-FY25 consensus EBIT estimates also look high due to challenging macro environment

-Some of large deals will likely start ramping up by Q4FY24

-These mega deals are margin dilutive in initial years

-As valuations not cheap historically, earnings trends are still going to be important

-Only Infosys/HCLT are rated neutral; all other stocks are sell rated

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Tech Mahindra | 1,220.20 | 1.21 | 845.83k |

| Infosys | 1,479.55 | 1.1 | 1.75m |

| HCL Tech | 1,248.55 | 1.06 | 1.37m |

| Persistent | 5,770.75 | 0.55 | 106.16k |

| LTIMindtree | 5,250.10 | 0.46 | 80.09k |

| COFORGE LTD. | 5,224.10 | 0.35 | 125.95k |

| Wipro | 407.95 | 0.28 | 1.47m |

| TCS | 3,597.50 | 0.23 | 898.92k |

| L&T Technology | 4,649.00 | 0.2 | 51.97k |

| MphasiS | 2,473.40 | 0.09 | 266.12k |

-330

October 06, 2023· 13:00 IST

Sensex Today | Market at 1 PM

The Sensex was up 316.46 points or 0.48 percent at 65,948.03, and the Nifty was up 91.90 points or 0.47 percent at 19,637.70. About 1914 shares advanced, 1156 shares declined, and 99 shares unchanged.

-330

October 06, 2023· 12:57 IST

-330

October 06, 2023· 12:54 IST

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| PCBL | 193.30 | 193.30 | 193.05 |

| Godrej Ind | 629.00 | 629.00 | 627.40 |

| AstraZeneca | 4710.30 | 4710.30 | 4,700.65 |

| Bajaj Finance | 8095.00 | 8095.00 | 8,085.35 |

| Chalet Hotels | 604.75 | 604.75 | 603.05 |

| Global Health | 758.00 | 758.00 | 745.35 |

| DLF | 544.60 | 544.60 | 527.85 |

| Angel One | 2042.00 | 2042.00 | 1,982.50 |

| Sun TV Network | 639.80 | 639.80 | 631.80 |

| eClerx Services | 2049.95 | 2049.95 | 2,010.00 |

-330

October 06, 2023· 12:51 IST

Stock Market LIVE Updates | Concord Biotech hits 52-week high after Jefferies initiates 'buy' call; sees 19% upside

Shares of Concord Biotech surged 8 percent to hit a 52-week high of Rs 1,177.00 on October 6 after foreign brokerage firm Jefferies initiated 'buy' call on the stock. Jefferies remains bullish on the pharma company and believes its wide portfolio and adequate capacities would drive industry leading revenue growth and operating leverage. On that account, the firm rolled out a price target of Rs 1,260 for the stock, reflecting a 19 percent upside potential from Thursday's closing price. Read More

-330

October 06, 2023· 12:49 IST

Sensex Today | Shishir Baijal, Chairman & Managing Director, Knight Frank India:

We welcome Reserve Bank of India’s (RBI) decision to continue the pause in REPO RATE for the fourth consecutive time. Continuation of pause in the Repo rate was much needed albeit looming inflationary pressure arising from – rising crude prices and rupee depreciation. By pausing the policy rate, the central bank continues to maintain its focus on economic growth, which is facing headwinds primarily from the external factors, such as slowdown in global growth, high energy prices and geopolitical tensions; and remains cautious of inflationary pressure as well.

Measures to reduce excess liquidity and improve transmission of earlier policy rate hike measures align with price stability goals of the central bank. The decision will continue to maintain the existing momentum of residential real estate demand in India. Since the interest rate upcycle, the repo rate has been hiked by 250bps, resulting in 160bps rise in home loan rates. Since then, although the overall housing demand has remained upbeat, the lower housing segment or the affordable housing demand has witnessed a deceleration due to a substantial rise in the borrowing costs and other challenges. The stance today should be considered as a big relief for the housing sector of the country which has shown tremendous strength in the face of headwinds over the last year.

-330

October 06, 2023· 12:47 IST

Stock Market LIVE Updates | Thomas Cook India soars 4% on Crisil rating upgrade

Shares of Thomas Cook India Limited darted up 4 percent to Rs 119 in morning trade on October 6 after the rating agency Crisil upgraded the company's rating to AA-/Stable for the long-term and to CRISIL A1 for the short-term.

The upgrade comes on the back of Thomas Cook’s sharp revival after the pandemic and a significant increase in revenues across segments as it continues to maintain healthy operating margins benefitting cash generation, Crisil said in a statement on October 5. Read More

-330

October 06, 2023· 12:44 IST

Sensex Today | Nifty Auto index rose 0.5 percent supported by Bosch, Bharat Forge, Maruti Suzuki:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bosch | 19,201.35 | 1.43 | 8.79k |

| Bharat Forge | 1,083.50 | 1.28 | 686.11k |

| Maruti Suzuki | 10,297.90 | 0.86 | 175.26k |

| M&M | 1,549.10 | 0.72 | 938.44k |

| Hero Motocorp | 3,038.00 | 0.71 | 90.01k |

| TVS Motor | 1,507.95 | 0.65 | 324.59k |

| MRF | 107,300.20 | 0.5 | 1.71k |

| Bajaj Auto | 5,029.10 | 0.36 | 134.07k |

| Eicher Motors | 3,453.05 | 0.27 | 123.65k |

| Tata Motors | 621.15 | 0.25 | 5.08m |

-330

October 06, 2023· 12:40 IST

Stock Market LIVE Updates | Vinyas Innovative Tech surges over 100% on debut

Vinyas Innovative Technologies Ltd shares debuted at a 100 percent premium to the issue price of Rs 165 on the NSE Emerge platform on October 6 after the initial public offering was subscribed over 43 times.

The stock opened at Rs 330 a share and touched a high of Rs 346. At 11.10 am, the stock was trading at Rs 340 on BSE, up 106 percent from its upper price band of Rs 165.

The engineering, and electronics manufacturing services company raised around Rs54.66 crore via IPO, which opened for subscription on September 27 and closed October 3. The proceeds from the issue will be used for meeting working capital requirements. Read More

-330

October 06, 2023· 12:38 IST

Stock Market LIVE Updates | Tata Motors rises 1% as JLR reports 29% jump in Q2 volumes

Shares of Tata Motors rose 1 percent in trade on October 6, as its wholly owned subsidiary Jaguar Land Rover (JLR) reported 29 percent jump in Q2 volumes.

It was further detailed in the filing that the wholesale volumes were reported at 96,817 cars (excluding the Chery Jaguar Land Rover China JV), up 29 percent from the year-ago quarter, and 4 percent higher from the April-June period, notwithstanding the annual two-week summer plant shutdown. Wholesale volumes for the first half of the financial year were 190,070, up 29 percent from the year-ago period. Read More

-330

October 06, 2023· 12:35 IST

-330

October 06, 2023· 12:32 IST

Sensex Today | Madhavi Arora, Lead Economist, Emkay Global Financial Services:

The RBI reiterated caution and the current policy narrative is still more hinged to inflation uncertainty and liquidity management than on the fluid and uncertain global narrative as markets reprice ‘higher-for-longer’. As global financial conditions transmit with a lag, there could be further volatility ahead. Even as domestic inflation is likely to meet policy targets by end-FY24, elevated DM rates and record-low interest differentials pose a headwind for the RBI. Amid the changing external dynamics, the policy prerogative would ensure financial stability, which may possibly even precede inflation management in coming months.

-330

October 06, 2023· 12:28 IST

Sensex Today | BSE Information Technology index rose nearly 1 percent led by Quick Heal Technologies, Sasken Technologies, Cressanda Solution

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Quick Heal Tech | 312.15 | 9.85 | 131.32k |

| Sasken Tech | 1,283.00 | 6.16 | 10.29k |

| Cressanda Sol | 24.39 | 5.45 | 2.57m |

| Axiscades Tech | 550.10 | 4.99 | 10.39k |

| C. E. Info Syst | 2,226.95 | 4.88 | 11.52k |

| Nucleus Softwar | 1,035.30 | 4.62 | 19.62k |

| Aurionpro Solut | 1,381.85 | 4.54 | 3.83k |

| D-Link India | 329.10 | 2.49 | 13.86k |

| Cigniti Tech | 830.00 | 2.3 | 9.83k |

| Accelya | 1,671.95 | 1.94 | 7.83k |

-330

October 06, 2023· 12:23 IST

Stock Market LIVE Updates | Jefferies View On Bajaj Finance

-Buy call, target price Rs 8,830 per share

-BAF plans to raise equity of Rs 8,800 crore via QIP & Rs 1,200 crore via warrant to Bajaj Finserv

-This is along expected lines, EGM may be end-Oct/ early-November

-Raising is 18 percent of capital

-Warrants will be convertible within 18 months after issue

-Warrants will be convertible with 25 percent being paid-upfront

-Raise is a tad ahead of time (Tier I CAR of 23 percent)

-Raise justified by strong AUM growth (33 percent in Q2)

-Dilution of 2 percent; FY25 EPS & BVPS may rise 6 percent & 13 percent; RoE will fall slightly

-330

October 06, 2023· 12:16 IST

Sensex Today | Apurva Sheth, Head of Market Perspectives & Research, SAMCO Securities:

RBI kept the policy rates unchanged at 6.5%. There weren’t any surprises in the Governors’ statement. Sometimes no news is good news, which is why markets have reacted with a slightly positive bias. However, RBI too is worried about the global macro-economic environment. The global economy is slowing due to tighter monetary conditions. The yields have hardened and US Dollar has appreciated. There are signs that rates may have topped out but they are not going down in a hurry. It remains to be seen how the world adjusts to higher interest rates not seen in the last 22 years. Thus, RBI would like to play their shots carefully on an ever evolving turning pitch globally.

-330

October 06, 2023· 12:04 IST

ALERT | Harish Krishnan joins Aditya Birla Sun Life AMC as Co-CIO and Head Equity from Kotak AMC

-330

October 06, 2023· 12:01 IST

Sensex Today | Market at 12 PM

The Sensex was up 245.08 points or 0.37 percent at 65,876.65, and the Nifty was up 74.90 points or 0.38 percent at 19,620.70. About 1891 shares advanced, 1141 shares declined, and 92 shares unchanged.

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 19621.10 0.39 | 8.37 -0.09 | 0.05 13.21 |

| NIFTY BANK | 44277.05 0.14 | 3.00 -0.69 | -0.30 12.71 |

| NIFTY Midcap 100 | 40191.00 0.36 | 27.55 -0.85 | -0.23 27.66 |

| NIFTY Smallcap 100 | 12800.10 0.51 | 31.54 0.40 | 0.99 32.46 |

| NIFTY NEXT 50 | 44820.05 0.34 | 6.24 -0.48 | -1.51 4.92 |

-330

October 06, 2023· 11:55 IST

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| HDFC Bank | 1,539.50 0.24 | 4.77m | 734.29 |

| Suzlon Energy | 29.20 -1.02 | 198.56m | 577.43 |

| MCX India | 2,032.00 4.25 | 2.47m | 497.60 |

| Bajaj Finance | 7,960.00 1.39 | 624.03k | 495.94 |

| One 97 Paytm | 923.50 3.17 | 5.03m | 465.22 |

| Zomato | 105.60 0.19 | 40.29m | 426.74 |

| Bajaj Finserv | 1,595.45 3.43 | 2.64m | 418.78 |

| Interglobe Avi | 2,533.70 2.44 | 1.36m | 345.37 |

| PNB | 77.00 -0.13 | 44.37m | 342.83 |

| BSE Limited | 1,400.00 5.57 | 2.25m | 312.07 |

-330

October 06, 2023· 11:48 IST

-330

October 06, 2023· 11:39 IST

Sensex Today| Umesh Kumar Mehta, Chief Investment Officer, SAMCO Mutual Fund:

Equities may have to compete with Bonds in Short Run: It is indeed a turning pitch as far as inflation is concerned for RBI but on the other side global market forces are scaring all the central bankers on higher bond yields, which are getting stronger by the day. The current pause wouldn’t last long, for that matter, for any central banks. The rates are likely to move higher before the actual pivot happening sometimes in middle of the next year. So, Equities will have serious competition from bonds going forward.

-330

October 06, 2023· 11:37 IST

Sensex Today| Dinesh Kumar Khara's term as SBI chairman extended till he attains age of 63

-330

October 06, 2023· 11:31 IST

Sensex Today | Raghvendra Nath, Managing Director, Ladderup Wealth Management:

In order to maintain the nation's strong growth rate, RBI was anticipated to leave the repo unchanged. Given the growing oil prices and the current global difficulties, the central bank has little reason to become more dovish at this point. The high interest rates are here to stay for quite some time before we see any changes being announced by the central banks.

-330

October 06, 2023· 11:27 IST

Sensex Today | Santosh Meena, Head of Research, Swastika Investmart:

The RBI's decision to maintain the status quo in its policy has been received positively by the market, despite growing concerns about rising inflation on a global scale. Nevertheless, the impact of this decision is expected to be limited, as the market's attention is anticipated to shift towards global market dynamics, notably the dollar index and US bond yields. Technically speaking, Nifty has managed to surpass the 50-day moving average (DMA), suggesting potential for a further recovery towards the 20-DMA level of 19,800. However, a significant bullish momentum is projected to materialize only upon breaching the 19,800 mark.

-330

October 06, 2023· 11:13 IST

Sensex Today | BSE Midcap index up 0.5 percent supported by Godrej Industries, Mahindra & Mahindra Financial Services, New India Assurance Company

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Godrej Ind | 616.60 | 2.68 | 24.75k |

| M&M Financial | 292.25 | 2.26 | 50.43k |

| New India Assur | 139.65 | 2.12 | 15.17k |

| Piramal Enter | 1,079.10 | 2.1 | 18.81k |

| Canara Bank | 378.00 | 1.87 | 127.65k |

| 3M India | 31,421.00 | 1.84 | 13 |

| Bharat Forge | 1,088.05 | 1.71 | 18.88k |

| REC | 283.90 | 1.65 | 244.05k |

| Castrol | 138.70 | 1.54 | 92.73k |

| Solar Ind | 5,050.00 | 1.54 | 1.59k |

-330

October 06, 2023· 11:10 IST

Sensex Today | Nish Bhatt, Founder & CEO, Millwood Kane International:

The RBI has kept interest rates on hold for the fourth time in a row, which is a prudent move given inflationary trends largely driven by food prices. The economic activities remain resilient so far, however, headwinds from weak global demand, volatility in the global financial markets, and uneven monsoon, pose risks to the future outlook.

Though, we can expect a rate-lowering cycle likely from H2CY24, depending on macroeconomics stability and no global shocks.

-330

October 06, 2023· 11:08 IST

Stock Market LIVE Updates | RailTel Corporation of India bags order worth Rs 68 crore from Jammu Smart City

RailTel Corporation of India has received the work order from Jammu Smart City Limited for design, supply, installation, testing, commissioning and operations and maintenance of data centre and disaster rRecovery centre for Integrated Command and Control Centre (ICCC) for Jammu Smart City

Limited amounting to Rs 67.95 crore (including GST).

-330

October 06, 2023· 11:01 IST

Sensex Today | Market at 11 AM

The Sensex was up 353.37 points or 0.54 percent at 65,984.94, and the Nifty was up 106.90 points or 0.55 percent at 19,652.70. About 2035 shares advanced, 909 shares declined, and 105 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bajaj Finserv | 1,586.75 | 2.87 | 52.60k |

| Titan Company | 3,272.45 | 1.77 | 11.38k |

| ITC | 443.45 | 1.71 | 163.72k |

| Bajaj Finance | 7,968.75 | 1.52 | 20.97k |

| IndusInd Bank | 1,419.35 | 1.28 | 15.39k |

| JSW Steel | 764.25 | 1.13 | 57.68k |

| Sun Pharma | 1,130.80 | 0.97 | 18.56k |

| SBI | 597.65 | 0.91 | 229.91k |

| NTPC | 236.00 | 0.9 | 157.76k |

| HCL Tech | 1,246.20 | 0.83 | 33.26k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| HUL | 2,508.85 | -0.53 | 22.41k |

| Power Grid Corp | 196.20 | -0.15 | 162.59k |

| Bharti Airtel | 927.35 | -0.15 | 30.38k |

-330

October 06, 2023· 10:58 IST

Stock Market LIVE Updates | Ujjivan Small Finance Bank hits 52-week high on robust Q2 update

Ujjivan Small Finance Bank surged more than 6 percent in the early trade to hit a fresh 52-week high of Rs 60.40 on October 6 after a robust quarterly update marked by strong loan growth and improved asset quality.

The lender's total deposits grew 43 percent on year to Rs 29,134 crore in the July-September quarter, while sequentially, they were up 9 percent. Advances also rose 27 percent on year and 5 percent on quarter to Rs 26,600 crore.

Disbursements were up 18 percent year on year (YoY) at Rs 5,749 crore in the quarter gone by. On a sequential basis, they rose 9 percent. Read More

-330

October 06, 2023· 10:54 IST

Sensex Today | Suvodeep Rakshit, Senior Economist, Kotak Institutional Equities:

The RBI’s decision to pause along with retaining the withdrawal of accommodation stance was in line with expectations. Importantly, the RBI has explicitly highlighted the need to use OMO sales to modulate liquidity. This will weigh down bond markets’ sentiments. Concerns on food inflation were highlighted which can impart upside to headline inflation. We believe that inflation risks remain on the upside given weather related impact as well as commodity prices. Global monetary conditions will also weigh on RBI’s policy decisions. The good part is that growth remains resilient and core inflation remains under check. We maintain our call for a prolonged pause on repo rate at 6.5% well into FY2025 while liquidity over the medium term will be aimed at being close to neutral.

-330

October 06, 2023· 10:50 IST

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Strides Pharma | 500.85 -1.62% | 2.45m 29,165.20 | 8,294.00 |

| Lambodhara Text | 183.00 6.99% | 41.24k 1,327.80 | 3,006.00 |

| APTUS VALUE | 292.85 -0.85% | 820.40k 40,135.00 | 1,944.00 |

| Source Natural | 88.00 -1.12% | 15.60k 1,000.80 | 1,459.00 |

| Xtglobal | 46.53 19.65% | 1.28m 83,325.00 | 1,430.00 |

| Alkali Metals | 116.00 4.08% | 21.48k 1,508.40 | 1,324.00 |

| Rasi Electrodes | 21.85 13.86% | 429.89k 47,644.80 | 802.00 |

| AKI India | 13.07 4.98% | 82.39k 10,571.60 | 679.00 |

| PNB Gilts | 88.17 15.03% | 561.37k 71,887.60 | 681.00 |

| Ashok Alco-Chem | 166.80 20% | 143.01k 19,114.40 | 648.00 |

-330

October 06, 2023· 10:47 IST

Sensex Today | Vinod Nair, Head of Research at Geojit Financial Services:

On a positive note, interest rates haven't increased as anticipated, however they are expected to remain elevated for an extended period. This will have an implication on rate-sensitive sectors like banking, auto, core industries, and heavy-weighted balance sheet companies. The elevated global bond yields and appreciation of the US dollar will affect the domestic economy and capital flows. However, it should not have a deep overhang effect on the economy but rather a mixed bias in the short term. The inclusion of government securities in the global bond index and moderation in inflation, like food & international commodity prices, will support INR and domestic corporate profit even in a volatile global currency market.

-330

October 06, 2023· 10:42 IST

Sensex Today | RBI may consider OMO sales of G-Sec to manage liquidity

RBI may consider OMO sales of government securities to manage liquidity consistent with the stance of monetary policy. The timing and quantum of such operations will depend on prevailing liquidity conditions.

-330

October 06, 2023· 10:41 IST

Sensex Today | BSE Auto index gained 0.5 percent led by UNO Minda, Apollo Tyres, TVS Motor

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| UNO Minda | 601.05 | 1.52 | 1.60k |

| Apollo Tyres | 378.00 | 1.33 | 76.30k |

| TVS Motor | 1,513.15 | 1.03 | 1.76k |

| MRF | 107,794.80 | 0.98 | 65 |

| Maruti Suzuki | 10,312.15 | 0.92 | 2.83k |

| Bosch | 19,045.85 | 0.64 | 155 |

| Tata Motors | 623.40 | 0.62 | 141.37k |

| Cummins | 1,700.80 | 0.6 | 911 |

| Bajaj Auto | 5,026.55 | 0.52 | 3.75k |

| Hero Motocorp | 3,030.20 | 0.51 | 1.20k |

-330

October 06, 2023· 10:39 IST

-330

October 06, 2023· 10:35 IST

Sensex Tdoay | Shantanu Bhargava, Managing Director, Head of Discretionary Investment Services, Waterfield Advisors:

The RBI had overlooked data in the early aftermath of COVID since the aim was to stimulate the economy & engineer a turn-around. Since changing its stance last year, the RBI has been data driven. According to the RBI's inflation prediction for Q3 & this FY, today's policy outcome is not surprising. We expect the RBI to retain the status quo unless we see a durable drop in inflation and if steady economic activity continues.

-330

October 06, 2023· 10:33 IST

Stock Market LIVE Updates | Hindalco gains on inking MoU for bauxite supply for proposed Odisha plant

Hindalco Industries traded higher on October 6 morning trade after the aluminium producer announced signing a memorandum of understanding with the state-owned Odisha Mining Corporation (OMC). The move would ensure a long-term supply of bauxite ore to its proposed alumina refinery at Kansariguda in Rayagada district of the eastern state. Read More

-330

October 06, 2023· 10:28 IST

Stock Market LIVE Updates | Som Distilleries fixes QIP floor price, stock down 3%

The Som Distilleries stock opened 3 percent lower on October 6, a day after the board of the alcoholic beverage maker approved a floor price of Rs 350 a share for a QIP.

The board of Som Distilleries authorised the opening of the Issue as of October 5, 2023 and approved the floor price of Rs 349.24 a share, the company told exchanges.

A meeting of the committee of the company would be held on October 10, 2023 to "consider and determine the issue price of equity shares, including a discount". Read More

-330

October 06, 2023· 10:25 IST

Sensex Today | Himanshu Panchmatiya - Cofounder Switch My Loan:

With no changes in Repo rate & CRR, we expect the lending portfolios to go this quarter as festive season is round the corner. Segments like Consumer Durable Loans, Car Loans, Personal Loans & fresh Home Loans is expected to do well in this quarter. We foresee the rates to remain unchanged for next quarter too seeing the Global economy market & elections in India. RBI may try to squeeze liquidity in other form and wouldn’t touch the CRR.

-330

October 06, 2023· 10:22 IST

Stock Market LIVE Updates | KPI Green Energy shares up 2% on bagging 12.10 MW solar power projects

KPI Green Energy share price rose 2 percent in early trade on October 5 after the company received new orders for executing solar power projects. At 09:18 hrs KPI Green Energy was quoting at Rs 907.85, up Rs 23.70, or 2.68 percent, on the BSE. The company has received orders aggregating to 12.10 MW for executing solar power projects, out of which 3.10 MW capacity will be undertaken by KPI Green Energy and 9 MW capacity by its wholly owned subsidiary, M/s. Sun Drops Energia Private Limited, under the Captive Power Producer (CPP) Segment.

The projects are scheduled to be completed in the financial year 2023-24, in various tranches as per the terms of the order. Read More

-330

October 06, 2023· 10:17 IST

Stock Market LIVE Updates | Mankind Pharma down as Sikkim floods disrupt operations

Shares of Mankind Pharma were trading 1.4 percent lower on BSE on October 6 morning after the company told exchanges about disruption of operations at its manufacturing facilities in Sikkim due to flash floods.

In the past three months, the stock of the drug company has risen more than 2 percent against a 0.3 percent decline in the Sensex. Read More

-330

October 06, 2023· 10:15 IST

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Panyam Cements | 13.09 | 73.38 | 7.55 |

| Panyam Cements | 13.09 | 73.38 | 7.55 |

| Natura Hue | 12.44 | 72.78 | 7.20 |

| Natural Biocon | 14.91 | 61.36 | 9.24 |

| Lime Chemicals | 36.93 | 58.29 | 23.33 |

| Softtech Engine | 282.95 | 55.47 | 182.00 |

| PRO CLB GLOBAL | 11.30 | 54.79 | 7.30 |

| Piccadilly Agro | 208.20 | 50.98 | 137.90 |

| Tarini Int | 11.83 | 44.98 | 8.16 |

| Bharat Bhushan | 40.75 | 41.15 | 28.87 |

-330

October 06, 2023· 10:09 IST

Sensex Today | Valiant Laboratories lists at Rs 162, a 16% premium to IPO price

Shares of Valiant Laboratories on October 6 listed at a premium of 15.8 percent over its issue price of Rs 140. The stock debuted at Rs 162.15 on the NSE and Rs 161 on the BSE. The listing was in-line with analyst expectations and the decent subscription numbers seen by the IPO.

The Rs 152 crore-issue was subscribed 29.76 times with investors buying 22.68 crore shares against the offer size of 76.23 lakh. High net worth individuals bought 73.64 times their quota of shares and retail investors 16.06 times the shares allotted to them. Read More

-330

October 06, 2023· 10:07 IST

Stock Market LIVE Updates | IndiGo soars 4% as fuel charge to offset rising ATF prices kicks in

Shares of Interglobe Aviation Limited, which operates IndiGo, were up 4 percent at Rs 2,569 in the early trade on October 6 after the budget carrier announced a fuel charge on domestic and international routes, effective October 6, offset rising ATF prices.

The move comes as the aviation turbine fuel (ATF) price have soared in the last three months with consecutive hikes every month, India's biggest airline said in a statement on October 5.

On October 1, the government increased jet fuel price by 5 percent, the fourth straight monthly increase since July. Read More

-330

October 06, 2023· 10:05 IST

RBI Governor Shaktikanta Das | MPC voted to remain focused on withdrawal of accommodation by 5 votes to 1

-330

October 06, 2023· 10:05 IST

RBI Governor Shaktikanta Das | Standing Deposit Facility and Marginal Standing Facility rates also left unchanged at 6.25 percent and 6.75 percent, respectively

-330

October 06, 2023· 10:04 IST

JUST IN | Reserve Bank of India (RBI) Governor kept policy rate unchanged at 6.5 percent

-330

October 06, 2023· 10:01 IST

Sensex Today | Market at 10 AM

The Sensex was up 156.91 points or 0.24 percent at 65,788.48, and the Nifty was up 54.00 points or 0.28 percent at 19,599.80. About 1926 shares advanced, 865 shares declined, and 104 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bajaj Finserv | 1,579.40 | 2.39 | 1.11m |

| Dr Reddys Labs | 5,478.50 | 1.32 | 65.78k |

| ITC | 441.70 | 1.3 | 2.15m |

| TATA Cons. Prod | 870.90 | 1.24 | 244.26k |

| Titan Company | 3,248.95 | 1.01 | 203.36k |

| Bajaj Finance | 7,930.00 | 1.01 | 361.26k |

| Maruti Suzuki | 10,310.50 | 0.98 | 56.77k |

| Cipla | 1,171.05 | 0.86 | 264.92k |

| Sun Pharma | 1,127.90 | 0.79 | 169.84k |

| Adani Ports | 831.65 | 0.78 | 484.18k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Power Grid Corp | 195.05 | -0.79 | 2.10m |

| HUL | 2,503.15 | -0.65 | 102.48k |

| Larsen | 3,080.65 | -0.5 | 381.36k |

| ONGC | 181.45 | -0.41 | 900.57k |

| Bharti Airtel | 925.10 | -0.4 | 179.90k |

| Asian Paints | 3,200.95 | -0.17 | 136.51k |

| Axis Bank | 1,001.70 | -0.15 | 723.91k |

| Britannia | 4,529.35 | -0.1 | 27.16k |

-330

October 06, 2023· 09:58 IST

Stock Market LIVE Updates | Adani Wilmar shares gain 1%; reports strong double-digit volume growth in Q2

Shares of Adani Wilmar rose 1 percent in early trade on October 6. In its Q2 business update, Adani Wilmar reported strong double-digit volume growth as rural sales have seen an uptick. However, in spite of growing volume, the value of sales declined on a year-on-year (YoY) basis. For the second fiscal quarter in FY24, Adani Wilmar's edible oil segment saw a 5 percent volume growth YoY, but the value growth slipped 19 percent. In Q2, the segment contributed around 74 percent to the company’s standalone revenue. Read More

-330

October 06, 2023· 09:55 IST

Force Motors Business Update | Total sales up 13.1% at 2,973 units against 2,628 units, YoY.

-330

October 06, 2023· 09:54 IST

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| RBM Infracon | 177.75 4.99% | 240.00k 15,000.00 | 1,500.00 |

| Lambodhara Text | 187.35 9.66% | 307.62k 29,509.60 | 942.00 |

| Pioneer | 56.25 8.8% | 311.65k 44,189.20 | 605.00 |

| PNB Gilts | 86.60 12.76% | 8.65m 1,359,060.20 | 536.00 |

| Shradha Infra | 54.90 13.55% | 379.02k 82,521.40 | 359.00 |

| Kirl Electric | 125.30 3.94% | 3.02m 661,744.80 | 357.00 |

| AXISBPSETF | 11.21 0% | 58.64k 14,781.60 | 297.00 |

| Electronics Mar | 150.45 4.99% | 2.32m 656,566.80 | 254.00 |

| Crown Lifters | 69.00 3.84% | 91.65k 25,647.00 | 257.00 |

| Royal Orchid | 331.00 7.48% | 303.74k 86,887.20 | 250.00 |

-330

October 06, 2023· 09:48 IST

Sensex Today | Vinyas Innovative Technologies to debut on the NSE Emerge on October 6

The engineering, and electronics manufacturing services company will make its debut on the NSE Emerge on October 6. The offer price is Rs 165 per share. Its equity shares will be available for trading in the trade-for-trade segment.

-330

October 06, 2023· 09:46 IST

Sensex Today | Organic Recycling Systems to list shares on the BSE SME on October 6

The waste management solutions company will list its equity shares on the BSE SME on October 6. The issue price is at Rs 200 per share. The shares will be available for trading in trade-for-trade segment for next 10 days.

-330

October 06, 2023· 09:45 IST

Sensex Today | Nifty Bank index up 0.2 percent led by IndusInd Bank, Bank of Baroda, AU Small Finance Bank

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IndusInd Bank | 1,411.70 | 0.7 | 141.75k |

| Bank of Baroda | 213.65 | 0.52 | 1.27m |

| AU Small Financ | 716.90 | 0.35 | 83.29k |

| SBI | 594.20 | 0.35 | 863.42k |

| Kotak Mahindra | 1,740.00 | 0.33 | 193.17k |

| HDFC Bank | 1,540.00 | 0.28 | 1.01m |

| Bandhan Bank | 249.90 | 0.26 | 1.10m |

| ICICI Bank | 941.95 | 0.12 | 681.36k |

-330

October 06, 2023· 09:44 IST

Sensex Today | BSE Realty index up 1 percent led by Oberoi Realty, Prestige Estate, Phoenix Mills

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Oberoi Realty | 1,105.80 | 1.34 | 3.20k |

| Prestige Estate | 680.20 | 1.32 | 15.35k |

| Phoenix Mills | 1,794.55 | 1.23 | 3.34k |

| Sobha | 717.05 | 1.19 | 32.07k |

| Mahindra Life | 543.85 | 1.16 | 1.84k |

| Godrej Prop | 1,617.70 | 1.07 | 3.86k |

| DLF | 530.00 | 0.97 | 5.97k |

| Macrotech Dev | 755.65 | 0.88 | 9.36k |

| Brigade Ent | 583.70 | 0.54 | 1.01k |

-330

October 06, 2023· 09:43 IST

Stock Market LIVE Updates | Lupin shares gain on tentative USFDA nod for Tolvaptan tablets

Lupin share price gained nearly a percent in the early trade on October 6 after the company received tentative approval from the United States Food and Drug Administration (USFDA) for its Abbreviated New Drug Application for Tolvaptan Tablets, 15 mg, 30 mg, 45 mg, 60 mg, and 90 mg to market a generic equivalent of Jynarque tablets of Otsuka Pharmaceutical Co., Ltd.

This product will be manufactured at Lupin’s Nagpur facility in India.

-330

October 06, 2023· 09:40 IST

Strides Pharma Science Large Trade | 13.75 lakh shares (1.5 percent equity) worth Rs 69.1 crore change hands at an average of Rs 502 per share, reported CNBC-TV18.

-330

October 06, 2023· 09:39 IST

-330

October 06, 2023· 09:37 IST

Stock Market LIVE Updates | BHEL gets favourable orders

Bharat Heavy Electricals Ltd. (BHEL) said it has has received two awards in arbitration proceedings against Jaiprakash Power Ventures Limited in two separate cases.

-330

October 06, 2023· 09:35 IST

Sensex Today | V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

The important event of today, the MPC’s monetary policy, is unlikely to impact the markets since no changes are expected in policy rates or stance. From the market perspective, the more important thing will be the US jobs data expected tonight. If the jobs data comes strong the market will react negatively discounting a rate hike by the Fed in the coming policy meeting. On the other hand, if the jobs data is weak, the market will rally discounting a pause by the Fed.

Expected Q2 results will influence stock prices in the coming days. Financials, particularly banking, automobiles, hotels, real estate, cement and capital goods will do well. A possible surprise may come from IT in the form of higher order bookings. Even if the results are expectedly poor, the stocks may rebound on the back of better orders and commentary.