November 15, 2022 / 16:27 IST

Ajit Mishra, VP - Research, Religare Broking

Markets gained nearly half a percent in a volatile trading session, in continuation of the prevailing trend. The Nifty index traded lackluster for most of the session however a sharp surge in the last half an hour pushed the index to the day’s high. It finally settled at 18,403.40; up by 0.4%.

Most of the sectoral indices traded in tandem with the benchmark and ended with modest gains however the underperformance continued on the broader front.

Participants are maintaining a cautious stance around the record high which is reflecting in the market move. However, selective buying in the index majors on a rotational basis is helping the index to hold gains and gradually inch higher as well. We thus maintain our view to continue to follow the up trend until Nifty holds 17,800 and look for buying opportunities on dips.

November 15, 2022 / 16:26 IST

Rupak De, Senior Technical Analyst at LKP Securities:

The headline index Nifty remained volatile during the session. On the lower end, 18300 acted as support on a sustained basis, whereas on the higher end, the index moved above 18400.

The trend remains positive for the short term, as the index closed above the 50 EMA. On the higher end, resistance is placed at 18500/18600. Support on the lower end is pegged at 18250-18300 zone.

November 15, 2022 / 16:17 IST

Narendra Solanki - Head Fundamental Research- Investment Services, Anand Rathi Shares & Stock Brokers.

Indian markets opened on positive note following positive overall Asian markets. However, the markets couldn't sustain the gains post morning session. During the afternoon session the markets traded volatile with weakness in Metal and Capital Goods shares dragged key gauges lower, while buying in Auto and Telecom stocks helped markets to trade near neutral lines.

Traders were cautious after India’s exports dip to USD 29.78 billion in October 2022 from USD 35.73 billion a year ago. Besides, trade deficit widened to USD 26.91 billion as against USD 17.91 billion a year ago.

During the closing session, some support also came from financial stocks which helped in markets to firmly trade in green.

November 15, 2022 / 16:16 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

Rally gathered pace towards the closing hours after trading range-bound for a major part of the trading session. Majority of the European and Asian indices logged gains, which had a rub-off effect on the local benchmarks. Sharp fall in the crude oil prices and the strengthening rupee against the dollar boosted investors' confidence.

With domestic inflation showing signs of cooling, traders are hoping that the RBI in next month's policy meeting may take a dovish stance in its rate setting decision.

For the trend following traders, 18300 would be the sacrosanct support level. Above which, the index could rally till 18500-18600. On the flip side, if the index trades below 18300, the chances of hitting 18230-18200 would turn bright.

November 15, 2022 / 16:02 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty continued with the brief consolidation in the first half of the session on November 15. Towards the end of the session the bulls took control & pushed the index higher. As a result, the Nifty managed to hold on to the support zone of 18300-18200.

On the higher side, the index has once again reached the rising trendline drawn from the previous key swing highs on the hourly chart. Going ahead, 18500 will be the key level to keep a tab on.

The recent up move in Nifty is not yet reflected in the broader market; the midcap & small cap indices are still in short term consolidation.

November 15, 2022 / 15:32 IST

Rupee Close:

Indian rupee closed 16 paise higher at 81.10 per dollar versus previous close of 81.26.

November 15, 2022 / 15:30 IST

Market Close:

Indian benchmark indices ended higher in the highly volatile session on November 15 with Nifty above 18400.

At Close, the Sensex was up 248.84 points or 0.40% at 61,872.99, and the Nifty was up 74.20 points or 0.40% at 18,403.40. About 1582 shares have advanced, 1814 shares declined, and 120 shares are unchanged.

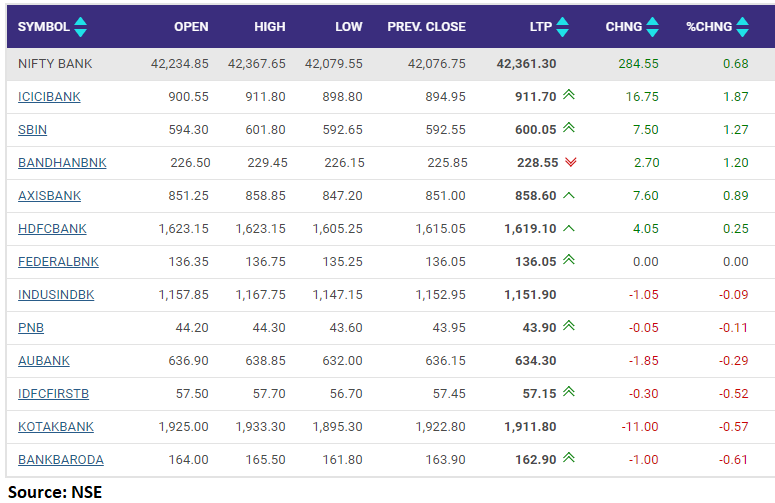

Power Grid Corporation, ONGC, ICICI Bank, Bharti Airtel and Dr Reddy's Laboratories were among the top Nifty gainers, while the biggest losers were Coal India, HDFC Life, Grasim Industries, Cipla and Bajaj Finserv.

On the sectoral front, auto, oil & gas, bank up 0.5-1 percent.

Broader indices underperformed the main indices with midcap and smallcap indices ended on flat note.

November 15, 2022 / 15:25 IST

Nomura keeps neutral rating on Bharat Heavy Electricals, target Rs 79

-Kept neutral call, target raised to Rs 79 per share

-Execution disappoints, but thermal orders rising

-Tendering momentum & working capital moderation key triggers

-Bidding strategy appears aggressive

-Cut EPS estimates by 30%/13% for FY24/25, reported CNBC-TV18.

Bharat Heavy Electricals was quoting at Rs 70.30, down Rs 1.25, or 1.75 percent.

November 15, 2022 / 15:22 IST

LTIMindtree’s $5 billion revenue target too optimistic: Jefferies

The $5 billion revenue target set for LTIMindtree, the new entity formed by the merger of Larsen and Toubro Infotech and Mindtree, is “optimistic,” investment bank Jefferies said.

Brokerages expect some uncertainty before LTIMindtree, which started operatingas a single entity from November 14, reorganises its strategy and reappraises priorities. Read more

November 15, 2022 / 15:19 IST

USFDA issues no observations for biologics facility of Syngene International

The US Food and Drug Administration (FDA) has conducted its pre-approval inspection of Syngene International's biologics facility at Bangalore from November 07, 2022 till November 15, 2022. The inspection was completed successfully without 483 observations.

Syngene International was quoting at Rs 625.00, up Rs 2.55, or 0.41 percent on the BSE.

November 15, 2022 / 15:19 IST

Jefferies on Grasim:

- Maintain BUY, target price at Rs 1,709

-Grasim's capex is slated to increase sharply over next 18-24 months as company march on to new (B2C) businesses

-Cut FY23-FY25 Ebitda estimates by 4-7 percent, while maintaining BUY

November 15, 2022 / 15:17 IST

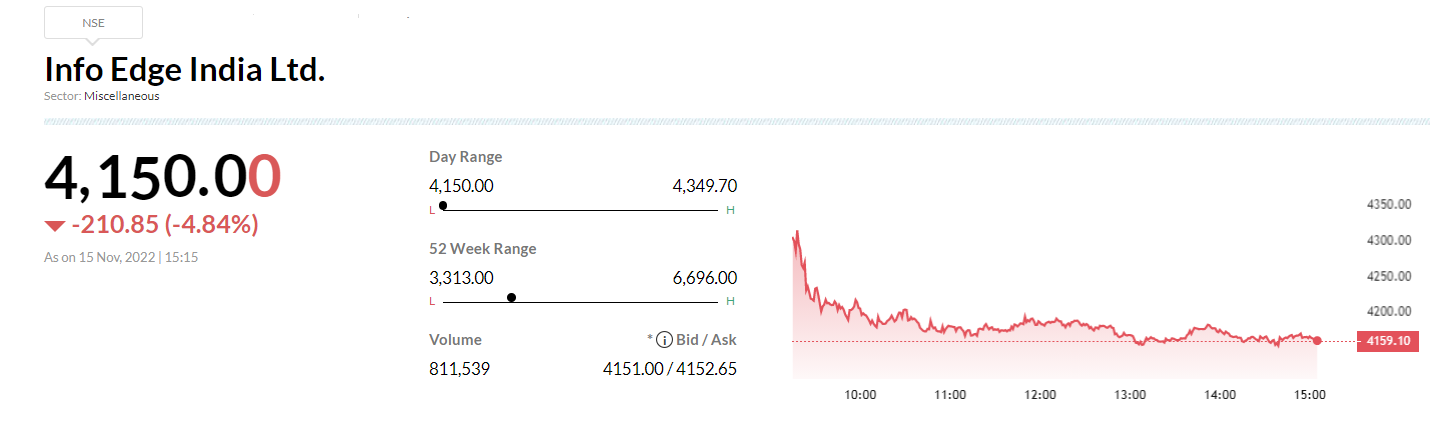

Nomura keeps buy rating on Info Edge, target at Rs 5,020 per share

-Kept buy call, target at Rs 5,020 per share

-Recruitment vertical: strong quarter despite IT hiring slowdown

-Real estate: high marketing costs continue to weigh on profitability

-Retain calibrated approach on investments in core biz & start-up ecosystem

-Raise EPS estimates by 3-4%, reported CNBC-TV18.

November 15, 2022 / 15:14 IST

Nifty Bank index hits record high led by the ICICI Bank, SBI, Bandhan Bank