Taking Stock: Market Falls For Second Straight Session As Fed Signals Rate Hike By 2023

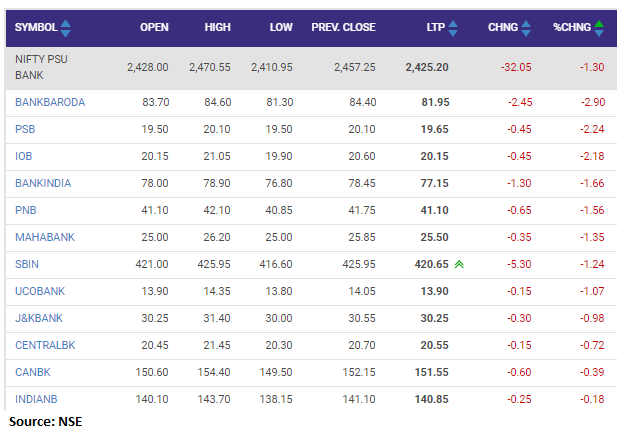

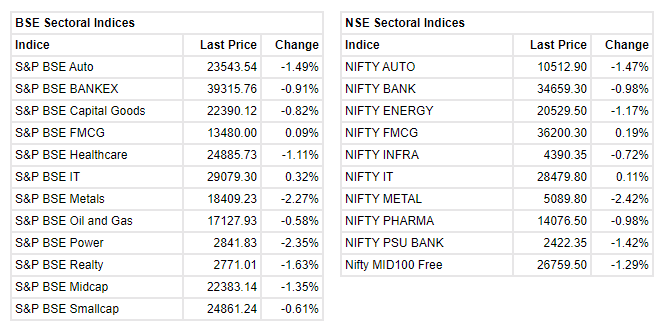

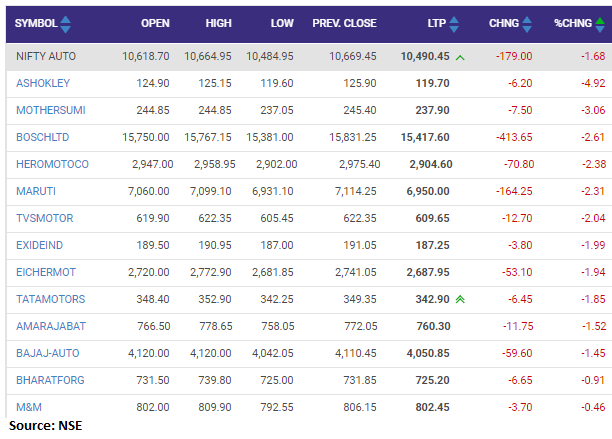

Except IT and FMCG, all other indices ended in the red with the metal index falling more than 2 percent. BSE midcap and smallcap indices shed 0.5-1.3 percent.... Read More