July 19, 2022 / 16:27 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Bulls continued positive momentum third day in a row, the Nifty ends 62 points higher while the Sensex was up by 246 points. Among Sectors, strong buying was seen in Reality and Banking stocks. Amid sectoral indices, Realty was the top gainer rallied nearly 2.5 percent.

Technically, the Nifty/Sensex not only cleared the short term resistance of 16300/54500 but it succeeds to close above the same which is broadly positive. In addition, it also holding higher bottom formation and on daily charts it has formed long bullish candle.

The short term trading setup is indicating further uptrend from the current levels. For the traders now 16250/54300 would be the trend decider level. Above which the index could move till 16400-16450/55000-55200. On the flip side, below 16250/54300 the index could slip up to 16150/54000.

July 19, 2022 / 16:10 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets extended gains and rose nearly half a percent amid mixed cues. Initially, weak global cues were weighing on the sentiment however surge in select index majors especially from the banking space gradually pushed the index higher. Consequently, the Nifty closed near day’s high at 16,340.5 levels, up by 0.4%.

On the sector front, a mixed trend was seen wherein realty, auto and PSU banks were top gainers while IT, pharma and FMCG were the top losers. Meanwhile, the broader indices outperformed and ended higher in the range of 0.7-1.1%.

Markets are taking comfort from global indices and buoyancy in the banking pack, which holds considerable weight, further adding to the positivity. The recent bounce in laggards like IT and metal has further eased the pressure. We maintain our positive yet cautious stance and prefer sectors like auto, FMCG and banking for long opportunities.

July 19, 2022 / 16:07 IST

Rupak De, Senior Technical Analyst at LKP Securities:

Nifty remained strong during the session as it moved above the previous swing high on the daily timeframe. A higher top higher bottom formation is visible on the daily timeframe. Besides, the Nifty has sustained above its major moving average suggesting a bullish trend.

Over the short term, the index may remain positive as long as it sustains above 16100 with a potential to reach 16450-16500 over the short term.

July 19, 2022 / 16:03 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Domestic indices witnessed bouts of volatility amid weakness in global markets, IT and Pharma sectors. But it was well countered by recovery in banking, auto and metal stocks.

Developed markets traded negatively due to slow hiring plans announced by blue chips MNC like Apple Inc. in anticipation of global economic slowdown.

However, due to the Indian economy’s strong fundamentals, we believe that the immediate impact of the slowdown in the domestic economy will be milder than of global peers.

July 19, 2022 / 15:56 IST

Kunal Shah, Senior Technical Analyst at LKP Securities:

The Bank Nifty index continued its strong buying momentum and remains in a buy mode with immediate support at the 35,400 level. The index is likely to test the level of 36,200 on the upside where it faces resistance at the previous high level. The option front immediate resistance stands at 36,000 where the highest open interest is built up on the call side.

July 19, 2022 / 15:55 IST

Jateen Trivedi, VP Research Analyst at LKP Securities:

Rupee traded neutral to range bound between 79.85-80.05 as the dollar index stayed in muted trading sessions. Also capital markets showed positive performance which helped the rupee stay in range bound session as in morning opening trade rupee touched fresh low's of 80.05 but took support there after an inch higher towards 79.85.

The Rupee range can be seen between 79.70-80.25 going ahead.

July 19, 2022 / 15:40 IST

Rupee Close:

Indian rupee ended marginally higher at 79.94 per dollar against Monday's 79.97.

July 19, 2022 / 15:36 IST

Market Close:

Benchmark indices extended the rally on July 19 with Nifty closing above 16300.

At close, the Sensex was up 246.47 points or 0.45% at 54,767.62, and the Nifty was up 62 points or 0.38% at 16,340.50. About 1961 shares have advanced, 1260 shares declined, and 143 shares are unchanged.

Axis Bank, M&M, IndusInd Bank, UltraTech Cement and Apollo Hospitals were among the top Nifty gainers, while losers included ONGC, Nestle India, HDFC Life, HCL Technologies and Tata Consumer Products.

Among sectors, except oil & gas and pharma, all other indices ended in the green with realty and PSU Bank gained over 2 percent each.

BSE midcap and smallcap indices added 0.5 percent each.

July 19, 2022 / 15:28 IST

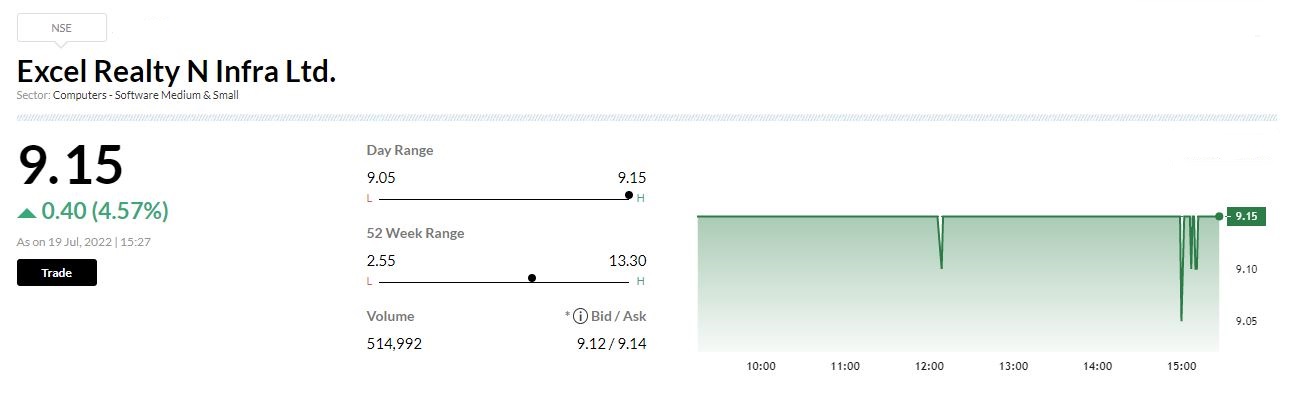

Buzzing

Excel Realty N Infra board will hold a meeting on August 4 to consider the sub-division of face value of Equity shares, and the issue of bonus share.

July 19, 2022 / 15:22 IST

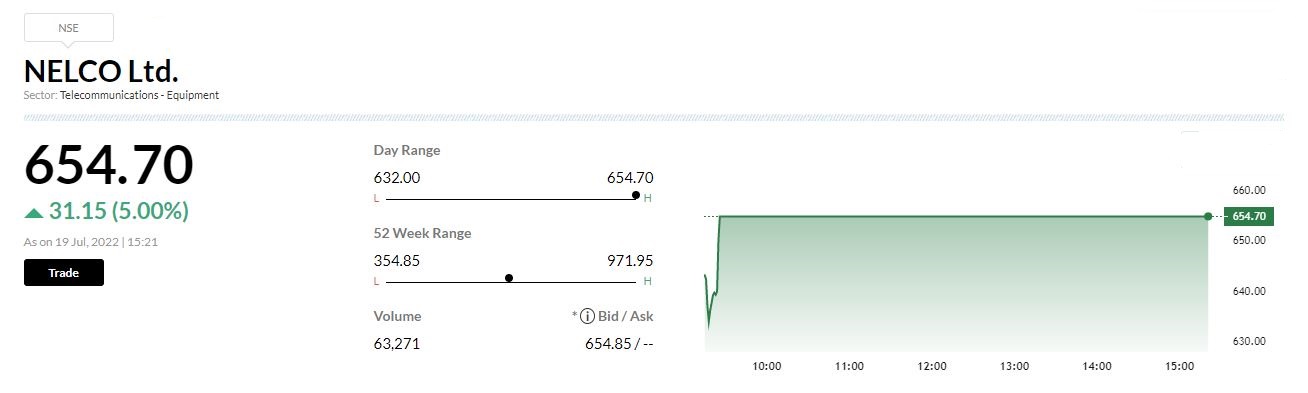

Nelco Q1 profit rises 7.8%:

Nelco clocked a 7.8% year-on-year growth in consolidated profit at Rs 4.72 crore for the quarter ended June 2022 supported by robust topline. Revenue grew by 48% to Rs 81.68 crore during the quarter YoY.

July 19, 2022 / 15:16 IST

Wipro Q1 Preview:

Wipro Limited, one of India’s top four IT services companies, is expected to report subdued earnings on July 20 for the first quarter ended June 2022, as has been the case with rivals TCS and HCL.

According to a poll based on the reports from various brokerages, the Azim Premji-owned company is expected to see a dip of 7-10 percent in its consolidated profit after tax (PAT) from the year-ago period, while the growth in consolidated revenue is likely in the region of 14-18 percent year on year.

The growth for the quarter is expected to be soft due to seasonal headwinds and moderation in demand. Click To Read More

July 19, 2022 / 15:06 IST

Rupee could fall to 85 and the Nifty to 14,200 after the pull-back rally: Rohit Srivastava

The market has been on a clear downward trajectory for three months now. In the second half of June, the indices climbed gradually. In an interview with Moneycontrol, Indiacharts founder, market strategist and Elliott Wave expert Rohit Srivastava explains how to interpret this movement for the short term and the medium term. Elliot Waves are patterns in financial market movements used by technical analysts to analyse and determine price trends. Click To Read More

July 19, 2022 / 15:01 IST

Market at 3 PM

Benchmark indices extended the gains and trading at day's high with Nifty above 16300.

The Sensex was up 242.57 points or 0.44% at 54763.72, and the Nifty was up 63.90 points or 0.39% at 16342.40. About 1879 shares have advanced, 1203 shares declined, and 124 shares are unchanged.