Taking Stock: Nifty Ends Above 15,800, Sensex Near Record High; Financials Lead

On the BSE, bank, metal and realty indices added 1-3 percent, while selling was seen in the names.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,138.27 | -503.63 | -0.59% |

| Nifty 50 | 26,032.20 | -143.55 | -0.55% |

| Nifty Bank | 59,273.80 | -407.55 | -0.68% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Asian Paints | 2,954.40 | 86.80 | +3.03% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Interglobe Avi | 5,697.50 | -96.50 | -1.67% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Pharma | 22905.00 | 17.20 | +0.08% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Bank | 59273.80 | -407.50 | -0.68% |

Rupee traded strong near 74.30 on back of retreat from dollar index prices as US Nonfarm payroll and Unemployment numbers did not encourage dollar and FED tapering can be delayed if data stays weak monthly. Inflow in the financial sector also helped rupee cheer by 0.40p. Going ahead the range of rupee can be seen between 74.15-74.60

The markets have been in fine form for the entire duration of trade today. However, we should take a call on the upside only when we cross 15900 on a closing basis. That would trigger renewed interest and momentum which should take the Nifty to 16100. The index is still range bound between 15400 and 15900.

Indian rupeeendedhigher by43paise at 74.31per dollar, amid buyingsawin the domestic equity market.It opened 22 paise higher at 74.52 per dollar against Friday's close of 74.74 and traded in the range of 74.30-74.55.

Benchmark indices ended higher for the second consecutive day on July 5 with Nifty above 15,800.

At close, the Sensex was up 395.33 points or 0.75% at 52,880, and the Nifty was up 112.20 points or 0.71% at 15,834.40. About 2174 shares have advanced, 1086 shares declined, and 162 shares are unchanged.

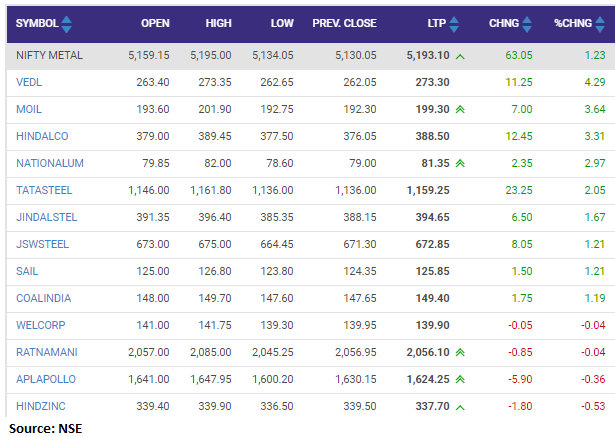

Hindalco Industries, ONGC, SBI, Tata Steel and Coal India were among the top gainers on the Nifty. Top losers were HDFC Life, Tech Mahindra, Dr Reddy’s Labs, BPCL and Britannia Industries.

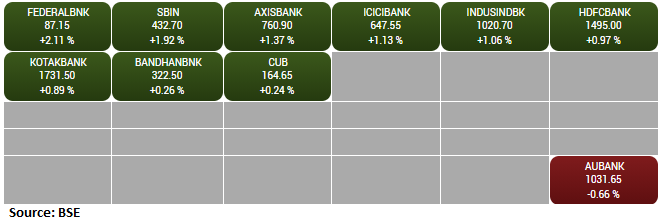

Among sectors, the bank, metal, realty and PSU Bank indices rose 1-3, while some selling seen in the IT and power names. BSE midcap and smallcap indices rose 0.3-0.8 percent.

After a few days of the lackluster movement, the market witnessed a positive trend in today’s activity. The market shows that the expected levels are likely to be in the range of 15800 and 15950, and it is going to be crucial for the short-term market scenario to sustain above the 15800 Nifty50 Index level. The market observed that the momentum indicators like RSI and MACD have recovered from their respective oversold zone and support the upside move and indicating potential upside from the current market level.

Due to the surge in COVID-19 cases being witnessed in Goa, the Government of Goa has extended the restrictions in the state respectively till July 12, 2021. Accordingly, the casinos operated by the Company and its subsidiaries in Goa will remain closed during this period.

The Government of Sikkim has allowed reopening of the Casinos in the State subject to the safety norms being followed. Further the company and/or its subsidiary operating the Casino in the state of Sikkim will resume its operations from July 06, 2021 and will follow all the safety norms laid down by the state in this regards, company said in its release.

Delta Corp was quoting at Rs 195.30, up Rs 7.70, or 4.10 percent on the BSE.

The print media sector in India will reach only three-fourths of its fiscal 2020 revenue mark despite ~35% on-year growth this fiscal, on a low base. Profitability, however, will revive to 9-10%, driven by sharp cost rationalisation measures and digitalisation of content, despite the recent rise in newsprint prices.

Benchmark indices were trading higher with Nifty holding above 15800 mark.

The Sensex was up 363.46 points or 0.69% at 52,848.13, and the Nifty was up 105.00 points or 0.67% at 15,827.20. About 2057 shares have advanced, 998 shares declined, and 133 shares are unchanged.

Hindalco Industries, Tata Steel, Eicher Motors, L&T and Bajaj Finserv were among major gainers, while losers were HDFC Life, Tech Mahindra, Britannia Industries, BPCL and HCL Technologies.

India Pesticides listed strongly on the exchanges today with 21% premium at Rs 360 per share against its issue price of Rs 296. It had seen healthy overall subscription of 29x, given its presence in the fast growing agrochemical space. IPL is the sole Indian manufacturer of five TECHNICALS and among the leading manufacturers globally for Captan, Folpet and Thiocarbamate Herbicide, in terms of production capacity.

Global agro-chemicals market is expected to grow at 7% CAGR to USD86bn by 2024 and IPL is well placed to tap this opportunity. Technicals in India which is strongly driven by export led demand and contract manufacturing, is expected to grow at 8% CAGR. With China+1 strategy, it opens huge opportunity for Indian players like IPL.

IPL plans to tap this opportunity by manufacturing complex off patented technicals, wherein 19 Technicals are expected to go off-patent between CY19-26 (opportunity of >USD4.2bn).

We like IPL given its presence in fast growing agrochemical space, diversified product portfolio and robust financials. Expanding product portfolio, growing customer base and increasing wallet share of existing customers can help IPL maintain its growth momentum. It is reasonably valued at 30.8x FY21 P/E, vis-à-vis peers, while it enjoys higher RoE of 36%.

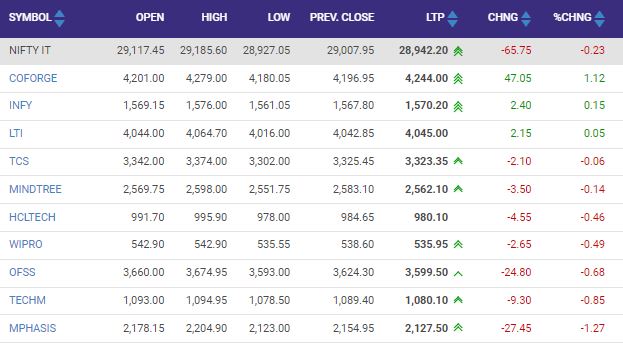

While all sectoral indices traded in the green along with the benchmarks, the Nifty IT index bucked the trend and traded in the red.