January 06, 2022 / 16:07 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas:

The Nifty witnessed profit booking on January 06 after having run up for the last four consecutive sessions. It had reached near 18000 mark, which was a key barrier & thereon the bulls took a pause for a breather. As a result of the recent rally, the hourly momentum indicators had reached the overbought zone & with the current minor degree dip, they are getting an opportunity to cool off.

Also, the hourly chart shows that the lower end of a rising channel is acting as a support for the minor degree dip. The junction of 40 HEMA & the hourly lower Bollinger Band is also present below the lower channel line.

Thus 17650-17600 is a key support zone where the Nifty can form a short term base for itself. The overall structure shows that the index can witness sideways action over the next few sessions post which it will be set to head higher.

January 06, 2022 / 15:56 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities Ltd:

On Thursday, the benchmark indices witnessed selling pressure at higher levels. Due to weak global conditions the market opened with a gap down and consistently registered to sell pressure at higher levels.

Technically, after an intraday sharp fall, the market took the support near 17650/59300 and reversed but failed to surpass 17800/59800 resistance level which is broadly negative. In addition, on daily charts, the index has formed a Hammer kind of candlestick formation that also supports short-term weakness.

The texture of the market is volatile and remain volatile in the near future. Hence, level-based trading would be the ideal strategy for day traders. Now, 17700/59000 would act as an immediate support level for the bulls. Above the same uptrend, the move will continue up to 17800-17875/59800-60000. On the flip side, trading below 17700/59000 could drag the index up to 17650-17610/58800-58600.

January 06, 2022 / 15:52 IST

Sachin Gupta, AVP-Research at Choice Broking:

The benchmark index extended the losses after a gap-down opening on Thursday due to weak global cues, after FOMC meeting minutes. However, we witnessed a slight pullback in the second half of the session ahead of Weekly expiry.

On a technical chart, the Nifty index has taken immediate resistance at upper Bollinger Band formation and traded below it. However, on a four hourly chart, the stock has still been trading above the Horizontal Line, which is acting as an immediate support zone.

An indicator MACD & RSI is still trading with a positive crossover that supports the bullish trend. At present, the index has support at 17600 levels while resistance at 18000 levels. On the other hand, Bank Nifty has support at 36700 levels while resistance at 38000 levels.

January 06, 2022 / 15:50 IST

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments:

Despite opening down with a gap, the index was quick to bounce from the lows. Until we do not break 17200, the short term trend of the market is positive.

Intra day corrections can be utilized to accumulate long positions for a target of 18050-18100. A closing below 17200 would be the stop.

January 06, 2022 / 15:42 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Following a sharp fall in western markets, the domestic market witnessed a gap-down opening and extended its losses led by selling in IT, realty and oil & gas shares.

Global markets were wounded by heavy selling as Fed meeting minutes pointed to a faster than expected policy rate hike considering elevated US inflation levels. Investors are also watching the fast spread of covid cases and stricter restrictions being imposed as it would keep the market highly volatile in the coming days.

January 06, 2022 / 15:36 IST

S Ranganathan, Head of Research at LKP securities:

The day witnessed a gap-down opening on the back of weak global cues and hawkish FOMC minutes which saw the US 10-year yield rising to 1.7%.

Bulls were a bit restrained on the back of rising covid cases and its impact on the fourth quarter corporate performance since it happens to be an important quarter for India Inc. The IT & Oil & Gas Index led the fall today with Cement stocks too witnessing profit taking.

January 06, 2022 / 15:35 IST

Market Close:

Benchmark indices broke the four-day winning streak and ended lower with Nifty below 17800 on the back of weak global cues.

At close, the Sensex was down 621.31 points or 1.03% at 59,601.84, and the Nifty was down 179.40 points or 1% at 17,745.90. About 1798 shares have advanced, 1336 shares declined, and 74 shares are unchanged.

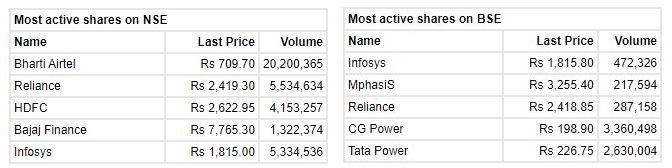

JSW Steel, UltraTech Cement, Tech Mahindra, Shree Cements and Reliance Industries were among the top Nifty losers. Gainers included UPL, IndusInd Bank, Bajaj Auto, Bharti Airtel and Eicher Motors.

Among sectors, except auto and oil & gas, all other sectoral indices ended lower with IT and Realty indices down 1 percent each. The BSE midcap and smallcap indices ended on flat note.

January 06, 2022 / 15:29 IST

CLSA view on UPL

Brokerage firm CLSA has kept buy call on UPL and raised the target price to Rs 1,100 from Rs 1,060.

The new launch successes are key to achieving goal of 25% EBITDA margin, while transition towards high-value products should drive a P/E rerating.

It raise FY22-24 EPS estimates by 2-3% as it build in spot currency assumptions.

UPL was quoting at Rs 783.75, up Rs 19.10, or 2.50 percent.

January 06, 2022 / 15:22 IST

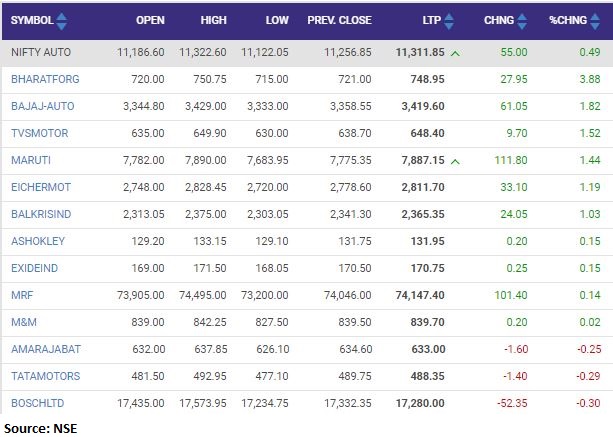

Nifty Auto index added 0.5 percent supported by the Bharat Forge, Bajaj Auto, TVS Motor

January 06, 2022 / 15:15 IST

Jefferies on Thermax

Foreign broking house Jefferies has upgraded Thermax to a buy rating with target at Rs 2,575 per share.

The management focussed on taking a step ahead in improving capital allocation and margin improvement.

Jefferies upgrades FY23-24 EPS by 11-36% to reflect revenue recovery.

Thermax touched a 52-week high of Rs 1,948.55 and was quoting at Rs 1,894, up Rs 54.90, or 2.99 percent.

January 06, 2022 / 15:08 IST

Manappuram Finance to consider various options for raising funds

Manappuram Finance is considering various options for raising funds through borrowings including by the way of issuance of various debt securities in onshore / offshore securities market by Public Issue, on Private Placement Basis or through issuing Commercial Papers, company said in its press release.

Based on the prevailing market conditions, the Board of Directors / Financial Resources and Management Committee / Debenture Committee of the Board of Directors of the Company may consider and approve issuances of Debt Securities during the month of January, 2022, subject to such terms and conditions including the issue price of debt securities, as the Board / respective Committee may deem fit, it added.

Manappuram Finance was quoting at Rs 166.95, up Rs 0.15, or 0.09 percent.

January 06, 2022 / 15:02 IST

Market at 3 PM

Benchmark indices erased some of the intraday losses but still trading lower with Nifty below 17800.

The Sensex was down 576.70 points or 0.96% at 59646.45, and the Nifty was down 167.80 points or 0.94% at 17757.50. About 1834 shares have advanced, 1291 shares declined, and 76 shares are unchanged.

January 06, 2022 / 14:54 IST

BSE Metal index fell 0.5 percent dragged by the JSW Steel, Tata Steel, APL Apollo