Taking Stock: Selling Continues On D-St As IT Stocks Tumble; Auto, Pharma Outshine

Auto and pharma indices rose 1 percent each, while IT index shed over 1 percent. BSE midcap and smallcap indices ended in the green.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 84,115.37 | -363.30 | -0.43% |

| Nifty 50 | 25,775.45 | -103.70 | -0.40% |

| Nifty Bank | 58,210.70 | -171.25 | -0.29% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Adani Enterpris | 2,505.80 | 17.60 | +0.71% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Infosys | 1,501.60 | -40.20 | -2.61% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8336.00 | 32.95 | +0.40% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 36156.40 | -523.00 | -1.43% |

:Indian rupee erased early gains and ended flat at 74.88 per dollar, amid selling seen in the domestic equity market.It opened higher by 22 paise at 74.65 per dollar against previous close of 74.87 and traded in the range of 74.64-74.98.

Index opened a day with a strong gap but profit booking from highs led the index to close in the negative note at 14294 with loss of half percent and formed a strong bearish candle on the daily chart.

The index has base around 14200-14250 zone if managed to sustain then some pullback possible if not saved then we may see next leg of a move towards 14000 marks which is another strong support on the downside, on the higher side 14400-14500 will be stiff hurdle also can be considered as initial profit booking levels.

In a volatile session today with news flow on the virus as well as the vaccine playing in the minds of investors, we witnessed yet another day when pharma stocks ruled high. Cement stocks came under a bout of profit booking today while the broader markets witnessed keen investor appetite for insurers.

Rupee trades volatile in range of 74.50-75.00 amid the uncertainty on who will have upper hand in coming times, covid-19 or Covid-19 Vaccines. The first is spreading rapidly in India & the other is being jabbed as fast as possible to neutralize the virus. This is impacting the rupee, hence volatile sessions are being witnessed. Going ahead the volatile range will be between 74.40-75.40.

Indian markets witnessed a bounce-back in its opening trade, however, failed to hold onto its early gains due to weak global cues and the possibility of a stricter lockdown in Maharashtra. Despite the vaccine drive kindling hopes of recovery, the trend in the market will depend on positive developments like decreasing covid cases and lifting restrictions. IT and FMCG were the sectoral laggards while mid and small-caps outperformed.

: Benchmark indices fell for the second consecutive day amid high volatility on April 20 dragged by the IT and financial stocks.

At close, the Sensex was down 243.62 points or 0.51% at 47,705.80, and the Nifty was down 63.10 points or 0.44% at 14,296.40. About 1603 shares have advanced, 1187 shares declined, and 155 shares are unchanged.

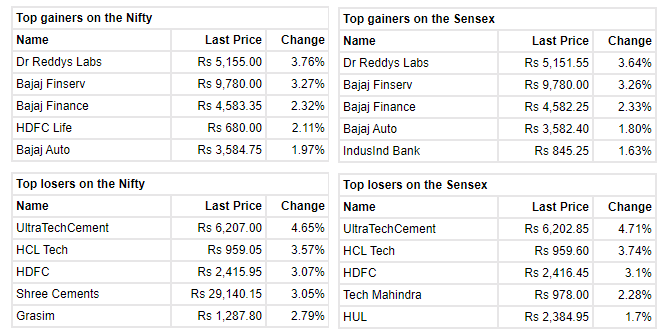

UltraTech Cement, HDFC, HCL Technologies, Grasim Industries and Shree Cements were among the major losers on the Nifty, while gainers included Dr Reddy's Laboratories, Bajaj Finserv, HDFC Life, Bajaj Finance and Bajaj Auto.

Auto and pharma indices rose 1 percent each, while IT index shed over 1 percent. BSE midcap and smallcap indices ended in the green.

The markets marginally threatened the 14200 level but was swift to bounce from there. If we break this level, we could fall rapidly to 13800-13900 and an extreme sell situation thereafter can take the Nifty down to 13600 as well.

GBPINR surged sharply by more than 1 percent touching the higher levels of 104.30 tracking the bullish move in USDINR. Also, GBPUSD has moved up by more than 1% overnight towards 1.4008 levels on expectations of better than expected economic data set releases this week which worked in favour.

Fall in US Dollar Index after the US Feds reiterated its view that any spike in inflation was likely to be temporary.

Benchmark indices extended the fall and trading at day's low level.

At 14:57 IST, the Sensex was down 501.62 points or 1.05% at 47447.80, and the Nifty was down 147.20 points or 1.03% at 14212.30. About 1456 shares have advanced, 1223 shares declined, and 130 shares are unchanged.

The announcement of Phase III of the vaccination drive appeared to bring a breath of fresh air into Dalal Street and helped Nifty recoup almost all of what was lost on Monday. However, the Nifty was reluctant to stretch the gains, which was evident at the open itself, with profit booking dragging it to the red by noon.

This profit booking was led by IT majors, which tracked weakness in the technology sector that pulled US indices lower from all-time peaks overnight.

Indian rupee has erased the early gains but still trading marginally higher at 74.82 per dollar, amid selling seen in the domestic equity market.

It opened higher by 22 paise at 74.65 per dollar against previous close of 74.87.

: Gold prices traded weak with COMEX spot gold prices were trading down at $1768 per ounce on Tuesday. Gold June future contract at MCX were trading lower at Rs. 47229 per 10 grams by noon.

We expect gold prices to trade sideways to down for the day with COMEX spot gold support lies at $1755 and resistance at $1790. MCX Gold June support lies at Rs. 46900 and resistance lies at Rs. 47600.