April 18, 2022 / 16:20 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets started the week on a muted note, in continuation of the prevailing consolidation phase and ended the session with a sharp loss of nearly two percent. After a gap-down opening amid weak global cues, the benchmark continues to trade with negative bias throughout the day.

Also, lower than expected results from heavyweights like Infosys and HDFC Bank impacted sentiments. Consequently, the Nifty ended lower by 1.7% at 17,173.7 levels. The broader markets, Midcap and Smallcap too ended lower by 1.1% and 1.3%, respectively.

Mixed trend was seen amongst the sectoral indices wherein IT and banking were the top laggards while Auto, FMCG and Energy were the gainers.

We believe global cues as well as the outcome of Q4 earnings will continue to add volatility in the coming sessions. Hence, we would remain cautious on the markets and suggest traders to keep their position hedged.

April 18, 2022 / 16:12 IST

Sumeet Bagadia, Executive Director at Choice Broking:

The Nifty50 index opened gap-down ahead of the weak global cues and settled at 17173.65 levels with a loss of 1.73% while Bank Nifty index ended at 36729 levels with 1.96% down fall. The market volatility index India VIX inched up by 9% during the day.

On the derivatives front, the highest call options OI is at 17500/17400 strike price followed by 17200 while on the put side, the highest put OI is at 17000 strike price followed by 17200 levels.

Technically, the index has formed a Doji candlestick on the daily chart but closed below the Middle Bollinger Band formation & 100-Days Exponential Moving Averages that suggests bearish moves for the coming day.

An indicator MACD & Stochastic witnessed a negative crossover on the daily time-frame, which supports the bearish sentiments.

At present, the index is having support at 17000 levels while resistance is placed at 17370 levels. On the other hand, Bank Nifty has support at 36200 levels while resistance at 37400 levels.

April 18, 2022 / 16:02 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas:

The Nifty, with a significant gap down opening, breached its short term moving averages on April 18. It went on to breach the 200-DMA on an intraday basis however managed to recover towards the end of the session thus holding on to the crucial moving average on a closing basis.

Over there the index has formed a Doji pattern, which shows indecision in the minds of the market participants.

Overall structure shows that the short term range for the index has shifted lower. The Nifty is expected to trade in the range of 17000-17500 in the short term.

On the downside, 17000 is a crucial support to watch out for. The index can form a base near 17100-17000 & attempt a recovery in the coming sessions as long as the level of 17000 holds on a closing basis.

April 18, 2022 / 15:56 IST

Rahul Sharma, Research Head, Equity 99:

After a long weekend, we witnessed huge fall of 2% in benchmark index. The fall was mainly on account of below estimates results of Infosys and HDFC Bank and the rising tension between Russia and Ukraine.

We expect further fall in markets in coming days, considering the recent rise of COVID cases in India and rising inflation concerns across the globe. Investors are advised to diversify their portfolio and also keep adequate liquidity in hand.

For Nifty 50 – post today`s session 17140 will act as strong support for index. If this level is breached than we might see 17060 levels, which if broken then 17000 levels is also possible.

On upper side 17240 will act as major resistance, if this level is breached than 17300 level is possible and on breaking which we might see 17400 levels.

April 18, 2022 / 15:51 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

On Monday, the market witnessed sharp selloff. The market opened with a gap down and touched the level of 200-day SMA. However, after morning selloff eventually it took the support near 17070/56850 and trimmed some losses. From the day lowest level, the index recovered over 130/ 300 points.

Among Sectors, IT Index lost the most, shed over 4 percent. Whereas despite weak momentum buying interest was seen in selective Energy and Metal stocks.

Technically, the Nifty/ Sensex has formed Gapping down Doji candlestick formation which suggest indecisiveness between bulls and bears.

Direction wise, post sharp fall the Nifty is trading near 200 and 50-day SMA. We are of the view that, the larger texture is still in to the bearish side and fresh pullback rally possible only after 17200/57300 level.

Above the same, the pullback rally is likely to continue till 17300-17375/57600-57900. On the flip side, 200-day SMA or 17150/57150 would act as an immediate support zone for the traders. Below the same, the index could retest the level of 17000-16900/57000-56700.

April 18, 2022 / 15:48 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Unfavourable start to earnings season in heavyweight stocks of IT and banking sector led to heavy sell-off. Lower-than-expected results prompted the market to worry about the headwinds faced by IT sector like attrition, wage inflation, lower utilization, and cut in IT spending by industries due to geopolitical and macro issue.

The degree of downfall is high because the sector was trading at high valuation and risk of a downgrade in outlook has increased.

April 18, 2022 / 15:40 IST

S Ranganathan, Head of Research at LKP securities:

Indices opened gap down on the back of weak global cues as the Federal Reserve tightens policies to tame inflation. Benchmark Indices never really recovered during the day from the twin blow of the IT Index & the Bank Nifty with rising oil prices and inflationary pressures adding to the woes.

The broader markets did see buying interest in select pockets like Defence, Paper & Fertilisers on the back of continued positive tailwinds.

April 18, 2022 / 15:35 IST

Market

Close: Benchmark indices extended the profit booking on the fourth day in a row amid selling seen in the IT and banking names.

At close, the Sensex was down 1,172.19 points or 2.01% at 57,166.74, and the Nifty was down 302 points or 1.73% at 17,173.70. About 1454 shares have advanced, 1990 shares declined, and 135 shares are unchanged.

Infosys, HDFC, HDFC Bank, Tech Mahindra and Apollo Hospitals were among the top Nifty losers. NTPC, SBI Life Insurance, HDFC Life, Coal India and Tata Steel were the top gainers.

IT index down 4.7 percent and realty and bank indices down 1 percent each. However, buying was seen in the auto, metal, FMCG and power names.

The BSE midcap and smallcap indices down 1 percent each.

April 18, 2022 / 15:23 IST

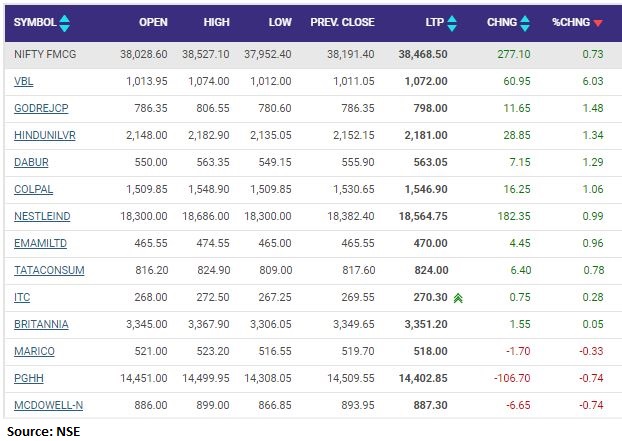

NSE FMCG index added 0.7 percent led by the Varun Beverages, Hindustan Unilever, Godrej Consumer Products

April 18, 2022 / 15:13 IST

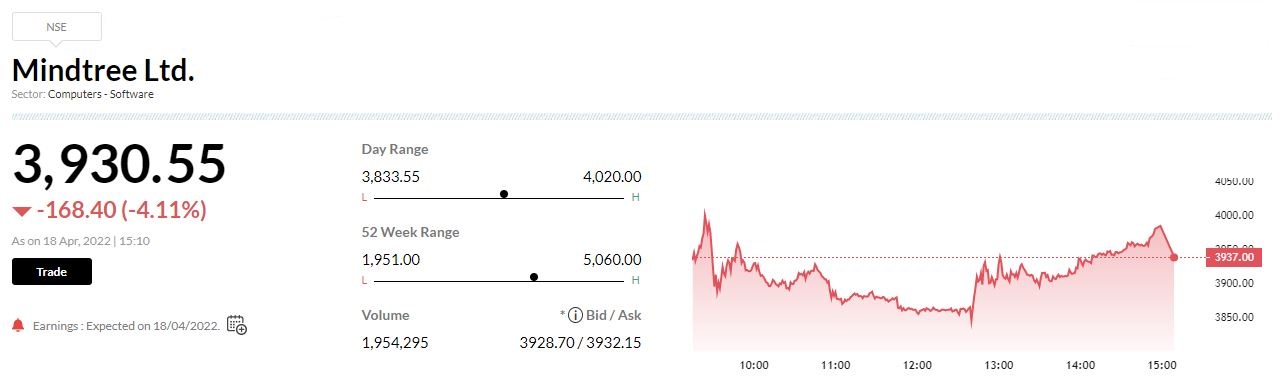

Mindtree stock in focus ahead of Q4 numbers

April 18, 2022 / 15:10 IST

Triggers For Selloff - Key Numbers

Sensex Down Nearly 1,400 pts

Nifty IT Index Down Over 5%

India Vix: Best Day In ~2 Months

Rs 4 Lakh Crore Market Cap Lost

WPI Inflation At 14.55% in March

US 10Y Yield Above 2.8%

Crude Back Above $112/bbl

China Q1 Retail Sales Slump By 3.5%

April 18, 2022 / 15:05 IST

Asahi Songwon to acquire 78% in Atlas Life Sciences

Asahi Songwon Colors has executed a Share Purchase Agreement with Atlas Life Sciences Private Limited (ALSPL) and certain identified promoters of ALSPL for acquisition of 100% stake in ALSPL in three tranches from certain identified promoters and other shareholders of ALSPL.

Also, acquisition of shares under first tranche i.e. 78% stake in ALSPL is completed today i.e. April 18, 2022.