All’s well that ends well is the perfect way to summarise what Indian markets witnessed this week. Massive cut for Nifty on Monday (down about 4.5 percent from highs) marked a panic low near 13,150, but a quick reversal in sentiments helped the index end near lifetime on Thursday. Monday’s setback was put aside as a strong comeback seen on broader markets as mid and smallcaps also joined the party.

Nifty ended flat while Bank Nifty underperformed with cuts of about 1.4 percent on a week-on-week basis. Monday’s carnage on Nifty saw a huge unwinding of positions on the open interest front. Nifty lost about 4.5 percent OI in futures while Bank Nifty saw 3.3 percent additions in OI during the week.

Strong hurdle zone for Bank Nifty is near 31k mark while Nifty is now likely to see support emerging near 13,500 in the short-term. We expect buoyancy to continue with a minor pullback that should be used to enter with a stock-specific approach as broader markets gaining strength.

Moving into the fag-end of December series, we expect sideways move with positive bias for the index, as India VIX collapsed back from nearly 24 mark to 20 levels along with sharp momentum in the past couple of days which is likely to see mild follow up. Expiry week trade setup suggests 13,600 to 13,800 as a trading band while larger traction is seen on Bank Nifty and broader markets.

On the front of the global markets, weakness on the dollar index likely to keep unabated foreign flows pouring in. Traders are a;sp likely to keep a strict watch on developments from the Brexit deal deadline. Fresh breakout on Russell index along with momentum on SPDR Bank ETF fueling momentum in Banking stocks domestic also as catch up moves would be seen on Bank Nifty in the near-term.

Sector-wise

IT stocks remained on a roll with strong gains seen on midcap IT pack on the back of short covering in Mindtree (shed about 4 percent OI, price gains 10 percent). TCS and Infy both lost about 5 percent in OI with strong gains. Shorts crept in media stocks like PVR and Suntv, banking stocks RBL continued to add short buildup adding about 40 percent fresh OI with about 7 percent price cut on a week-on-week basis. Financials are likely to remain under the thick of the action as Bank Nifty trades back above the 30k mark.

FII’s positioning remained overall strong with index futures long to short ratio currently stands at 2.2 times levels, second half on the week saw selling on Index options from FII’s we expect dull trade in the expiry week as holiday mode sets on.

Strategy for the next week:

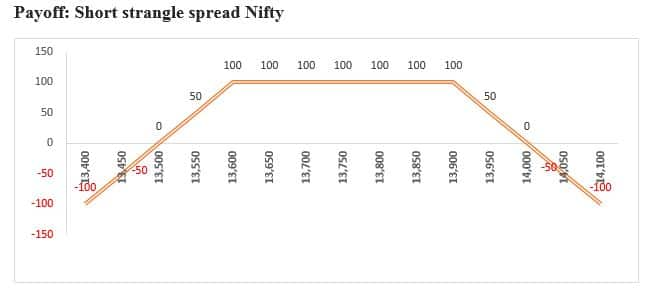

Short Strangle (Expiry 31st December) 1:1

Sell Nifty strike 13,600 put and Sell 13,900 Call with net outflow about 100 points

Target is 20/10 points on the total spread

Stop loss is 159 on the total spread

(1) Rationale: We expect consolidation to in markets post recent whipsaw as significant cool off seen on index ATM options.

(2) Now options setup suggest strong support at 13,500/13,600 zone while upside massive buildup seen on 14k strike for monthly Nifty series.

(The author is Senior Derivatives Analyst – Institutional Equities, YES SECURITIES)

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!