The Indian healthcare system has evolved over the years, thanks to the shift in demographic trends, growing technological capabilities and rise in non-communicable diseases.

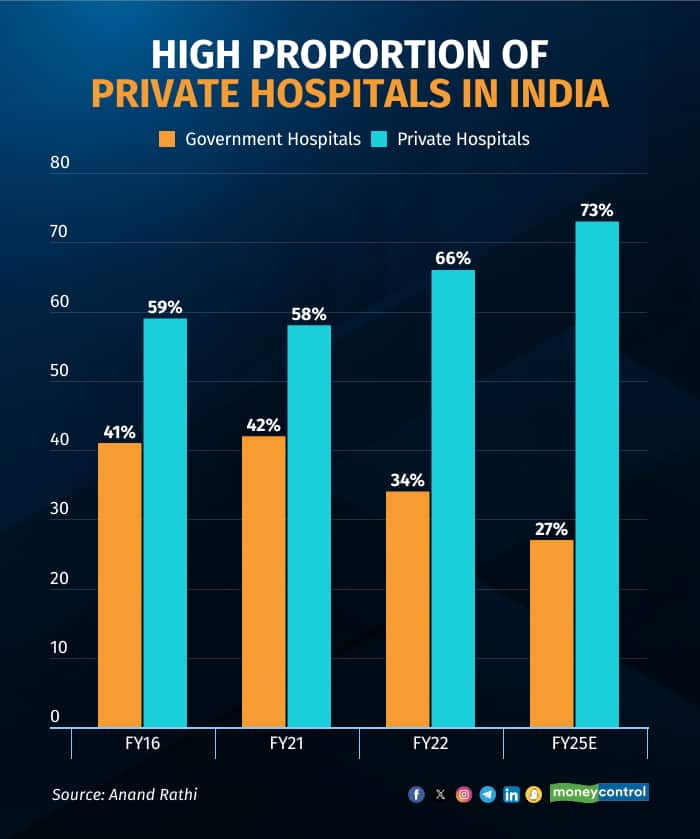

However, the government’s limited fiscal headroom and inadequate healthcare infrastructure will lead to private hospitals dominating the healthcare space, according to a report by Anand Rathi from April 23.

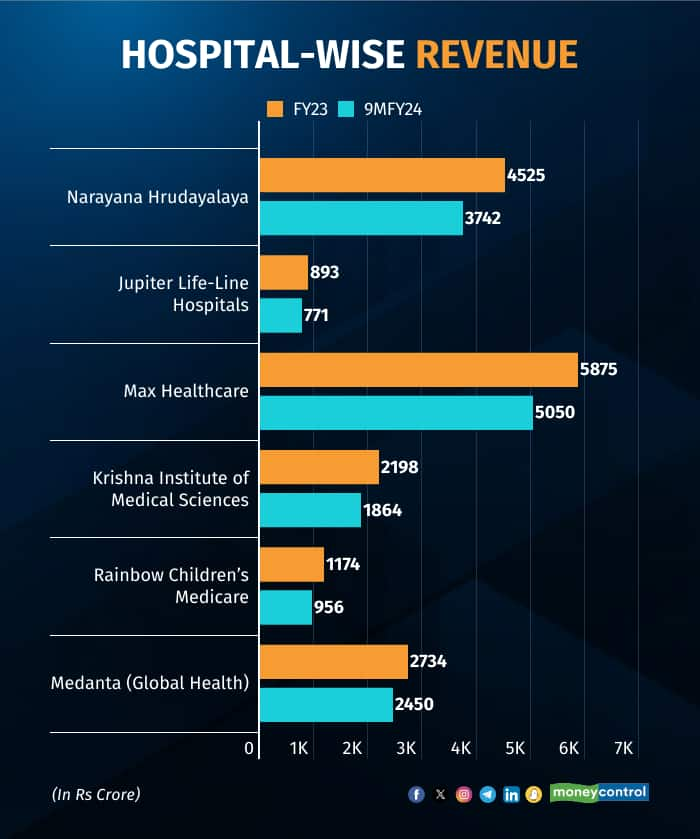

The brokerage initiated coverage on six hospitals as the total number of hospital chains across India are poised to grow.

It recommended a ‘buy’ on Max Healthcare, Rainbow Children’s Medicare, Krishna Institute of Medical Sciences (KIMS) and Jupiter Life Line Hospitals, and a ‘hold’ on Global Health (Medanta), and Narayana Hrudayalaya.

The Indian demographics are seeing a structural shift, with more patients able to pay higher prices, and are seeking advanced treatments and a broader range of services.

With the rise of lifestyle-related illnesses, higher penetration of health insurance, growing urbanisation, and increasing household income, there will be a demand expansion for the healthcare delivery services in India.

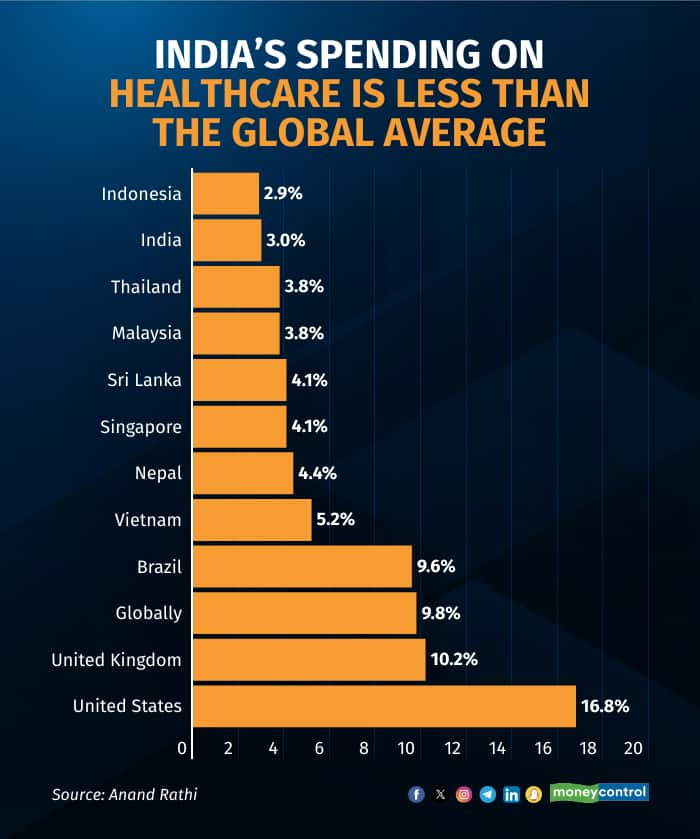

Currently, India is lagging in terms of healthcare infrastructure and spending when compared to most countries across the world. Compared to global peers, India spends roughly three percent of its GDP on healthcare. A large reason is that India faces affordability challenges in accessing quality healthcare facilities.

“This demand-supply mismatch is unlikely to be bridged soon. Given the limited fiscal headroom, the private sector is likely to continue to benefit from the industry growth,” said Anand Rathi.

Private hospitals account for a tad more than two-thirds of the healthcare delivery market by value, which can increase to around 73 percent by the end of FY25. Of this, hospital chains hold around 12 percent of the market share.

Leading hospitals are entering their expansion phase, with a visible increase in capex and commissioning of new beds likely to gain momentum beyond FY25.

Of the hospitals under Anand Rathi’s coverage, Narayana Hrudayalaya has the highest number of operational beds, while Max Healthcare boasts of the highest revenue.

Max Healthcare will see two times brownfield expansion over the next five years, adding around 2,600 beds or 75 percent of its current capacity. Max boasts of the best operating parameters among its peers, such as increasing occupancy and reduced average duration per stay. Max's third-party diagnostics and home lab businesses will also drive growth.

Anand Rathi issued a 'buy' rating on Max, with a target price of Rs 950 per share. Since issuing the buy call on April 23, shares of Max have gained more than five percent over the last two sessions.

Rainbow Children’s MedicareRainbow Children’s Medicare has a moat around paediatric and perinatal services. This model is still in its nascent stages in India, and has allowed the player to see cost-effective growth and breakeven faster.

"Given its strong pedigree in this field and hold on unit economics, the company is poised to replicate the model in other Indian cities," said the brokerage, giving the stock a 'buy' call, with a price target of Rs 1,470 apiece.

Also Read | Kotak starts coverage on Neogen Chemicals, sets target at Rs 1,840 a share

Krishna Institute of Medical SciencesKIMS has a key focus on affordable care and takes a cluster-based approach, and doctors are given an equity stake in the firm. "The company is a leader in south India’s healthcare market with 12 multi-specialty hospitals and a unique business model of affordable pricing through cost rationalisation," the brokerage said.

Based on its solid expansion plans and targeting new markets, Anand Rathi issued a bullish call, with a target of Rs 2,370 apiece.

Jupiter Life Line HospitalsJupiter Life Line Hospitals has three units in the western micro-markets - Thane, Pune, and Indore - which are areas with higher insurance, and less reliability on government schemes. The firm is also planning to double its bed capacity by setting up two greenfield hospitals.

Anand Rathi sees a 19 percent revenue CAGR over FY23-26, aided by the scale-up in occupancy at its Pune and Indore units. The target price on the counter is Rs 1,380, with a buy rating.

Global Health (Medanta)Medanta's growth will be aided by developing hospitals in Lucknow and Patna. Capacity will grow by 25 percent, with more than half in Tier 2 cities.

With higher capacity utilisation in new hospitals and more international patients, the firm will see a 16 percent CAGR over FY24-26. Anand Rathi has a 'hold' rating on the player, with a target price of Rs 1,430.

Also Read | HUL in Q4: Revenue buoyed by premiumisation, rural recovery hinges on monsoon

Narayana HrudayalayaNarayana Hrudayalaya has dominance in Karnataka and east India and is in a catch-up mode in Delhi/NCR and Mumbai. The bed expansion over the next years is likely to be more modest, compared to peers.

Anand Rathi expects 10 percent revenue CAGR over FY24-26, driven by rising occupancy. The occupancy gain would offset upfront cost on new beds, leading to flat EBITDA margins. The brokerage issued a hold rating on the counter, with Rs 1,380 as the price target.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.