PNC Infratech share prices gained 7.4 percent, and KNR Constructions 3 percent intraday on November 15 as Japanese brokerage firm Nomura remained bullish on the stock after their September quarter earnings.

The research house maintained buy call on PNC Infratech with a target price of Rs 267, implying 45.5 percent potential upside from current levels as July-September quarter results were above its estimates at all levels.

The revenue was a beat, signifying robust execution even in the monsoon quarter, the brokerage said, adding the company was on track to beat its revenue guidance of Rs 4,500 crore for FY20 and would maintain lower gearing levels for FY20.

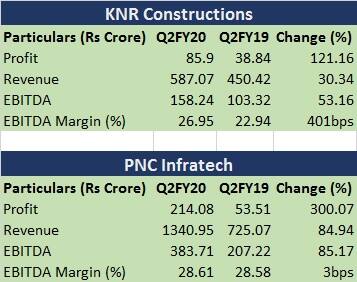

PNC Infratech reported healthy earnings growth across parameters with consolidated profit rising 300 percent year-on-year (YoY) to Rs 214.08 crore and the revenue increasing 85 percent YoY to Rs 1,341 crore in the quarter ended in September.

Consolidated earnings before interest, tax, depreciation and amortisation (EBITDA) grew by 85 percent to Rs 383.71 crore compared to year-ago with flat margin YoY.

ICICI Securities also likes PNC Infratech given its strong orderbook position, execution capabilities and strong balance sheet position.

The company reported higher other income of Rs 44.7 crore in Q2FY20 which includes Rs 35.6 crore interest on arbitration claim received for Hapur-Moradabad project. Adjusting for one-offs associated with claims at operating level as well as other income level, operational PBT grew by 1.3x YoY to Rs 101.3 crore in Q2FY20.

PNC's consolidated profit in first half of FY20 increased sharply by 129 percent year-on-year to Rs 392 crore on revenue of Rs 2,866 crore which grew by 75 percent YoY. EBITDA in first half of FY20 shot up 50.6 percent to Rs 735 crore YoY.

PNC stock rallied more than 32 percent in the last nine months and was quoting at Rs 184.70, up Rs 1.25, or 0.68 percent, on the BSE at 11:49 hours IST.

Nomura has also maintained buy call on KNR Constructions with a target price at Rs 363 which implies 47.8 percent potential upside from current levels.

"There was a strong pick-up in execution during July-September period after a weak April-June period. Asset sale to Cube Highways is a key positive," the brokerage said.

ICICI Securities prefers KNR Constructions as well, given its strong orderbook position, execution capabilities, strong balance sheet position and the company focusing on monetising its under construction HAM projects.

KNR also delivered a strong set of earnings for the quarter ended in September with profit rising 121.2 percent YoY to Rs 85.9 crore, and the revenue grew by 30.3 percent to Rs 587.07 crore compared to the year-ago period.

EBITDA during the quarter increased 53 percent to Rs 158.24 crore, and the margin expanded by massive 401bps to 26.95 percent compared to the same period in 2018.

The stock gained more than 20 percent in last nine months and was quoting at Rs 246.80, up Rs 1.15, or 0.47 percent, at 11:49 hours IST.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.