For the first time in history, Nifty closed above the psychological mark of 15,000 on February 8, 2021.

Nifty has come a long way after it was launched in April 1996, when it traded at 1,107, with the base year of November 1995 set as 1,000.

Like the Sensex, which recently crossed the 50,000 mark, Nifty took nearly about 18 years to reach the level of 7,000, while the next 8,000 points came in the last 6.8 years.

Brokerage firm Motilal Oswal Financial Services pointed out that from the pandemic lows of 7,511 in March 2020, the index has doubled in just 220 days.

The sharp recovery in the index has been driven by a benign global liquidity backdrop, better containment of COVID-19 cases, sharp recovery in corporate earnings, and a market-friendly Budget.

"Nifty50 constituents make up roughly 58 percent of the total Indian market-cap. On this spectacular journey, Nifty has mirrored the country’s economic growth from the time that it was launched," said Motilal Oswal.

"It saw the initial phase of political instability over 1996–98; since then, it has seen and overcome various challenges – such as the Asian Financial Crisis, the dot com bubble, the global financial crisis (GFC), the

taper tantrum, and the COVID pandemic – all of which have shaped it into the economic powerhouse it is today."

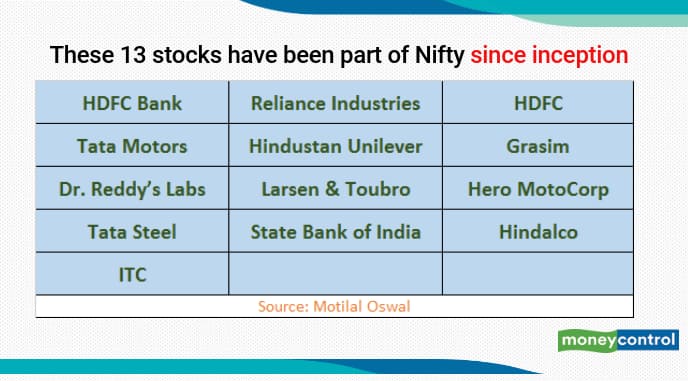

Of the 50 stocks in the Nifty, 13 companies – HDFC Bank, RIL, HDFC, ITC, HUL, L&T, SBI, Tata Motors, Dr. Reddy’s Labs, Tata Steel, Grasim, Hero, and Hindalco – have been a part of the index’s journey since inception, Motilal said.

The combined market-cap of these 13 companies has grown at a CAGR of 18 percent between April 1996 and February 2021, said the brokerage firm.

"The common stock weightage in the Nifty50 has reduced to 44 percent currently from 50.8 percent in April 1996. Nifty EPS compounded by 8 percent over FY1997–FY2020. Nifty EPS, which was at Rs 75 in FY1997, ended FY2020 at Rs 467," said Motilal Oswal.

In line with the change in the underlying composition of the Nifty, the valuation multiples of the Nifty have also moved up.

The average P/E multiple of the Nifty between April 1996 and February 2021 stands at 15.7 times; however, the average for the last 10 years is 18.8 times, said the brokerage firm.

Motilal Oswal highlighted while traversing its journey from 1,107 to 15,000, the Nifty (up about 14 times) has delivered 11.1 percent CAGR returns in the last 25 years.

"The year 2009, the post-GFC year – in which the markets rebounded from the lows of the GFC and the UPA formed a stable government at the center – was the best year of annual returns, with the Nifty delivering 76 percent gains. On the other hand, the year 2008, the year of the GFC, was the worst – the Nifty ended this year with a 52 percent decline," Motilal said.

In the last 25 years, the Nifty has given calendar annual returns of more than 20 percent in 10 years and has declined in 7 years.

As per Motilal Oswal, Nifty’s journey from 1,107 to 2,000 was the most excruciating – as it took a total of 2,167 trading days (almost 8.7 years). The move from 6,000 to 7,000 was also prolonged (1,589 trading days or 6.5 years) as the markets took time to recover from the long phase of correction in the aftermath of the GFC in 2008.

On the other hand, the move from 14,000 to 15,000 has been the quickest – covered over just 25 days. Of course, as the levels move higher, every 1,000 point journey implies lower percentage returns, the brokerage firm said.

Over the years, the sectoral representation of the Nifty has also changed tremendously and remains in consonance with the changes in the underlying economy.

"With a change in the economy from the manufacturing to services over the past three decades and the rise of the private sector, the sectoral representation in 2021 is vastly different from that of 1996," said Motilal Oswal.

The Nifty in April 1996 had zero representation from technology and was dominated by consumers, PSU banks, and other sectors such as oil & gas, NBFC, autos, metals, and textiles, Motilal Oswal said.

The brokerage firm pointed out that the top two sectors in 2021 – private banks (25.5 percent) and technology (16.1 percent) – had 0.4 percent and 0 percent representation, respectively, in the Nifty in 1996.

PSU banks and metals have also seen a massive decline in weights to 2.3 percent/2.1 percent now in 2021, from 12.2 percent/10.7 percent in 1996.

Textiles (4.9 percent), hotels (2.2 percent), and shipping (0.9 percent) have zero representation in the Nifty as of 2021.

The weight of consumer/auto/capital goods/cement weight has dropped to 9.4 percent/6 percent/2.9 percent/2.4 percent in 2021 from 17.6 percent/10.9 percent/4.4 percent/3.9 percent in 1996, Motilal Oswal said.

Life insurance and retail are other smaller sectors with a representation in the Nifty in 2021 which were not present in 1996.

Long-term outlook positive

The market is teeming with positivity and the long-term outlook remains positive.

Benchmark indices more than doubled from the March 2020 low caused by the outbreak of the pandemic, but the recovery was swift and the market did not give much time to investors to buy the dip.

For investors who are already sitting on profit should use the rally to book some profits, suggest experts. The rally could extend towards 15,500 in February series, and to 16,000 in the year 2021 on the Nifty50, they said.

Although the market is high, we don't see the market is overvalued in terms of the fundamentals but we believe that the market sentiment is at the peak of optimism and an adjustment of it is more likely,” Ashis Biswas, Head of Technical Research, CapitalVia Global Research Limited told Moneycontrol.

The market is supported by the favourable government policies also.

While the economy is improving and demand is coming back, government stimulus and growth-oriented policies will keep the market high.

In the Union Budget 2021, Finance Minister Nirmala Sitharaman signalled that the government will not compromise on growth and will not resort to conservative methods of increasing taxes to fund CAPEX.

Quarterly earnings have been good, GST collection touched a record high and rating agencies are predicting a sharp bounce in the economy in FY22. Unless a strong, unexpected negative surprise appears, the market has no reasons to be subdued.

Occasional profit-booking cannot be ruled out but for a long-term investor, the market has much more to offer.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!