Adani Enterprises could see the maximum inflow and Shree Cement the maximum outflow after the Nifty indices rejig takes effect on Friday, according to Edelweiss Alternative and Quantitative Research. The former is being included in the Nifty50 index and the latter is being excluded from the same index after the semi-annual exercise.

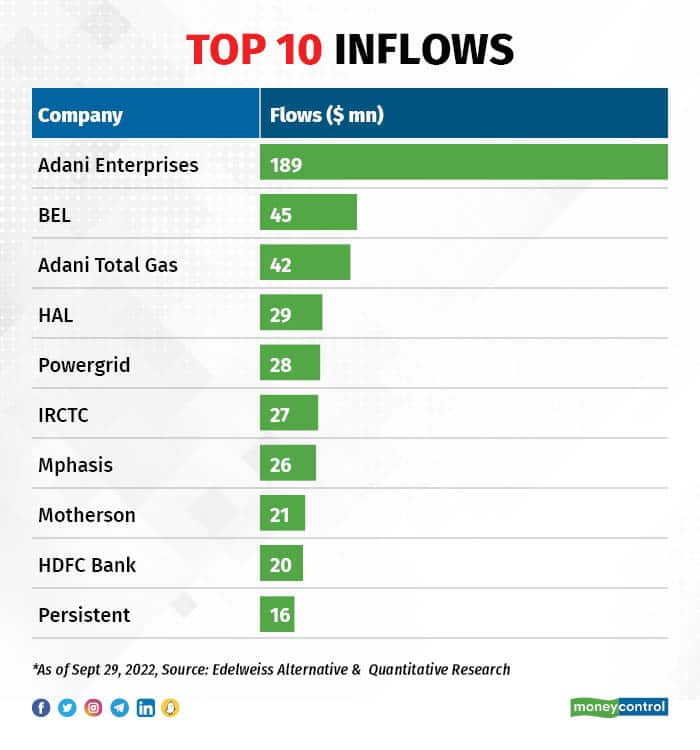

Actually, two Adani Group stocks will be among the top three to see the maximum inflow after this rejig, said the Edelweiss Alternative and Quantitative Research report. Adani Enterprises, which will be added to the Nifty 50 after an upgrade from the Nifty Next 50, could see an inflow of $189 million. Adani Total Gas, which will be included in the Nifty Next 50, will likely see an inflow of $42 million.

PSU stocks BEL, HAL and IRCTC, which are new entrants in the Nifty Next 50 index, could get inflows of $45 million, $29 million and $27 million each.

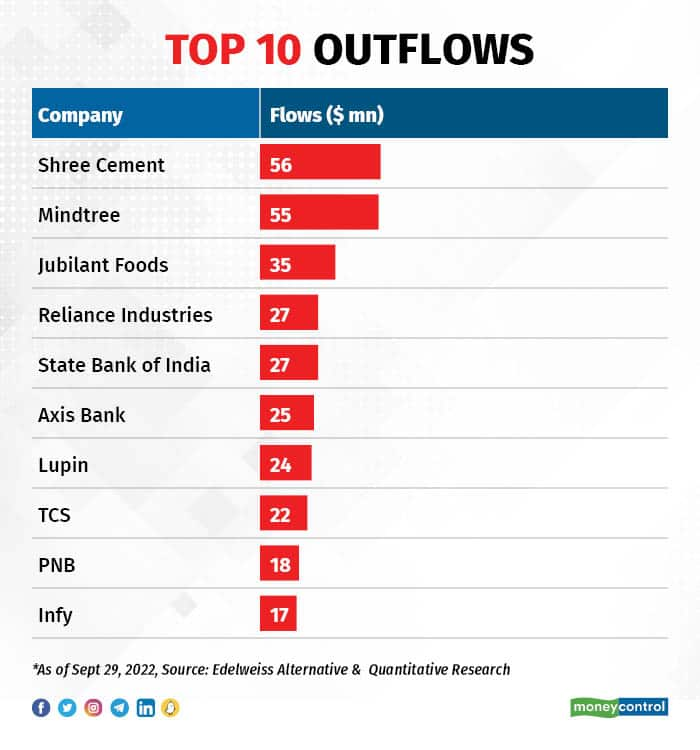

Shree Cement could see an outflow of $56 million. Mindtree, which is being excluded from Nifty Next 50, comes a close second with an expected outflow of $55 million. Jubilant Foods, which is also being excluded from Nifty Next 50, comes third with an expected outflow of $35 million.

Reliance Industries’ weightage on the Nifty50 index is being reduced by 0.11% and State Bank of India’s weightage on the Nifty Bank index is being reduced by 0.68%.

The indices are rejigged periodically, when stocks are included or excluded depending on the change in their average free-float market cap. When a stock is on the index, it automatically gets money from passive funds that track indices.

Adani Enterprises is part of indices of MSCI Enterprises and FTSE India Index. “Interesting, the only Adani Group stock missing in MSCI Standard Index is Adani Wilmar and the key deterrent is free float,” said Abhilash Pagaria, head of alternative and quantitative research at Edelweiss.

After the Nifty rejig, Adani Enterprises is likely to see additional buying of 4.3 million shares, 1.3 times the 20-day average volumes. Adani Total Gas is likely to see additional buying of 1 million shares, a 2.4-fold jump over the 20-day average volumes, according to the Edelweiss team’s calculations.

(Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.)

(Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!