Dear Reader,

Despite continued selling by foreign investors, Indian markets stabilized over the week and closed relatively flat. October 2024 witnessed record monthly selling, surpassing the ₹1 lakh crore mark. The volatility in the market was exacerbated by escalating tensions in the Middle East and the upcoming US elections.

During the week, benchmark indices rose by 0.5%. Mid-cap stocks experienced a decline of 0.5%, while small-cap stocks outperformed, gaining nearly 2%. IT stocks were notably affected, dropping by 3% throughout the week, with both Nifty FMCG and Bank indices also falling by nearly 1% each.

The US markets experienced volatility ahead of the crucial presidential election, with major indexes closing lower despite the Nasdaq reaching an all-time high on Wednesday before sharply declining on Thursday. The upcoming week is expected to be turbulent as election results are set to be announced, alongside quarterly earnings from five of the "Magnificent Seven" mega-cap tech stocks.

In Europe, the STOXX 600 index fell by 1.52% due to concerns over escalating conflict in the Middle East and disappointing corporate earnings. Among the major indices, France's CAC 40 declined by 1.18%, Germany's DAX dropped by 1.07%, Italy's FTSE fell by 1.42%, and the UK's FTSE decreased slightly by 0.29%.

On the economic front, the Eurozone experienced a growth of 0.4% in the third quarter, surpassing the consensus estimate of 0.2%. Germany managed to avoid a recession with a growth rate of 0.2%, while France and Spain reported stronger-than-expected economic performance. In Japan, the Nikkei 225 index rose by 0.4% as the Bank of Japan (BoJ) maintained steady interest rates amid ongoing political uncertainty.

Chinese stocks declined by 0.84%, and the Hang Seng index fell by 0.41%. Notably, China's factory activity expanded for the first time since April, with the manufacturing purchasing managers' index (PMI) rising to 50.1 in October from 49.8 in September, exceeding expectations. Additionally, the non-manufacturing PMI increased to 50.2 in October, up from 50 in September.

Importantly, the value of new home sales from the country's top 100 developers increased by 7.1% compared to a year ago, following a significant 37.7% decline in September. This marks the first year-on-year growth in 2024. Analysts are becoming increasingly optimistic about Chinese economic data, viewing the improvements in the Purchasing Managers' Index (PMI) and real estate figures as early indicators of recovery in the Chinese economy.

Short term gain likely but medium-term pain continues

The Nifty index was largely flat this week, but we saw many big moves and rotation in the sector. Many of the short-term indicators are now hinting toward a bounce in the forthcoming trading sessions, leading to a durable bottom in the Nifty index at some point in the coming week. However, one should not confuse this with the end of a correction and a new rally.

The medium-term corrective phase is still incomplete, but we can see a meaningful pullback that can take many traders by surprise and push the weak hands out of the market. The scenario of a meaningful short-term pullback in the Nifty index at some point in the next week holds true as long as the Nifty index does not break its major support zone of 23700 – 24000.

The Nifty 500 index’s percentage of stocks above the 100-day Simple Moving Average (SMA) line has slightly risen in the past few trading sessions. We have seen this pattern occurring repeatedly when we see a short-term pullback within the medium-term correction. Similar minor pullbacks were observed in the December 2022 to March 2023 correction.

The medium-term correction usually ends when the percentage of stocks above the 100-day Simple Moving Average (SMA) line hits the first line (20%) or the second line (10%) on the downside. The current reading is at 35. The ideal scenario will be if the Nifty 500 index corrects the lower end of the rising channel and the indicator line hits the first or the second oversold line on the way down.

Source: web.strike.money

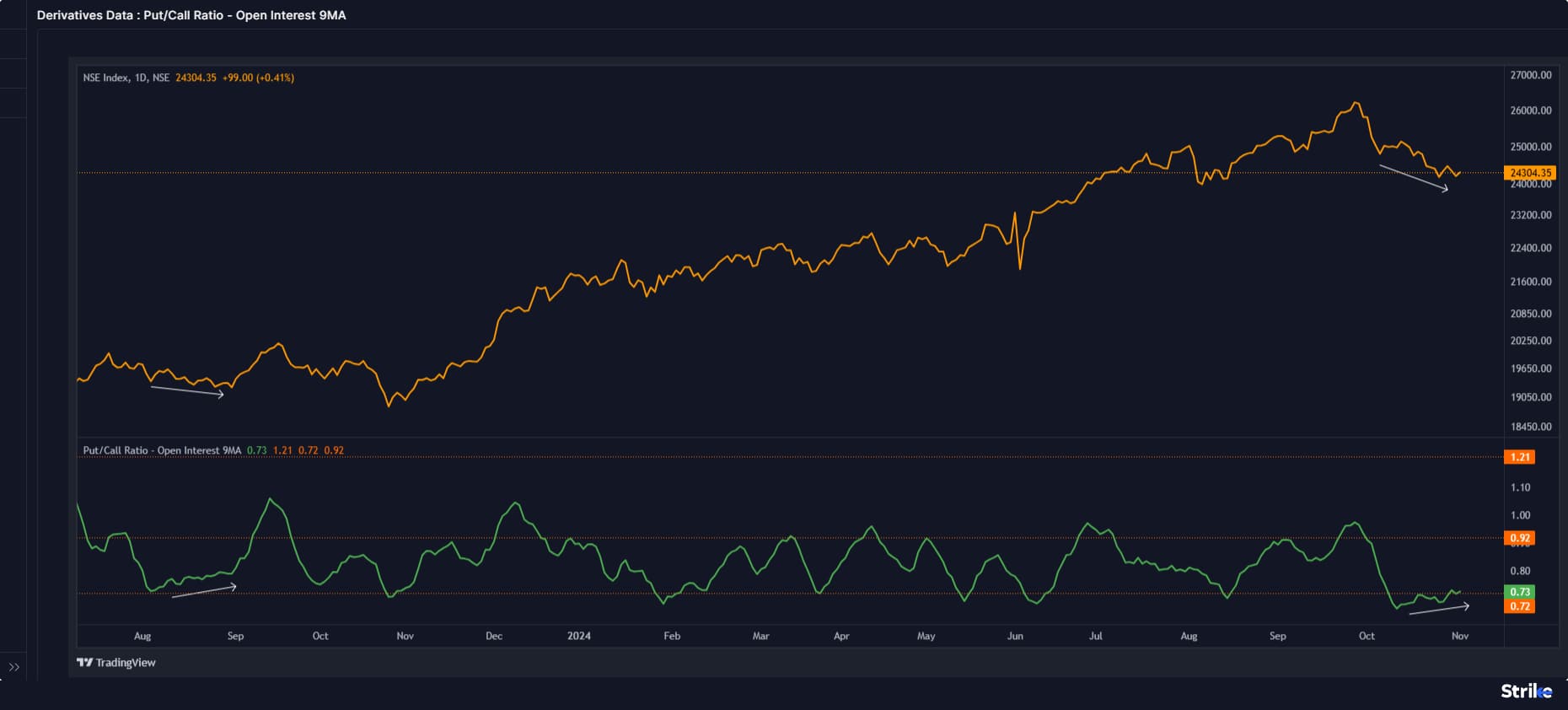

The market-wide OI PCR (9MA) helps to predict the short-term tops and bottoms and this is hinting towards an up move/bounce in the short-term. There is a divergence visible between the market-wide OI PCR line and the Nifty index. Despite the Nifty index correction and forming lower lows, the market-wide OI PCR is gradually rising and forming higher lows indicating that smart money is comfortable shorting puts with a view that the downside could be limited.

Since there is a divergence between the Nifty index and the indicator line, one of the two is wrong i.e. either the Nifty index must bounce back since the indicator line is gradually rising higher or the Nifty index keeps falling and the indicator line also declines and break the higher high formations. As the OI PCR is towards the bottom end of the range, it is expected that the Nifty index can see an up move/bounce which can last for a few days or a couple of weeks.

Source: web.strike.money

The FIIs' net short positions in the index futures are at 1,51,607 contracts but the index long positions percentage has fallen to 22.55%. Medium-term bottoms are made when this reading falls to 17% or below. The ideal scenario of a medium-term bottom formation will be when the index long positions percentage drops to 17% or below and the FIIs' net short positions in the index futures fall to 2,50,000 or below OR we get a price action reversal.

For the Nifty index, 24500 – 24700 is a major resistance zone in the short term. Until we don’t see an extreme reading on FIIs' net short position/ index long position percentage or resistance zone breakout, the Nifty index can drift lower with some short-term pullbacks in between.

Source: web.strike.money

Stocks to watch

Among the stocks expected to perform better during the week are City Union Bank, Federal Bank, MFSL, National Aluminium, Eicher Motor, HDFC Bank, Laurus Lab and Apollo Hospital.

Among the stocks that can witness further weakness are IndusInd Bank, Nestle, Astral and Birla Soft.

Cheers,

Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!