When it comes to the stock markets, just like cricket, Bollywood, or even politics, everyone has an opinion. But the market opinions that matter the most belong to people actually managing the money. The Moneycontrol Market Sentiment survey aims to gauge the mood of the market and get a sense of its direction by polling money managers.

The continued strong earnings momentum of corporate India will help the market eventually trump the short-term negative effects of the ongoing elections in key states like Uttar Pradesh and concerns over the US Federal Reserve raising interests, the eighth edition of the Moneycontrol survey of domestic fund managers revealed.

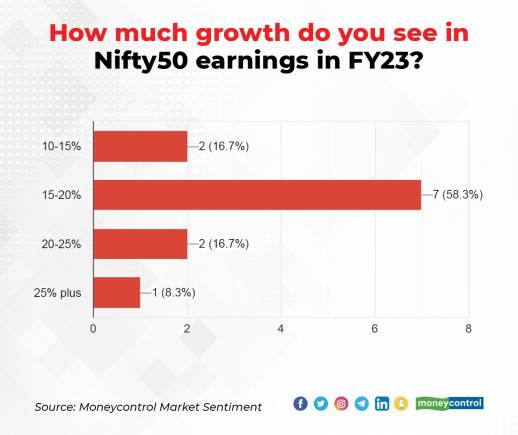

Earnings of Nifty 50 companies grew 25 percent year-on-year in the quarter ended December on a topline growth of 30 percent on-year. Nearly three out of five fund managers surveyed expect corporate earnings to grow by 15-20 percent in the next financial year on top of the near 30 percent growth expected for 2021-22.

That said, two of three fund managers polled expect the equity market to undergo a time correction or sideways movement in the short term and only a handful see a material rebound from current levels.

Twelve fund managers, managing assets worth $115 billion, participated in this edition of the Moneycontrol Market Sentiment Survey.

Domestic equity markets have been extremely volatile with the India VIX index crossing the much-dreaded 20-point mark this month as investors juggle concerns around geopolitical tensions in Eastern Europe, the impending outcome of state elections in Uttar Pradesh, crude oil nearing $100, and prospects of the US central bank raising interest rates.

The Nifty 50 index has failed to hit its record high for more than four months, the longest such streak since it breached the pre-pandemic high in late 2020.

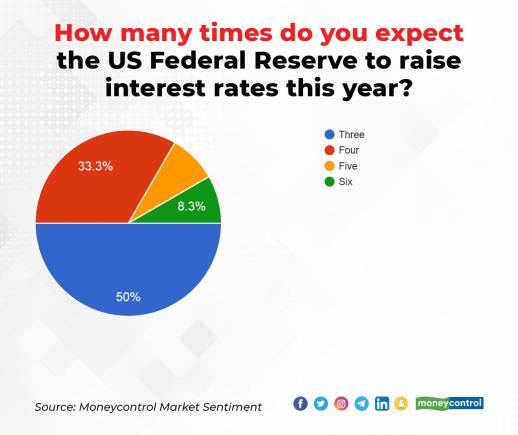

While the geopolitical tensions between Ukraine and Russia have caught the market’s attention in recent weeks, investors have been more concerned about the pace at which the US Federal Reserve will raise interest rates to tame multi-decade high inflation.

Investment bank HSBC sees the US Fed raising rates by five times this year including a 50 basis points hike in the upcoming March meeting. However, the majority of fund managers surveyed by Moneycontrol do not expect the central bank to raise interest rates by more than three times.

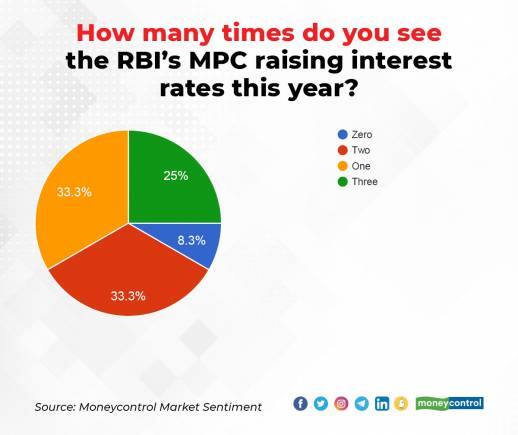

As for the Indian central bank, fund managers are divided on whether the Reserve Bank of India’s Monetary Policy Committee will raise the repo rate one time or two times in 2022. But, an overwhelming 90 percent of the fund managers expect the MPC to raise rates despite the recent dovish commentary at the monetary policy meeting earlier this month.

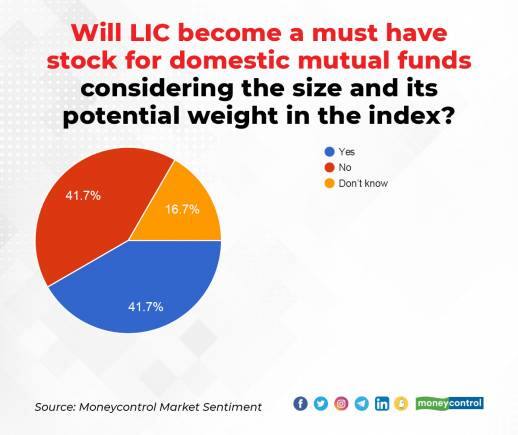

The filing of the draft papers for the initial public offering of Life Insurance Corporation of India, the biggest IPO in India’s history, has led to questions over its impact on the liquidity in the secondary market going ahead. The majority of fund managers disagreed with the statement that IPO will accelerate selling pressure in the run-up to the IPO’s launch.

Fund managers were also divided on whether LIC’s stock will be a must-have for domestic mutual funds considering its large size and potential weight in key indices like Nifty 50 as and when it is included.

Overall, 50 percent of the fund managers expect the Nifty 50 to give returns of 10-15 percent in 2022 despite the dodgy start to the year while more than 40 percent see only high single-digit returns for the index. For comparison, Nifty 50 rose more than 20 percent in 2021.

The cash position of the fund managers also remained largely unchanged from the previous survey at around 3-5 percent.

In terms of investment bets, a third of the fund managers indicated they will deploy funds in banks, real estate, information technology and automobile stocks going ahead. While IT stocks have come in for a correction in-line with global technology stocks, banks and automobile stocks have seen an outperformance in recent weeks.

Despite the steep correction in shares of new-age technology stocks seen in the course of the past two months, 67 percent of the fund managers saw no value yet. Almost 42 percent of the participants said they will avoid new-age technology stocks followed by consumer staples and pharmaceutical stocks.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.