April 24, 2020 / 16:50 IST

Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities:

We are of the view that the market will remain volatile throughout the next week. Technically, profit booking was seen in Nifty between 9300-9350 levels, and we can expect further price correction below 9150. For the next few trading sessions, 9150 should act as a trend decider level, below which we can expect one more correction wave up to 9050-9000 level. However, trading above 9150 could possibly open another uptrend rally up to 9275.

April 24, 2020 / 16:45 IST

Sugandha Sachdeva VP-Metals, Energy & Currency Research, Religare Broking:

After gaining some lost ground, the Indian rupee again succumbed to selling pressure, registering losses of 0.51 percent to finish the day at 76.45 mark on the back of renewed weakness in domestic equities and a strengthening US dollar. However, the local unit ended the volatile week marginally higher by 0.10 percent.

Market participants continue to gauge the contraction in economic activity throughout the world as a fall-out of the coronavirus pandemic for further cues. The bumpy ride looks to continue for the domestic currency as there is no end in sight to this pandemic, where the level of 77 will act as a strong cushion area.

Once the said support of 77 mark is taken out, the domestic currency looks inclined to witness further depreciation towards the level of 77.50.

April 24, 2020 / 16:13 IST

Ajit Mishra, VP - Research, Religare Broking:

The continuous underperformance from the banking pack will remain the overhang on the benchmark ahead also. Consistent buying interest mainly in pharma and select FMCG majors is indeed providing some solace to the participants but it’s not sufficient enough to trigger a sustainable up move in the benchmark. Nifty may see fresh slide below 9000 so traders should plan their positions accordingly.

April 24, 2020 / 16:05 IST

Rohit Singre, Senior Technical Analyst at LKP Securities:

For coming session Nifty has good base near 9000-8800 zone if managed to hold above said levels we may see some consolidation move in the range of 9400-8800 zone, immediate hurdle for Nifty is coming near 9300-9400 zone. Nifty Bank closed a week at 19587 with big loss of 5 percent on weekly basis forming a bearish candle, Nifty bank needs to hold above 18700-18500 zone for rebounding move otherwise sharp cuts may be seen below 18500 zone on the other hand resistance for Nifty Bank is coming near 20000-20350 zone.

April 24, 2020 / 15:54 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Indian indices fell by over 1.5%, in sync with global markets and tracking increasingly weak economic data from countries around the world and especially in the US. There was also uncertainty regarding the effectiveness of a vaccine that was in development, which contributed to the overall negativity. Markets are expected to remain volatile considering the rising number of cases in India and no positive signals from the ongoing earnings guidance.

April 24, 2020 / 15:51 IST

S Ranganathan, Head of Research at LKP Securities:

Market shaved off today as winding up of a few debt schemes by a large fund house in India added to the selling pressure witnessed in Banks and NBFC stocks. Reliance and a few Pharma names were the only saving grace in today's trade. Investors should have a clear asset allocation strategy to navigate the present volatility created by the Pandemic.

April 24, 2020 / 15:35 IST

Market Close

: Benchmark indices ended on negative note in a volatile session on April 24 with Nifty finished below 9,200 level.

At close, the Sensex was down 535.86 points or 1.68% at 31327.22, while Nifty was down 159.50 points or 1.71% at 9154.40. About 773 shares have advanced, 1545 shares declined, and 159 shares are unchanged.

Bajaj Finance, Bharti Infratel, Zee Entertainment, Bajaj Finserv and Hindalco were among major losers on the Nifty, while gainers included Reliance Industries, Britannia Industries, Cipla, Sun Pharma and Hero MotoCorp.

On the sectoral front, except energy and pharma all other indices ended lower. BSE Midcap and smallcap indices close with over 1 percent cut.

April 24, 2020 / 15:26 IST

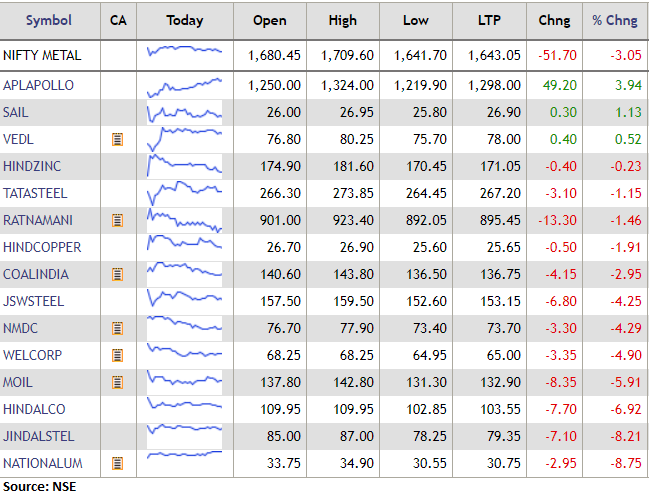

Metal Index down 3 percent led by the Nalco, Jindal Steel, Hindalco:

April 24, 2020 / 15:10 IST

Nomura on Sun TV

The broking house has maintained buy call and cut target to Rs 588 from Rs 731 per share. The subscriptions is going strong in the tough times and expect healthy subscription growth of 12%/6% in FY21/ 22. However, it lower FY21/22 revenue estimates by 22%/ 11% & EBITDA by 18%/10%