April 16, 2020 / 16:43 IST

Anuj Gupta DVP Commodities and Currencies Research, Angel Broking:

Today Rupee touched life time low at 76.86 against dollar. This is due to the lower India growth forecast and also the lower interest rate in India. FII outflow was around USD 4.9 bilion of Indian shares so far in March and this is surpass the 2008 figures.

Upcoming GDP and IIP data may be lower in India due to the lower industrial activity and lockdown in India may reduces spendings. Lower demand may also be the reason of the big dent on the indian economy. However lower crude prices and good monsoon expectation may support the Indian economy further.

April 16, 2020 / 16:41 IST

Gaurav Ratnaparkhi, Senior Technical Analyst, Sharekhan by BNP Paribas:

Going ahead, 9100, which is near 61.8% retracement mark will be the key resistance to watch out for. A larger structure shows that the index is forming a bearish Wedge pattern. Thus unless 9300-9400 gets taken out on a closing basis Nifty is expected to resume the larger downtrend. Initial target area in the south is at 8650 - 8500 with a potential to slide down to 8000 subsequently.

April 16, 2020 / 15:58 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Economic data from around the world remained grim and global markets also remained weak. Stock specific news and information with regards to normalization of business is expected to drive stock and sector specific action in the markets.

April 16, 2020 / 15:34 IST

Market close

: Indian indices broke the two days losing streak and ended higher in the volatile session on April 16.

At close, the Sensex was up 222.80 points or 0.73% at 30602.61, and the Nifty was up 67.50 points or 0.76% at 8992.80. About 1596 shares have advanced, 743 shares declined, and 148 shares are unchanged.

NTPC, Vedanta, ICICI Bank, Hindalco and Titan were among major gainers on the Nifty, while losers were HCL Tech,, Kotak Mahindra Bank, Tech Mahindra, Hero MotoCorp and Infosys.

Except IT and FMCG all other sectoral indices ended in the green.

April 16, 2020 / 15:27 IST

Sumeet Bagadia, Executive Director at Choice Broking:

MCX Gold Futures is expected to remain bullish in the coming week amid rising deaths owing to the Pandemic coronavirus. Moreover, global crude prices can also find support with negative manufacturing data in the United States for the month of March and rising worries of global recession after the IMF had declared that the world can witness a decline in growth rate by 3%.

Volatile global equity markets are creating fear in the minds of investors about how long the pandemic would continue. However, major upside movement in global gold prices could be capped amid stronger dollar in the global market with a stimulus package news by the Indian government in the coming days.

Indian government is also planning to give some lockdown reliefs, opening up of some industries in rural areas after April 20th to reduce the distress caused to millions of people because of a prolonged lockdown to halt the spread of coronavirus, which includes farm activities, construction of roads and buildings in the hinterland which has so far been less affected by the coronavirus contagion.

This is expected to improve business activities in the coming week and we are hoping the COVID-19 reports to be flattened in India which can bring cheers and limit extreme bullishness in gold prices.

April 16, 2020 / 15:22 IST

Morgan Stanley overweight on Grasim

Morgan Stanley has maintained overweight on Grasim with a target at Rs 756 per share.

The strong cyclical headwinds could put significant pressure on earnings, while supply-side challenges to ease by the end of this month, reported CNBC-TV18.

April 16, 2020 / 15:01 IST

Morgan Stanley underweight on Hero Moto

Morgan Stanley has remained underweight on Hero MotoCorp with target at Rs 2,000 per share.

It has lowered the FY020 EPS by 7.8% and assume Rs 10,000 per bike discount for 1.5 lakh inventory cleared in last 2 weeks of FY20.

April 16, 2020 / 14:45 IST

Rupee ends at record low

Indian rupee ended at fresh record low at 76.86 per dollar on April 16 amid volatility in the domestic equity market.

April 16, 2020 / 14:28 IST

Buzzing

: Hindustan Composites share price rose 10 percent intraday on April 16 after the company resumed partial operations at its Aurangabad unit.

April 16, 2020 / 14:13 IST

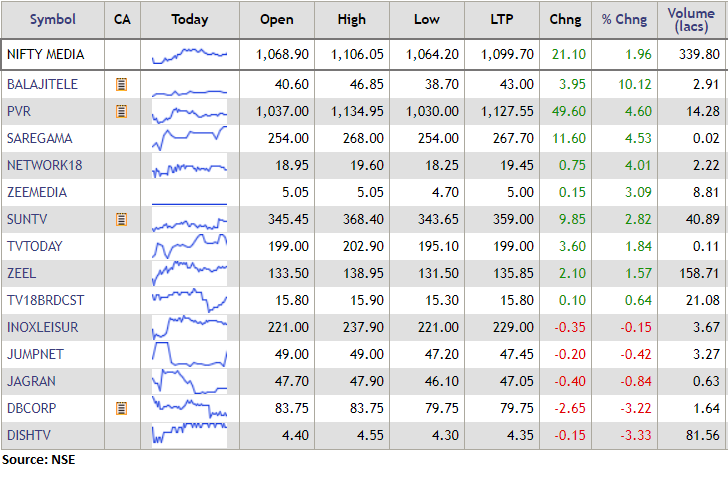

Nifty Media Index up 2 percent led by the Balaji Tele, PVR, Saregama: