Taking Stock: Sensex, Nifty Close In The Red Again; Metals Outperform

Selling seen in auto, infra and pharma sectors, while metal, IT and PSU bank end in the green.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,138.27 | -503.63 | -0.59% |

| Nifty 50 | 26,032.20 | -143.55 | -0.55% |

| Nifty Bank | 59,273.80 | -407.55 | -0.68% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Asian Paints | 2,954.40 | 86.80 | +3.03% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Interglobe Avi | 5,697.50 | -96.50 | -1.67% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Pharma | 22905.00 | 17.20 | +0.08% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Bank | 59273.80 | -407.50 | -0.68% |

Markets opened in the red on the back of weak cues and drifted lower on higher WPI and partial lockdown in certain states. However, a spirited rally in Metals & IT stocks in afternoon trade with support from financials helped Indices recoup part of the losses.

Weakness in national macro data and rise in global bond yield ahead of the crucial FED monetary policy meeting dented domestic momentum. Both the inflations of retail and wholesale, inclined higher than estimated while industrial production de-grew in January 2021. However, optimism in European & other Asian markets helped to recover from the sharp initial losses. We can expect this volatility to stabilize based on the global outlook post a confirmation from FED to maintain an accommodative policy.

Indian rupee has extended the early gains andended higher by 33 paiseat 72.48per dollar, amid sellingsawin the domestic equity market.

It opened higher by 9 paise at 72.72 per dollar against Friday's close of 72.81 and traded in the range of 72.39-72.77.

Indian benchmark indices fell for the second day in a row on March 15 but recovers some of the intraday losses with Nifty finishing above 14,900 mark.

At close, the Sensex was down 397.00 points or 0.78% at 50,395.08, and the Nifty was down 101.50 points or 0.68% at 14,929.50. About 1210 shares have advanced, 1788 shares declined, and 207 shares are unchanged.

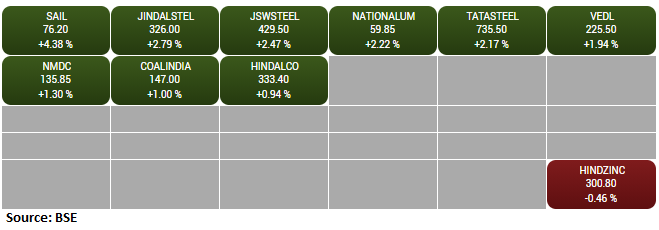

Divis Labs, Hero MotoCorp, Coal India, Bajaj Finserv and GAIL were among major losers on the Nifty, while gainers included JSW Steel, Tata Steel, Tech Mahindra, Power Grid Corp and IndusInd Bank.

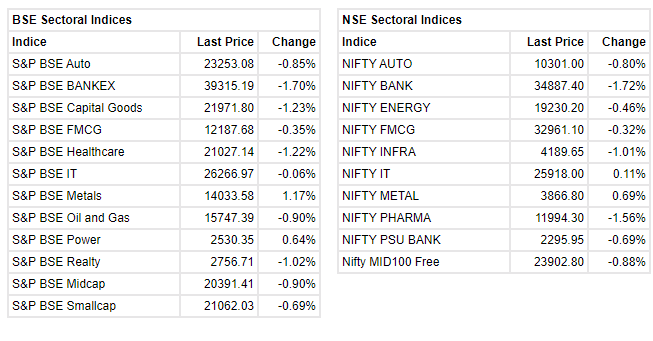

Among sectors, metal, IT and PSU bank indices ended in the green, while seling witnesse in the auto, infra and pharma sectors. BSE Midcap and Smallcap indices ended 0.5 percent lower.

The market witnessed some swift recovery from its short-term support around the Nifty50 Index level of 14,800 in the market. The expected level should range between 14,950 and 15,300, and it’s going to crucial for the short-term market scenario to sustain above the 14,800 to keep the long-term uptrend intact. While it is subject to further price action evolution, it is prudent to wait for a decisive breakout above 15,000 and technical factors to improve before going long in the market.

The traders are advised to refrain from building a new buying position until further improvement is seen and a breakout above 15,000.

Alkem Laboratories announced the launch of Brivasure, an affordable anti-epileptic drug for the treatment of Epilepsy in India, company said in release.

At 15:05 hrs Alkem Laboratories was quoting at Rs 2,692.95, down Rs 79.50, or 2.87 percent on the BSE.

Indian rupee has extended the early gains and trading near the day's high level at 72.52 per dollar, amid selling seen in the domestic equity market.

It opened higher by 9 paise at 72.72 per dollar against Friday's close of 72.81.

: Benchmark indices have recovered some losses but still trading lower with Nifty around 14850.

At 14:47 IST, the Sensex was down 655.02 points or 1.29% at 50,137.06, and the Nifty was down 177 points or 1.18% at 14,854. About 982 shares have advanced, 1830 shares declined, and 163 shares are unchanged.

The initial public offering (IPO) of Laxmi Organic Industries was subscribed 1.23 times on March 15, the first day of bidding as investors put in bids for 3.99 crore equity shares against the offer size of 3.25 crore shares, subscription data available on exchanges showed.

The portion reserved for retail investors subscribed 2.34 times and that of non-institutional investors 28 percent but qualified institutional buyers were yet to bid for the issue.