India's corporate sector revenue growth fell to an 11-quarter low in the first quarter of the financial year 2020, said investment Information and credit rating agency ICRA.

"The cumulative revenue growth of 642 companies in the Indian corporate sector skid to an 11-quarter low at 5.7 percent in Q1 FY20 mainly due to weak consumer sentiments and subdued government spending on Infrastructure," ICRA said.

Shamsher Dewan, Vice President and Sector Head - Corporate Sector Ratings, ICRA said the weakness in the consumer-linked sectors was visible in multiple sectors.

"Automobiles sales reported a sharp double-digit decline, which has continued into the current quarter as well, while FMCG companies reported a sequential slowdown in volume growth in both rural and urban markets," he said.

As per the rating agency, cement volume growth slowed to 1.8 percent due to slowdown in project execution on account of general elections, economic slowdown impacting private sector capex, as well as liquidity issues and labour scarcity. Steel consumption, on the other hand, grew by 7 percent during the quarter on a YoY basis.

However, some companies in the consumer durable sector reported growth during the quarter on the back of sales of cooling products due to the extended and harsh summer.

IT sector reported strong revenue growth of 10 percent in Q1FY20 (in rupee terms) supported by rupee depreciation on a YoY basis and traction in digital offerings across verticals.

ICRA further said that the financial results of its sample companies reflected a sequential revenue contraction of 7.7 percent in consumer-oriented sectors, while demand from the infrastructure segment was also down, with government spending on infrastructure projects reducing in the run-up to the general elections in Q4FY19 and Q1FY20.

"This was reflected in the sharp slowdown in growth in gross fixed capital formation (GFCF) during the two quarters to 3.6 percent and 4 percent and the slowdown in cement production volume growth," ICRA said.

The EBITDA margin, however, reflect an improvement of 136 bps on a year-on-year (YoY) basis and remained flat sequentially at 17.7 percent in Q1FY20, largely on account of the transition to Ind AS 116, whereby operating leases have been capitalized by the companies, thereby reducing rental costs and increasing depreciation and interest outgo, the rating agency said.

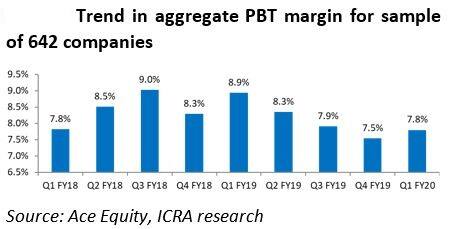

PBT margins, on the other hand, contracted on a YoY basis by 114 bps to 7.8 percent and improved sequentially, ICRA added.

"The contraction in PBT margins was due to the subdued volumes, negative operating leverage, high discounting and tepid realization in select commodity sectors, especially metals,” said Dewan.

The interest coverage ratio of the sample companies, which was adjusted for sectors with low debt levels such as IT, FMCG and Pharmaceuticals, witnessed a decline to 3.5 times from 4.1 times in Q1FY19 and 3.7 times in Q4FY19.

"This was driven by sharp YoY increase of 22 percent in interest costs on account of higher interest rates, increase in debt levels and Ind AS 116 adjustments, on account of which lease rentals have been bifurcated into interest and depreciation costs. Sectors like oil & gas, telecom and construction saw a significant increase in interest costs on a YoY basis," ICRA said

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!