India Inc saw higher number of credit rating upgrades than downgrades in H1 FY24, however the pace of downgrades has increased, said rating agencies.

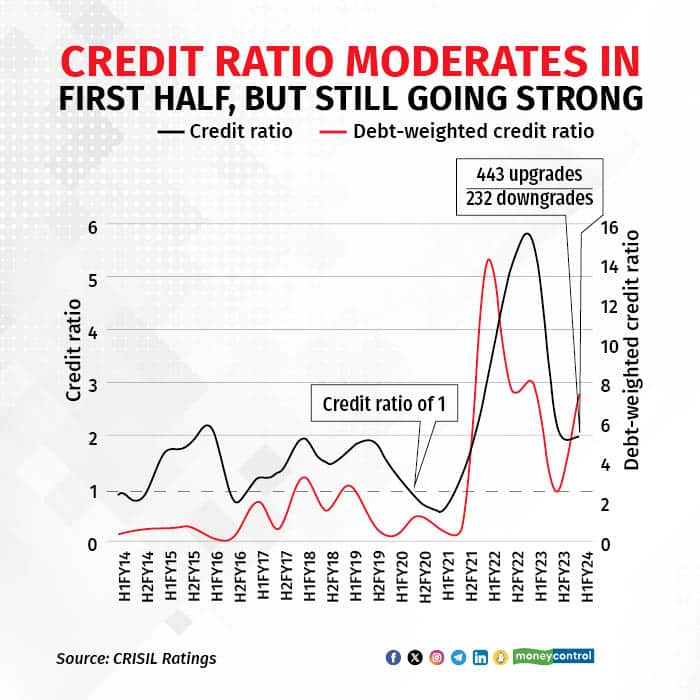

The CRISIL Ratings credit ratio moderated in the first half of this fiscal to 1.91 from 2.19 in the second half of last fiscal. Credit ratio is the proportion of rating upgrades to downgrades. A ratio higher than 1 denotes more upgrades than downgrades.

Similarly, CareEdge Ratings’ credit ratio has moderated to 1.67 in H1 FY24, down from 2.72 seen in H2 FY23.

According to economists, upgrades are largely being led by sectors that are benefitting from growth in domestic demand and high government spending. "Improved revenue growth is the primary reason for 65 percent of all upgrades," said CRISIL. Essentially, BFSI and manufacturing sectors are the biggest beneficiaries of the upgrades.

Credit ratio of the BFSI sector saw an upward momentum, majorly due to robust loan growth both in the NBFC and banking space, said CareEdge.

Credit ratio of the BFSI sector saw an upward momentum, majorly due to robust loan growth both in the NBFC and banking space, said CareEdge.

"Continued strengthening of balance sheets, improvement in asset quality and strong credit growth driven by sustained retail and corporate credit growth benefitted the sector’s credit profile," added analysts.

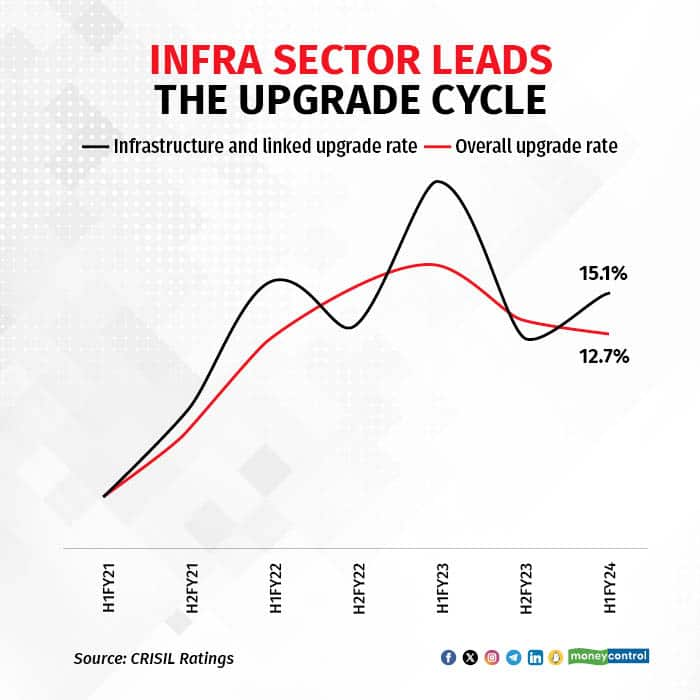

In the infra segment, strong budgetary allocation, better risk sharing in contracts and acceptability of investment vehicles such as InvITs, drove the upgrades cycle.

"Moreover, upgrades in renewable power segment are being driven by improved cash flows and faster realisation from counterparties. Residential real estate developers are on a strong footing backed by liquidation of existing inventory and new launches amid healthy sales growth," said CRISIL Ratings.

Meanwhile, most downgrades in H1 FY24 were witnessed by small and mid-sized companies across chemicals, textiles, API (Active Pharmaceutical Ingredients) drugs and agro-based sectors, with many of them being focused on exports.

These companies have "inherently weak credit profile", said CareEdge.

Other major reason behind downgrade actions was liquidity mismatches. "However, liquidity challenges were not due to any systematic disruptions, and were largely from entity-specific issues," noted India Ratings.

Summing it up, Somasekhar Vemuri, Senior Director, CRISIL Ratings said that India's credit quality outlook remains positive with upgrades expected to outnumber downgrades for the rest of this fiscal, too.

"But downside risks have increased with inflation obstinately high and major central banks hawkish on interest rates. While growth worldwide has been holding out, the impact of a likely global deceleration on export oriented sectors (especially goods exports) needs watching," he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.