Nandish Shah, Senior Derivative & Technical Analyst at HDFC Securities

The Nifty plunged by 427 points on June 13, to close at 15,774 levels. This is the highest percentage daily fall since May 19, 2022. The fall was led by mainly technology, metal, and banking stocks. This is the lowest closing level since July 30, 2021 for the Nifty. In the last seven sessions, the benchmark has fallen more than a thousand points from the high of 16,793 levels, made on June 3 this year.

Short-term trend for the Nifty is bearish as it trades below its 5, 20, and 50-day EMA (exponential moving average). It has been making lower tops and lower bottoms for the last several weeks. The 20-week SMA (simple moving average) is now sloping down and is placed below the 50-week SMA, implying a negative moving average crossover. The 14-week and 14-month RSI (relative strength index), too, are in decline mode, which calls for caution.

In the Index Futures segment, FIIs have created fresh shorts during the last few days, where their net long to short ratio has fallen to 0.26 level from 1.26 levels on May 30. In the options segment, we have seen aggressive call writing at 17,400-17,500 levels.

Therefore, we believe that the short-term trend will remain bearish till the Nifty is trading below 16,500 levels.

On the downside immediate support is placed around 15,670 odd levels, a low made on March 8, 2022. Far support is seen around 15,400 levels.

Here are three buy calls for the next 3-4 weeks:

Deepak Fertilizers: Buy | LTP: Rs 655.6 | Stop-Loss: Rs 603 | Target: Rs 735 | Return: 12 percent

The stock price has broken out from the symmetrical triangle on the daily chart on June 1, 2022. The primary trend of the stock is positive as it is trading above its all-important medium-term and long-term moving averages.

The stock price has corrected 10 percent from the recent high which we believe is an opportunity to accumulate stock.

NCC: Buy | LTP: Rs 59.5 | Stop-Loss: Rs 56 | Target: Rs 67 | Return: 13 percent

After correcting 10 percent from the June month's high, the stock price has reached the upward sloping trendline support, adjoining the lows of February 24 and May 26, 2022.

During the last few months, the stock price has formed multiple bottoms around Rs 58 levels. Momentum Oscillators RSI (11) on the daily chart has reached near an oversold level of 30. The stock price has corrected 15 percent year-to-date, which we believe is an opportunity to accumulate stock.

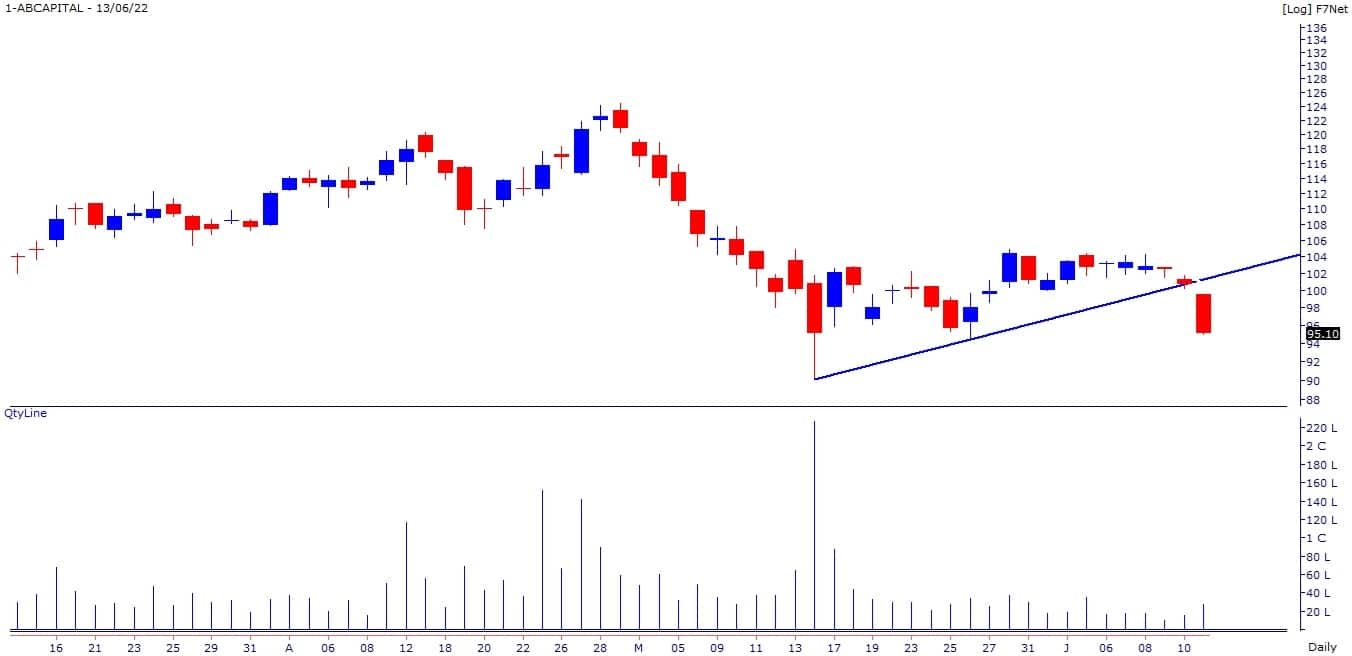

Aditya Birla Capital: Sell | LTP: Rs 95 | Stop-Loss: Rs 100 | Target: Rs 87 | Return: 8.5 percent

The stock price has broken down from the upward sloping trendline on the daily chart, adjoining the lows of May 16 and May 26, 2022. The stock price is forming lower top lower bottom formation on the weekly chart.

Momentum Oscillator like RSI and MFI (money flow index) is placed below 40 and sloping downwards, Indicating strength in the current downtrend of the stock.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!