Bulls came back with a vengeance as the Nifty surged nearly 200 points and ended near the day’s high. At close, the Nifty was up 1.08 percent or 195 points at 18,264, highest gain in percent terms in the current fiscal. From the low of April 21, 2023, the Nifty has witnessed a rally of more than 700 points in a span of just 10 trading sessions.

Primary and intermediate trend of the Nifty remains positive as it trades above its important moving averages. Momentum Oscillators like RSI (relative strength index - 11) and MFI (money flow index - 10) on the daily and weekly chart suggest strength in the current bullish trend. Therefore, we believe that this uptrend in the Nifty is likely to continue for the coming weeks.

After surpassing a hurdle of 17,550 levels few weeks back, the benchmark index witnessed a decisive breakout from another key resistance of 17,864 last week. This level will now interchange its role as a support going forward.

In the Derivative side, we have seen aggressive Put writing at 17,800-18,000 levels. This level coincides with the 20-day EMA (exponential moving average) which is placed at 17,863. Therefore, on the downside, 17,800-17,900 could now be considered as an immediate support for the Nifty.

On the upside swing high of 18,473 (December 21, 2022) could act as an immediate resistance for Nifty. Above 18,473, the Nifty could move towards next resistance level of 18,700 and 18,888.

Traders are advised to hold longs with trailing stop-loss of 17,900 in Nifty on closing basis.

Considering the positive momentum currently being seen in the markets, we believe midcap and small-cap stocks could continue their outperformance and thereby offering some opportunities for short term traders.

Here are three buy calls for the next 3-4 weeks:

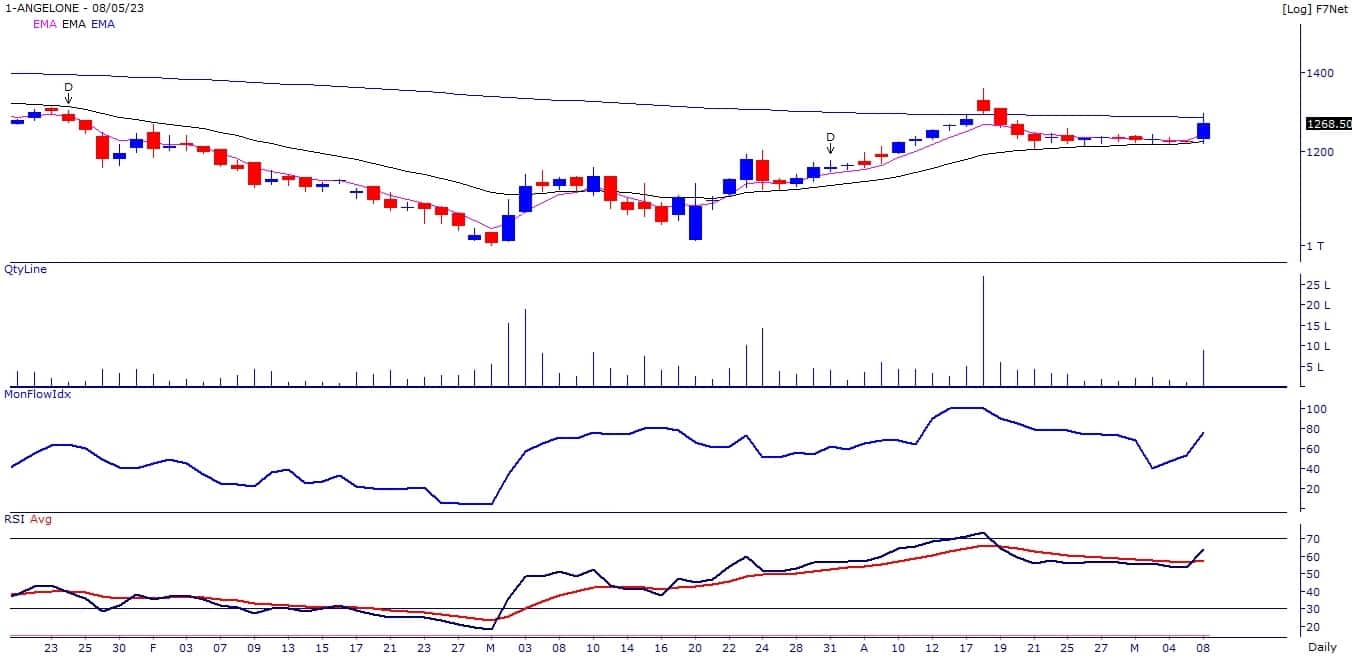

Angel One: Buy | LTP: Rs 1,268.5 | Stop-Loss: Rs 1,150 | Target: Rs 1,390-1,440 | Return: 14 percent

The stock price has broken out on the daily chart with higher volumes. It has formed multiple bottoms in the vicinity of Rs 1,200-1,220 levels on the daily chart. Momentum oscillators - RSI (11) and MFI (10) is sloping upwards and placed above 60 on the daily chart, indicating strength in the stock.

Plus DI (directional indicator) is trading above minus DI while ADX (average directional index) line is placed above 25, Indicating momentum in the current uptrend.

MSTC: Buy | LTP: Rs 307.75 | Stop-Loss: Rs 285 | Target: Rs 336-355 | Return: 15 percent

The stock price has broken out on the daily chart from the downward sloping trendline, adjoining the highs of November 30, 2022 and February 1, 2023. Price up move is accompanied by the surge in volumes indicating strong uptrend.

Primary and intermediate trend turned positive as stock price has closed above its 50, 100 and 200-day EMA (exponential moving average). Momentum Oscillators - RSI (11) and MFI(10) is sloping upwards and placed above 60 on the daily chart, indicating strength in the stock.

NOCIL: Buy | LTP: Rs 236.75 | Stop-Loss: Rs 220 | Target: Rs 255-265 | Return: 12 percent

Primary trend of the stock turned positive as stock price has crossed its 200-day EMA. Stock price has broken out on the daily chart from the downward sloping trendline, adjoining the highs of October 7, 2022, January 4, 2023 and February 20, 2023.

Stock Price has formed multiple bottoms around Rs 200 levels on the daily and monthly chart. Momentum Oscillators - RSI (11) and MFI(10) is sloping upwards and placed above 60 on the daily chart, indicating strength in the stock.

Plus DI is trading above minus DI while ADX line is placed above 20, indicating momentum in the current uptrend.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.