Analysts seem to have pinned their faith on the long-term business prospects of Hindalco, one of India’s biggest aluminium manufacturers. Yet, they seem to be anxious about the metal company’s near-term performance.

In the past year, shares of Hindalco — that houses the US-based Novelis, the largest producer of aluminium beverage can sheets — have only delivered 1 percent returns compared to the benchmark Nifty Metal index, which has rallied 14 percent.

Despite this underperformance, analysts are happy to recommend this stock to investors. Of course, with many caveats.

Analysts see weakness in the Q1 FY23-24 earnings of Novelis, as well as in Hindalco’s India operations, brought on by lower volumes as well as prices.

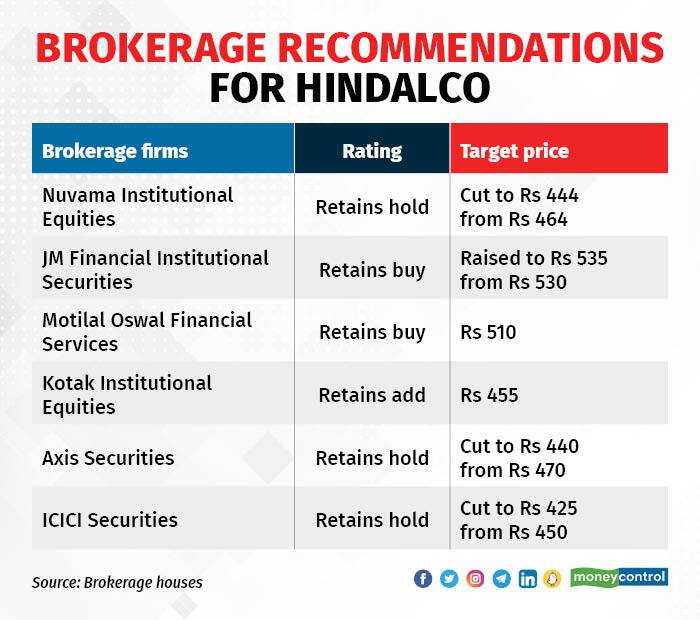

Hindalco brokerage recommendations

Hindalco brokerage recommendations

Rising capex a worry

The company’s management hopes to fund the major portion of its ongoing expansion through internal accruals, both in India and at Novelis, USA. The capex for FY23-24 is guided to be Rs 50 billion for the Indian operation and $1.6–1.9 billion for Novelis. The capex was Rs 3,000 crore in FY22-23.

Satish Pai, Managing Director of Hindalco Industries, said in a post-earnings call that the company would fund its entire capex requirements through internal accruals and will not raise debt.

Read more | India’s copper and aluminium demand strong, says Hindalco MD Satish Pai

But Nuvama Institutional Equities has expressed concerns about consolidated net debt rising in FY23-24 and FY24-25, considering that the entire capex might not be internally funded. It sees consolidated net debt rising to Rs 38,100 crore in FY23-24 and Rs 43,100 crore in FY24-25.

The release of working capital led to a significant reduction in consolidated net debt during the quarter, which came down to Rs 34,000 crore from Rs 41,700 crore in the December quarter.

Earnings outlook — no great shakes

The management has not guided for any reduction in the cost of production. Also, as the copper unit, which contributes substantially to domestic operations, is undergoing a scheduled maintenance shutdown until mid-June, 2023, it will impact the company’s margins to an extent, Motilal Oswal Financial Services pointed out. This prompted the brokerage firm to lower its consolidated EBITDA and APAT (adjusted profit after tax) estimates by 2 percent and 5 percent, respectively, for FY23-24.

Nuvama Institutional Equities believes Hindalco will report a weak EBITDA in Q1 FY23-24 because of softer aluminium prices, and lower aluminium as well as copper volumes. Accordingly, it has slashed its EBITDA estimate for FY23-24 and FY24-25 by 8.3 percent and 8.7 percent, respectively, and built in lower prices and higher costs.

Aluminium prices have corrected 8-10 percent from the quarter ending March 2023, primarily due to persistently weak global demand outweighing supply-side risks in the market, as per analysts.

Kotak Institutional Equities has pointed out that even though Hindalco has guided for stable costs in the near term, it believes LME (London Metal Exchange) aluminium prices will remain under pressure due to weak demand and declining cost support.

Cans biz lacks fizz

Novelis is the leading buyer and recycler of used beverage cans globally. Headwinds from channel destocking and a weak macro continue to impact beverage cans and specialty segments, which form around 80 percent of its volumes.

The management expects beverage can debottlenecking to continue in Q1 FY23-24, and stabilise 2Q FY23-24 onwards.

Read more | Largest macroeconomic uncertainty is the status of the Chinese economy: Hindalco MD

Axis Securities said the destocking phase of the key can segment is likely to persist till Q1 FY23-24 at Novelis, hence margin recovery will be gradual. Kotak Institutional Equities also raised a similar concern, that Novelis continues to face demand headwinds in beverage cans and specialty segments, making the brokerage firm believe margins will remain choppy in the near term.

Given the uncertainties in the near term, the company has deferred volume guidance for FY23-24. The management expects normalisation of margins by Q4 FY23-24, hence the next two-three quarters are likely to remain choppy.

Long-term biz in good shape

Despite the near-term uncertainty, the long-term outlook for Hindalco continues to remain buoyant.

The factors that have driven JM Financial Institutional Securities to believe that the metal major’s long-term outlook is good are: Novelis maintaining medium-term EBITDA per ton guidance of approximately $525 (expected by 4Q of FY23-24), resilient performance by its Indian aluminium operations, enhanced coal security post the acquisition of Meenakshi and Chakla coal mines, and capex to augment capacity in downstream businesses.

Time to buy the stock?

The stock has fully priced in headwinds, such as a slowdown in China, and the impact of high-interest rates and higher input costs, according to Motilal Oswal Financial Services.

Read more | Novelis Q4 profit decline disappoints Hindalco investors but brokerages retain Buy

It sees robust demand in India, an increase in capacity utilisation, higher spends on infrastructure, better business sentiment, and moderating commodity prices supporting the company’s performance going ahead.

“We remain confident about the company’s long-term growth opportunities and believe that any weakness in the stock after Q4 results should be an opportunity to buy,” said Motilal Oswal Financial Services. Nuvama Institutional Equities also awaits a lower entry point in the stock.

Though the stock trades at an inexpensive valuation of 5.4 times EV/EBITDA FY25, the uncertain outlook of Novelis’ earnings should keep the stock under pressure in the near term, according to Kotak Institutional Equities.

ICICI Securities also expects near-term challenges to prevail on stock performance, despite long-term benefits from capacity expansion at Novelis, and value-added capacity enhancement at India operations.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!