Brokerages are upbeat on dairy player Heritage Foods after its posted its September quarter earnings and believe the stock could turn out to be multibagger.

Heritage Foods on October 28 reported a 79.6 percent year-on-year (YoY) fall in its September quarter consolidated net profit at Rs 2.91 crore against Rs 14.26 crore in the same quarter a year ago.

Net sales slipped about 10 percent YoY, coming at Rs 610 crore in Q2FY21 against Rs 680 crore in Q2FY20.

As per the company's website, it deals in dairy and renewable energy and its milk and milk products have a market presence in Andhra Pradesh, Telangana, Karnataka, Kerala, Tamil Nadu, Maharastra, Odisha, NCR Delhi, Haryana, Rajasthan, Uttarakhand & Uttar Pradesh.

What do brokerages say?Brokerage firm Elara Securities said the fall in the company's revenue in Q2 was on expected lines.

The brokerage has a 'buy' call on the stock with a target price of Rs 629, which is 105 percent higher than the stock's close at Rs 306.20 on BSE on October 30.

Elara has upgraded its earnings by 127 percent for FY21E and 17 percent for FY22e to factor in a higher gross margin for FY21E of 27.5 percent, which, as per the brokerage, is unsustainable and over a cycle will revert to an average margin of 22 percent.

"We reiterate a 'buy' with a higher target price of Rs 629 from Rs 567 as we value core dairy business at Rs 603 on 10 times (unchanged) FY22E EV/EBITDA and investments in Future Retail valued at Rs 26 per share," Elara said.

Elara said the company's liquid milk and curd volume contracted 20.3 percent YoY and 34.4 percent YoY, respectively, because of subdued out-of-home (OOH) consumption, withdrawal of operations from Punjab and Rajasthan as part of the rationalisation exercise and one-week disruption caused by unprecedented rains in Hyderabad and parts of Andhra Pradesh.

Elara pointed out that the company's Q2FY21 EBITDA was up 296.1 percent YoY which was 77 percent ahead of the brokerage's estimates. EBITDA margin expanded 1,110 bps YoY to 14.4 percent.

The company is planning to enter the cheese category with an aim of growing in eCommerce.

"The company is planning to enter the cheese category (Rs 20 crore per quarter in sales, three months of working capital) in the asset-light model (co-packaging facility) for growth in eCommerce where having cheese is essential for a complete portfolio," Elara said.

"The first half of FY21 cash flow from operations at Rs 160 crore is already at par with a yearly average operating cash flow of Rs 120-160 crore (last decade) and will be utilised for the retirement of high-cost debt of Rs 75 crore and expansion into cheese (Rs 20 crore)," Elara added.

Brokerage firm ICICI Securities, too, has a 'buy' call on the stock, raising the target price to Rs 400 from Rs 360.

"We model Heritage to report revenue and PAT CAGRs of 4.8 percent and 63 percent, respectively, over FY20-FY22. Core return ratios are expected to improve over the same timeframe," ICICI Securities said.

The brokerage expects milk procurement prices will be lower even in the second half of FY21 due to the commencement of the flush season. This will lead to better margins for the company. Moreover, the gradual re-opening up of the economy will steadily lead to higher revenues.

ICICI Securities highlighted that the company has initiated some cost-saving measures which have also helped to improve margins and the brokerage believes some cost-saving measures are structural in nature.

The stock hit its 52-week low of Rs 146.70 on March 25, 2020, on BSE and has now recovered 109 percent so far.

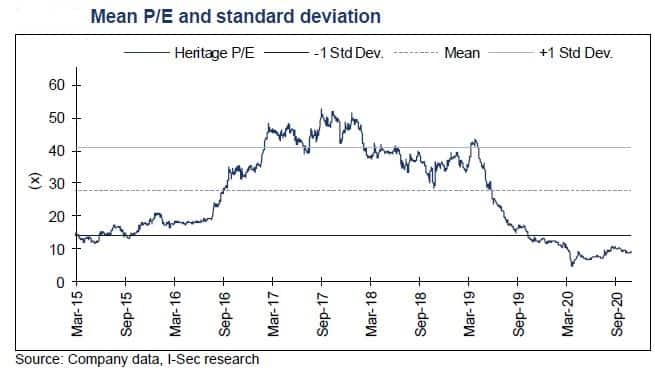

ICICI pointed out that the stock has traded at an average P/E of 29 times over the past three years and it is trading below its Mean PE- 1 SD (standard deviation) now.

Much of the stock's fortunes will depend on commodity prices. Any major increase in commodity prices may hit the prospects of the company's profitability.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.