Brokerages are optimistic about the specialty chemicals sector, terming it as one of the most promising sectors and a decadal growth opportunity for long-term investors.

The sector is rapidly growing, offering a strong opportunity to investors.

India is emerging as a fast-growing specialty chemicals hub amid a rise in competitiveness, driven by the availability of low-cost labour and lower regulatory costs, brokerage firm JM Financial pointed out.

The rising availability of low-cost feedstock for Indian players and India’s strong IP protection and improving R&D expertise are also the factors that are facilitating the sector's growth.

India’s specialty chemicals market has posted an 11.7 percent CAGR over CY14-19 against a 5.7 percent CAGR across the globe. At a valuation of $32 billion in CY19, the sector constitutes about 4 percent of the global specialty chemicals market. China still leads the $805 billion, with a 25 percent market share.

The brokerage firm believes India’s accelerated growth may continue with a 12.4 percent CAGR over CY19-25 versus a 6.4 percent CAGR globally.

"India’s specialty market is likely to reach $64 billion supported by robust growth in specialty chemicals exports, robust domestic consumption growth, and rising import substitution," JM Financial said.

However, the sharp run-up in the specialty chemicals space over the last 1-2 years has capped the near-term upside.

JM Financial believes that India’s specialty chemicals industry is a decadal growth opportunity and it is still not too late to participate in the value creation process.

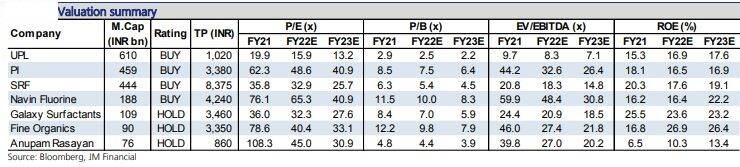

The brokerage firm has a buy call on UPL, PI Industries, SRF and Navin Fluorine.

Globally, the specialty chemicals business accounts for about 20 percent of the $4 trillion chemicals industry. From having an insignificant presence (4.5 percent) in this segment, India’s share in specialty chemicals is expected to double over the next five years at a nearly 12 percent CAGR to $64b by CY25, Motilal Oswal Financial Services underscored.

Strong domestic consumption, led by a young population, a high percentage (about 67 percent) of which forms the working-age group, favorable labour cost, and government impetus are the key positives for the sector, Motilal added.

Motilal Oswal has initiated coverage on the sector with a positive outlook with Deepak Nitrite as its top pick. It has assigned a buy rating to Deepak Nitrite, Vinati Organics, Galaxy Surfactants, and NOCIL and a neutral rating to Atul, Alkyl Amines, Navin Fluorine, and Fine Organics.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!