The outcome of the US Fed meeting on Wednesday is expected to result in another hike in benchmark interest rates, raising the federal funds rate by 25 basis points from its current range of 1.75-2 percent to 2-2.25 percent.

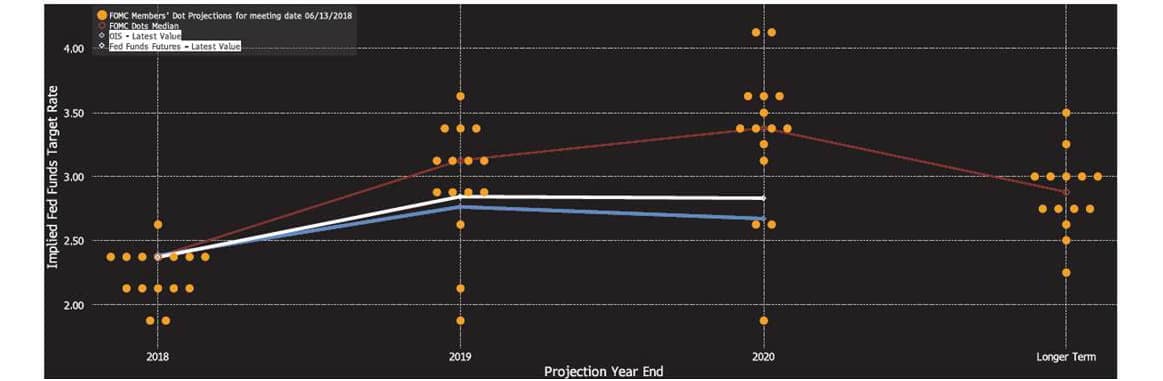

The release of the updated dot plot will be closely watched to judge the direction of the US monetary policy going ahead. The Dot Plot is a scatter plot showing estimates of the federal funds rate by all the members of the Federal Open Market Committee (FOMC) for the end of each of the three years going ahead and also the long run forecast.

This week there will be 16 dots on the plot as currently there are three vacancies on the board.

The latest Dot Plot released in the June meeting signalled a total of four interest rate hikes this year and put the median view of the federal funds rate at 2.4 percent at the end of 2018. The federal funds were expected to rise gradually to a range of 3.25-3.5 percent by the end of 2020.

The key factors influencing the slope of the latest Dot Plot would be Unemployment, inflation, GDP growth, and the yield curve.

The US unemployment is at the record low as the rate of unemployment stood at 3.9 percent in August. Inflation has also reached and sustained above the Fed's 2 percent target for some time now.

US Economic growth is booming on the back of tax cuts and pro-cyclical fiscal policy. GDP grew above expectations by 4.2 percent in Q2 CY18. Such a tax-cut fuelled economy with rising corporate profitability is pulling unemployment down, all the while widening the fiscal deficit and ballooning the alarmingly high national debt.

The US Treasury is likely to borrow extra $430 billion over last year. The dot plot might get steeper as the urgency to hike rates will be there amidst such factors.

Another factor that the Fed ought to consider is the continuously flattening yield curve. The Fed is seeking to hike rates so that a balance between sustained economic growth and economic risks such as inflation would be reached.

However, reaching such a balance might result in an inversion of the yield curve, which is historically seen as an indicator of recession. If the Fed were to consider the risks of yield curve inversion they would have slowed down the pace of rate hikes this year.

In conclusionWith the US short-term rates rising to decade highs and the Fed sticking to its rate hike path the dollar liquidity squeeze may intensify. Troubles mounted for a number of EMs like Argentina, Turkey, South Africa, and Indonesia in the H1 of 2018 due to the dollar liquidity squeeze.

The unwinding of the balance sheet by the US Fed, incremental borrowing by the US Treasury and repatriation of profits by US corporations will likely make dollar liquidity squeeze more intense in Q4 CY18.

Watch out for stress signs in bond yields and currency markets of EMs. Base metals and equity would have to face headwinds for rising borrowing costs and tighter liquidity.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.