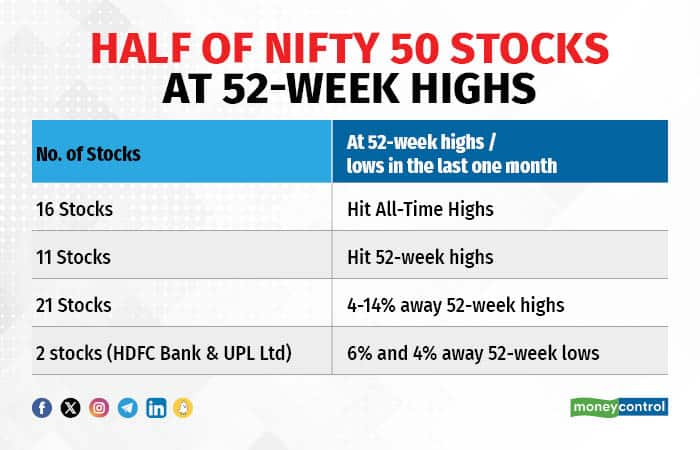

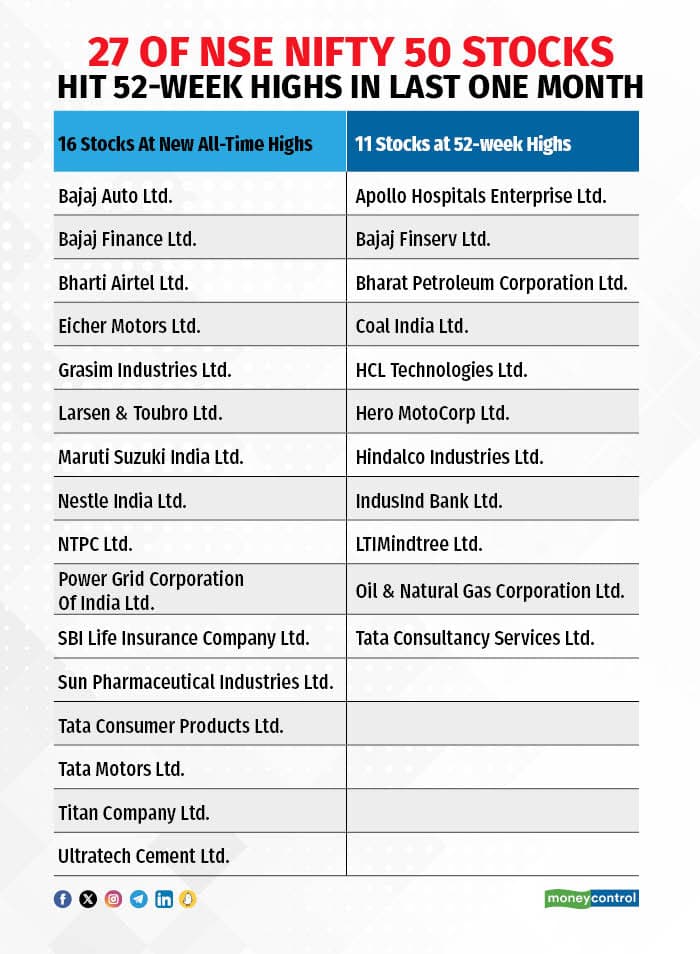

Over 50 percent, or 27, of the Nifty 50 stocks hit a 52-week high in the past month, with 16 of them at a record high. Meanwhile, Nifty is just 1 percent higher during this period.

Additionally, 21 stocks on the Nifty 50 are 5 percent to 14 percent short of their 52-week highs. And, while none of the stocks is near a record low, UPL Ltd. and HDFC Bank are about 6 percent and 4 percent, respectively, away from their 52-week lows.

The market’s attention is now on individual stocks, signalling substantial sectoral changes in the PSU, IT, metals, power, oil, and healthcare sectors, according to analysts. IT and healthcare, which didn’t actively participate in the recent rally that started in April, are garnering interest due to attractive valuations.

Individual stocks are moving differently due to their own triggers and concerns, depending on sectoral or company-specific factors, said Rahul Arora, an analyst at Nirmal Bang.

Also Read: Banking system liquidity deficit rises to 5-year high on tax outflows

Blue-chip stocks including Titan Company, Sun Pharmaceutical Industries, Bajaj Auto, Bharti Airtel, Larsen & Toubro and HCL Technologies reached a one-year high. In the PSU sector, NTPC, Bharat Petroleum, Oil and Natural Gas Corporation, Coal India, and PowerGrid India attracted significant investor interest, hitting 52-week highs.

US investors

Jefferies suggested in a recent report that US investors are increasingly intrigued by India's industrial companies due to promising earnings prospects. Jefferies' analysts, after discussions with US-based funds, noted a widespread belief that India's capital expenditure cycle is on the rise.

Investors showed keen interest in understanding L&T, PowerGrid, NTPC, and JSW Energy, said Jefferies.

Meanwhile, blue-chip companies such as Reliance Industries, ICICI Bank, HDFC Bank, Axis Bank, Asian Paints, and Kotak Mahindra Bank have yet to reach their one-year highs.

The Reliance stock has declined over 6 percent so far this year. Several brokerages raised its target price after the Q2 earnings due to a steady outlook, expecting increased free cash flow generation and debt reduction as the current capex cycle peaks. However, some brokerages maintain concerns over high capex, low free cash flow yields, and low return ratios impacting earnings strength.

Deepak Jasani, head of retail research at HDFC Securities, said bank stocks initially performed strongly until July but have since underperformed due to concerns arising from the latest quarterly results. Issues regarding net interest margins and anticipated trends in asset quality have emerged.

Additionally, the recent Reserve Bank of India directive to increase the risk weights on personal and credit card loans has impacted their valuations.

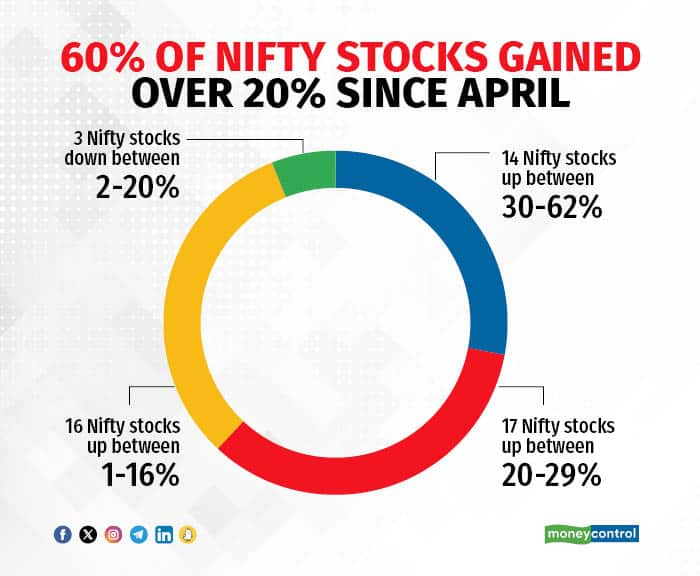

Many analysts now predict that blue-chip companies will outperform midcap and small-cap companies in the second half. In April-September 2023, both Sensex and Nifty gained around 10 percent each while BSE midcap and small cap jumped around 35 percent and 39 percent respectively.

In an October 9 report, Kotak Institutional Equities said five of the top-six Nifty 50 index stocks, accounting for 34 percent weightage, have shown negative returns in the past two years. Additionally, 22 stocks, constituting 55 percent weightage in the Nifty 50, have yielded less than 10 percent returns during this period.

Sanjeev Prasad of Kotak Equities said his team sees better value in the top large-cap stocks, specifically the top 15-20 stocks by market capitalisation, expecting them to outperform in the next 6-12 months.

Nilesh Shah, MD of Kotak AMC, advised investors in a recent Moneycontrol interview to consider profit booking due to high valuations and then re-enter the market at reasonable valuations.

Also Read: Revenue from non-Tata group cos growing at a faster rate: Warren Harris, Tata Tech MD

Shah emphasised the market's upward trajectory in the long run, but highlighted that currently, large caps are at around their historical average valuations, mid-caps slightly exceed their historical averages, and small caps are roughly 20 percent higher than their historical averages.

His suggestion is to marginally favour large caps, maintain an equal allocation to mid-caps, and slightly reduce exposure to small caps.

Disclaimer The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!