After a doji candle formation in the last session, which indicates indecisiveness, the benchmark indices saw selling on May 31, which some traders said was on the expected lines.

The Nifty 50 index traded down 92 points or 0.5 percent at 18,541 as of 10.50am. The Bank Nifty index also slipped 0.81 percent to 44,075.

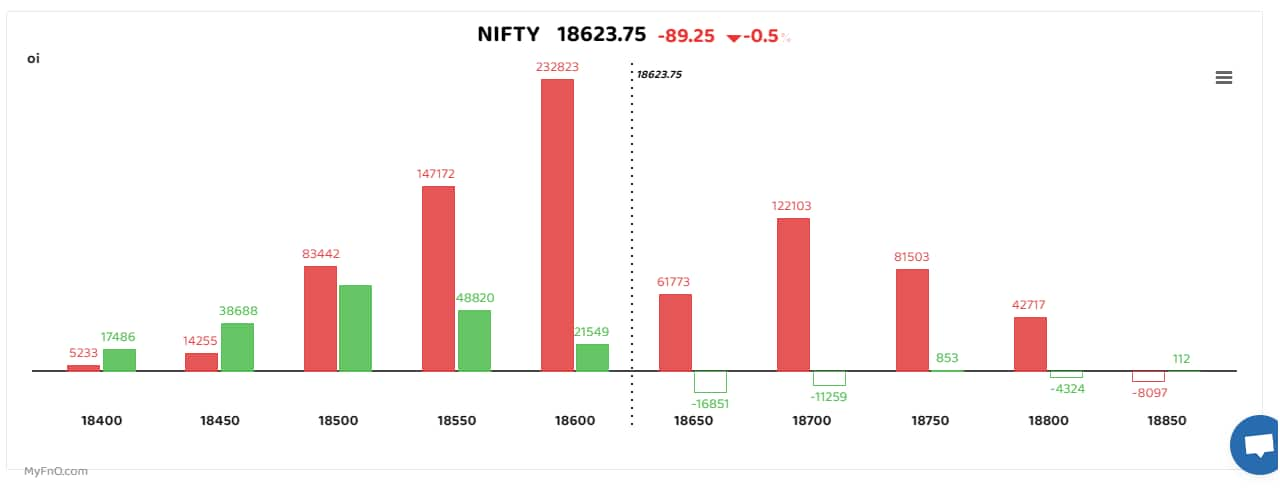

Option data shows that call writers were dominant during the day with maximum activity at the 18,600 level in weekly options. Hurdles are also being created at 18,550 levels.

Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.

Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.

Traders have pointed out that the current sluggishness in the Nifty Index is expected even if the all-time high level gets taken out which should happen in this monthly series itself.

“The Nifty Index saw an addition of 18,700 puts for the June-end expiry. This is an in-the-money put option signalling that the bullishness is very much intact for the June series,” said Rahul Ghose, a Mumbai-based algo trader.

Some traders expect the market to position itself for any reaction to the GDP growth data that will be released later in the day.

Among individual stocks, traders were seen taking long positions in Torrent Pharma and Dixon Technologies. Other pharma names such as Aurobindo Pharma and Sun Pharma also saw open interest addition along with price increase – a bullish sign.

Energy names such as Coal India and ONGC saw short buildup, while Vedanta futures continued to trade at a discount to spot prices to compensate for dividend payment.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!